2024-5-9 20:00 |

As the clock ticks closer to the end of today, May 3, the cryptocurrency market braces itself for potential upheavals, with roughly $2.4 billion worth of Bitcoin and Ethereum options set to expire.

This significant event could catalyze notable shifts in market dynamics, steering the trajectory of Bitcoin and Ethereum prices in the near term.

Notably, Options contracts in the crypto sphere allow traders to hedge against price volatility or speculate on future price movements without directly holding the assets. Typically structured as either calls or puts, these contracts enable buying (call) or selling (put) at predetermined prices within a specified timeframe.

As the expiry date approaches, movements within these contracts tend to introduce heightened volatility into the market, given the adjustments traders make to hedge their positions or capitalize on anticipated price movements.

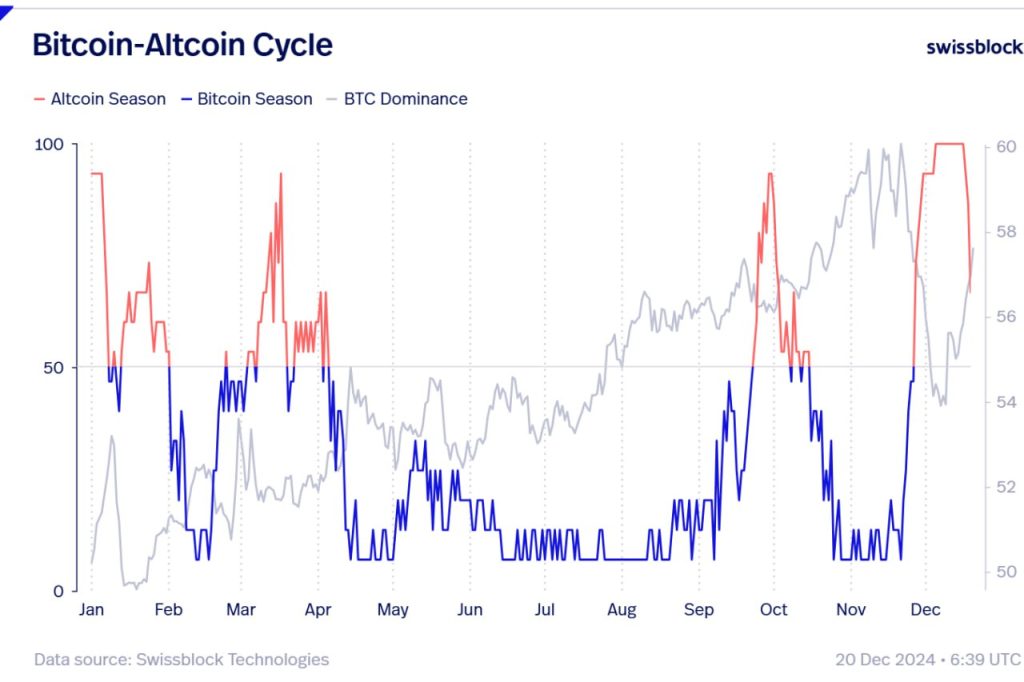

Market Mechanics And Sentiment IndicatorsThe mechanics of options trading offer insights into market sentiment, primarily through analyzing the put/call ratio. This ratio gauges the market’s bullish or bearish stance, depending on whether the volume of call options (betting on price rises) outweighs put options (betting on price drops) or vice versa.

Presently, the put-to-call ratio for Bitcoin stands at a relatively low 0.5, suggesting a bullish sentiment as more traders bet on rising prices with the maximum pain point—a price level causing maximum trader losses—at about $61,000 and a notional value of $1.4 billion.

In contrast, Ethereum’s options market is also teeming with activity, marked by the upcoming expiry of contracts valued at around $1 billion. With a put-to-call ratio of 0.37, the sentiment leans even more bullish than Bitcoin, indicating stronger trader confidence in Ethereum’s price performance.

