2019-4-14 22:30 |

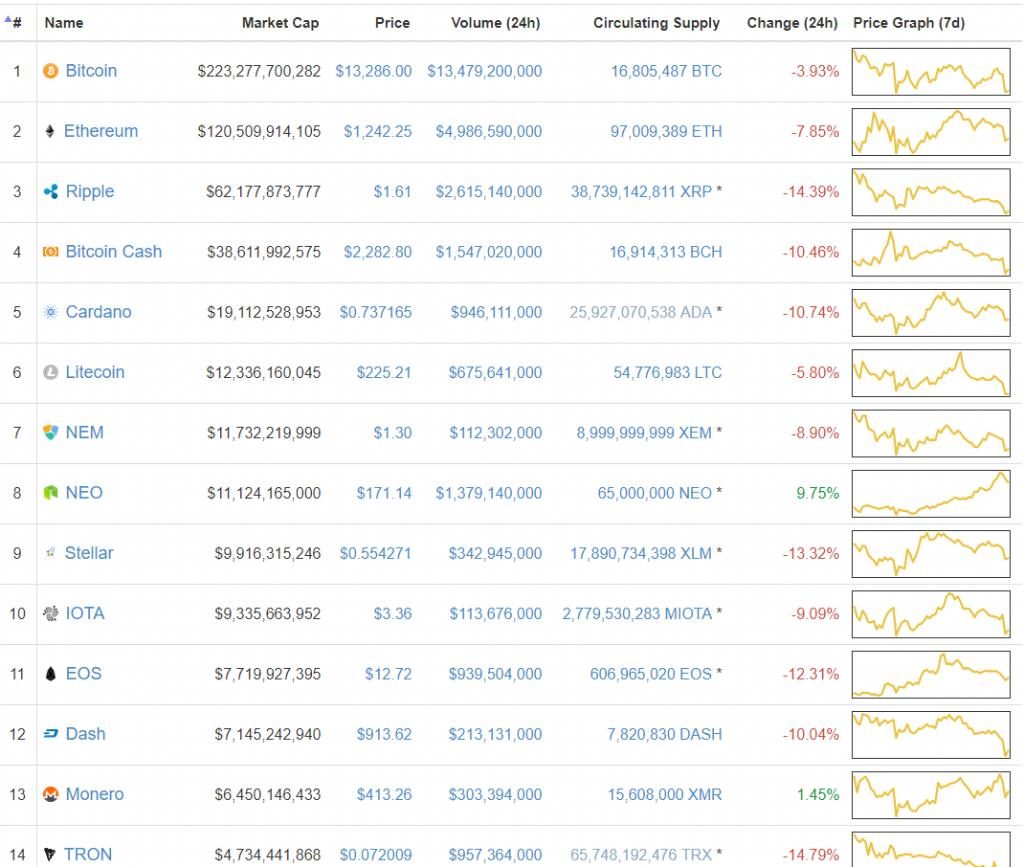

Ethereum and Tron’s communities are both involved in developing DApps that have various utilities, but work on cryptocurrency’s underlying technology, blockchain.

Ethereum led the way with DApps, but failed to scale due to excessive users that surged into its use. However, Tron has been slowly succeeding where Ethereum failed. Tron’s transactions exceeded that of Ethereum and reached an all-time high of 4.27 million, going to show the efficiency of Tron in the face of competition.

Ethereum 1 day chart

Source: TradingView

Support 1: $80.72

Resistance 1: $181.63

Resistance 2: $248.64

Resistance 3: $318.18

Resistance 4: $478.76

The Bollinger Bands showed that the widening of the bands continued, indicating that there was volatility in the market. The price seemed to have recovered falling towards the simple moving average, which indicated bearish momentum for ETH.

The Chaikin Money Flow indicator was crawling towards the zero-line, indicating that the strength of buyers was diminishing slowly.

The Stochastic RSI showed that the Stochastic line had dipped into the oversold zone, indicating bearish momentum for ETH.

Tron 1 Day

Source: TradingView

Support 1: $0.0119

Resistance 1: $0.0267

Resistance 2: $0.0396

For TRX, the Bollinger Bands were slowly converging. TRX’s price bounced just before hitting the simple moving average, indicating slight bullish momentum.

The Chaikin Money Flow indicator crossed the zero-line, implying a reduction in the money flow. However, the CMF line was recovering, at press time.

The Stochastic RSI for Tron showed a similar pattern as that of Ethereum i.e., a strong bearish crossover that hit the oversold zone.

Conclusion

ETH and TRX prices were being pushed by bearish pressure, a projection confirmed by Chaikin Money Flow, Bollinger Bands, and Stochastic RSI.

The post Ethereum [ETH] and Tron [TRX] Price Analysis: Bears gradually gain control of both ETH and TRX appeared first on AMBCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|