2021-5-3 22:09 |

Ethereum was one of the best performers on the cryptocurrency market last month, and the price of this cryptocurrency has advanced from $1922 above $2800 in April. The current price stands around $2940, and according to digital assets investment guidance provider Two Prime, Ethereum is still undervalued.

Fundamental analysis: The daily volume of ETH remains highEthereum has exploded since the beginning of April, and this cryptocurrency continues to trade in a bull market. The daily volume of ETH remains high, and if this positive trend continues, Ethereum could advance soon above $3000 resistance.

Ethereum’s network continues to enjoy a significantly high hash rate, and strong network fundamentals continue to be one of the main characteristics of Ethereum. The cryptocurrency market continues to attract institutional investors, and according to the latest news, the European Investment Bank will issue $121 Million worth of digital bonds on the Ethereum public blockchain.

Ethereum has successfully attracted the attention of institutional investors this year, and according to digital assets investment guidance provider Two Prime, Ethereum is “steeply undervalued” compared to Bitcoin.

“Based on our analysis of ETH’s price performance, derivatives markets, and on-chain data, we believe that ETH has earned a place, alongside BTC, as an institutional-grade investment, store of value, and treasury reserve asset, “Two Prime wrote.

Bitcoin has surpassed $1 trillion in market capitalization, and according to Two Prime, Ethereum has begun attracting institutional investment in early 2021 and still has lots of room for growth. It is also important to mention that one of the biggest cryptocurrency investment companies globally, Grayscale Investments, currently holds more than 3.2 million ETH, which represents about 3% of the total supply.

This proves that even big players like Grayscale have confidence in the future of Ethereum, which creates a price lift pressure. The total value of Grayscale Ethereum Trust has reached over $9 billion at the beginning of May, while the demand for Ether continues to soar.

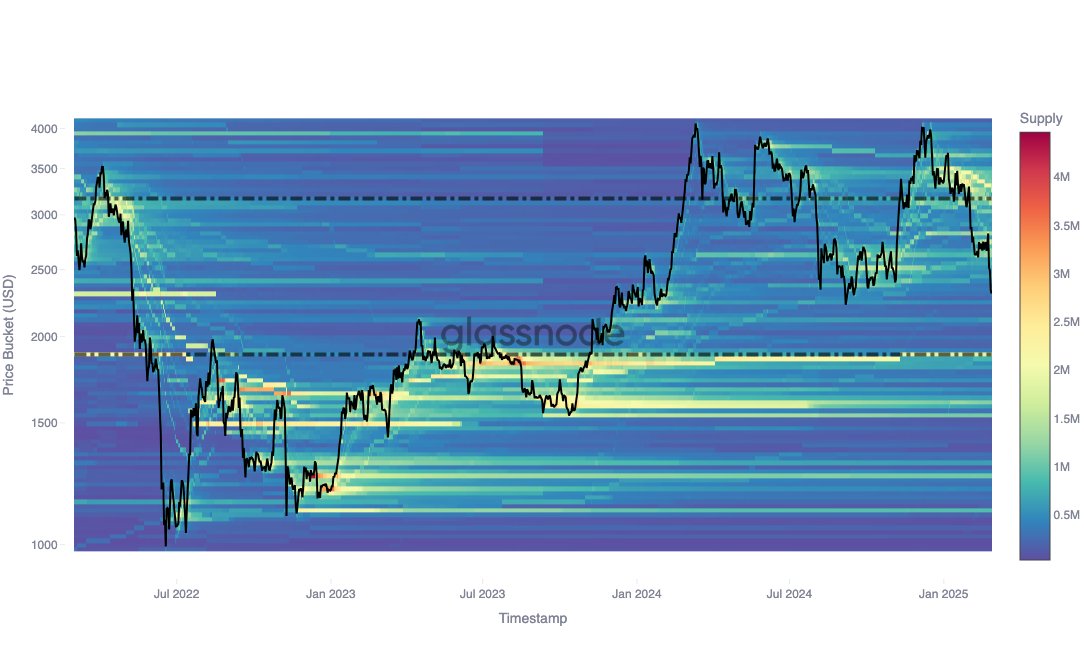

Technical analysis: $2500 represents a strong support levelThis cryptocurrency has made a big jump in a short period and, if you decide to buy Ethereum (ETH), you should consider that the price could also weaken from the current levels.

Data source: tradingview.comEthereum is currently trading around $2940 level, and if the price jumps above $3000 resistance, it would be a signal to trade Ethereum (ETH). The next price target could be around $3200 or even $3500; still, if the price falls below $2500 support, it would be a strong “sell” signal.

SummaryEthereum has exploded since the beginning of April, and according to digital assets investment guidance provider Two Prime, Ethereum is still undervalued. Ethereum has successfully attracted the attention of institutional investors this year, while the total value of Grayscale Ethereum Trust has reached over $9 billion at the beginning of May.

The post Ethereum could advance even more in the ongoing bull market. Here are the next targets for buyers appeared first on Invezz.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|