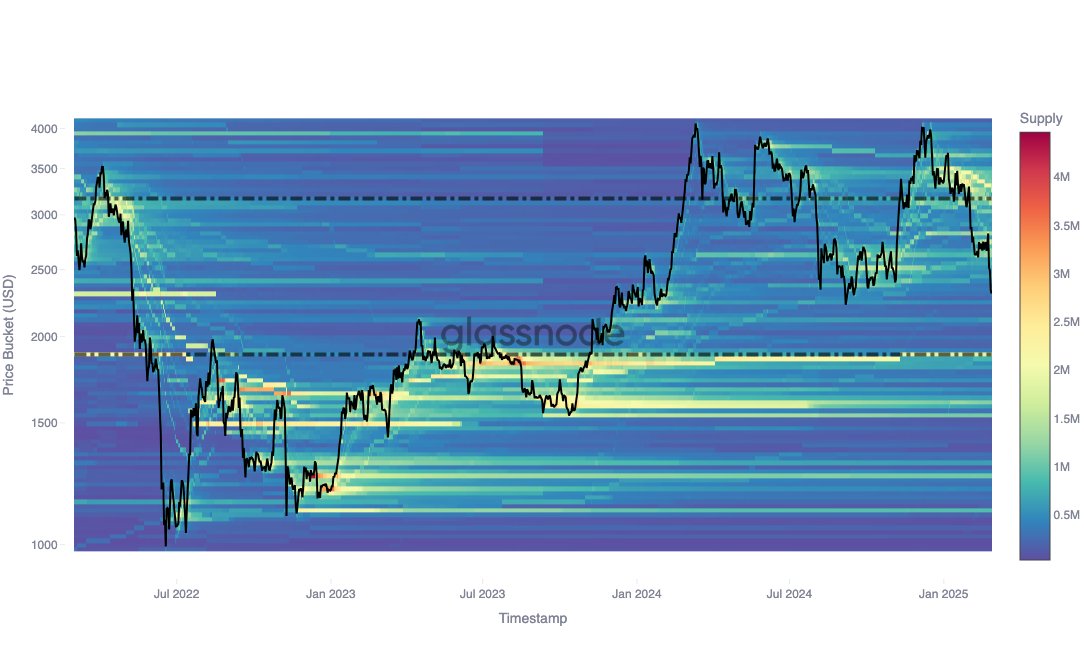

Ethereum’s designated maximum pain point sits at $3,000, aligning with key psychological and technical support levels.

May 3 Options Data 23,000 BTC options are about to expire with a Put Call Ratio of 0.49, a Maxpain point of $61,000 and a notional value of $1.4 billion. 330,000 ETH options are due to expire with a Put Call Ratio of 0.36, Maxpain point of $3,000 and notional value of $1… pic.twitter.com/mEA4PV98C3

— Greeks.live (@GreeksLive) May 3, 2024

Implications And Bitcoin InsightsHistorically, the expiration of such a voluminous cache of options has precipitated abrupt price fluctuations in the spot markets for Bitcoin and Ethereum. This is attributed to the large-scale repositioning by institutional and retail investors in anticipation of or in response to the expiry outcomes.

These strategic movements are particularly pivotal when both cryptocurrencies recover from recent pullbacks. GreeksLive noted:

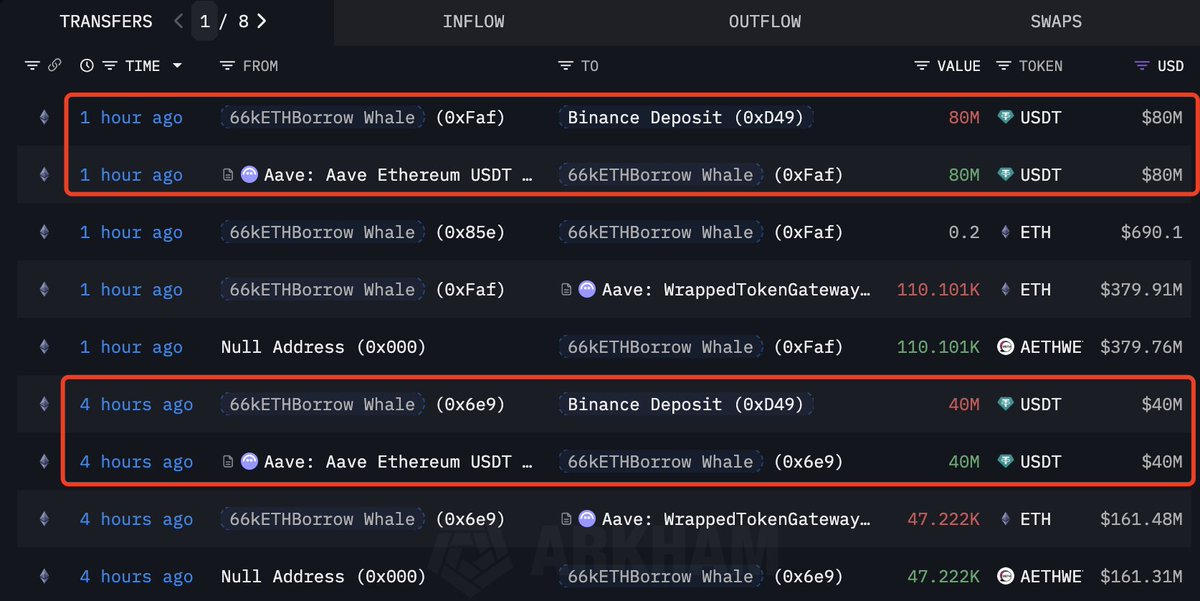

The current point of sustained sideways trading is unlikely, no rebound is bound to be a downward relay, the giant whale on the lack of confidence in the market, Block trading is worth strengthening attention.

Meanwhile, Bitcoin appears to be recovering from the recent downturn with a 5.4% increase in the past day, momentarily piercing the $60,000 mark, signaling a potential resumption of its upward march.

Similarly, Ethereum has shown resilience, climbing above the $3,000 threshold with a modest 3% gain. These upticks coincide with broader market analyses like that of Marco Johanning, a well-known crypto analyst and founder of The Summit Club, suggesting that foundational bullish sentiments remain intact despite recent corrections.

Featured image from Unsplash, Chart from TradingView

origin »Bitcoin price in Telegram @btc_price_every_hour

Setcoin (SET) на Currencies.ru

|

|