2025-12-23 09:11 |

BitMine Immersion Technologies’ Ethereum (ETH) holdings have surpassed 4 million following the company’s purchases in the past week.

This aggressive accumulation comes amid ongoing market volatility, as Ethereum continues to face broader headwinds. Nevertheless, market analysts point to technical signals that suggest potential upside for the asset.

Corporate Ethereum Holdings Grow as BitMine Passes 4 Million ETHThe world’s largest corporate holder of Ethereum revealed that it acquired 98,852 ETH, extending its ongoing accumulation streak. The purchase lifted its total holdings to more than 4 million ETH, valued at approximately $12.1 billion.

These holdings form part of a $13.2 billion treasury, which also includes 193 Bitcoin, a $32 million stake in Eightco Holdings, and $1 billion in cash. Notably, today, on-chain analytics platform Lookonchain reported another purchase of 29,462 ETH, worth $88.1 million, from BitGo and Kraken exchanges.

The firm now controls 3.39% of Ethereum’s total supply, moving closer to its stated goal of holding 5%.

“Bitmine holdings now exceed the crucial 4 million ETH tokens. This is a tremendous milestone achieved after just 5.5 months. We are making rapid progress towards the ‘alchemy of 5%’ and we are already seeing the synergies borne from our substantial ETH holdings. We are a key entity bridging Wall Street’s move onto the blockchain via tokenization. And we have been heavily engaged with the key entities driving cutting edge development in the defi community,” BitMine Chairman, Tom Lee, stated.

While BitMine continues to increase its exposure, other players have moved to sell Ethereum. BeInCrypto reported that ETHZilla sold 24,291 ETH, worth approximately $74.5 million.

However, the sale does not signal a bearish outlook on Ethereum. The move was made to repay senior secured convertible debt.

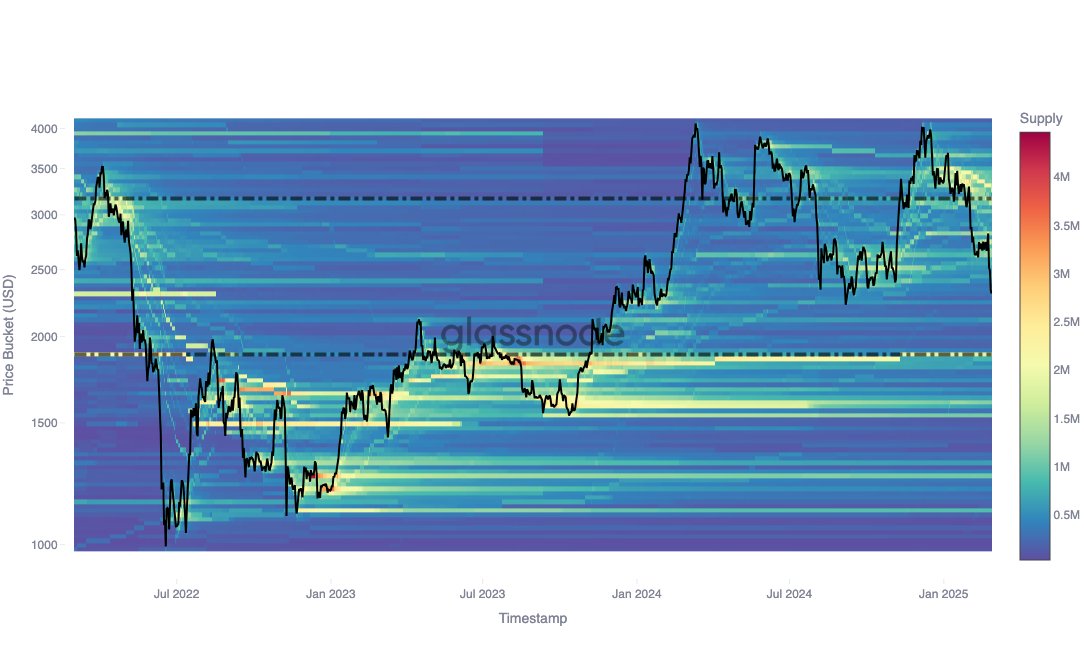

Ethereum Price OutlookBitMine’s purchase comes as ETH, along with the broader market, continues to face volatility. The coin has dropped below $3,000 mark again in early Asian trading hours and is down over 1% in the past 24 hours.

At the time of writing, its trading price was $2,993.5, just slightly above the firm’s average purchase price of $2,991 per ETH.

Ethereum (ETH) Price Performance. Source: BeInCrypto MarketsDespite recent price weakness, BitMine’s conviction remains strong. Chairman Lee previously expressed confidence that Ethereum’s price could strengthen in the coming months.

The positive outlook is echoed by market analysts, who cite technical signals as evidence of a potential upcoming recovery. Bitcoinsensus identified a right-angled, descending, broadening wedge pattern on Ethereum’s chart.

It is a bullish reversal pattern in technical analysis, often signaling weakening selling pressure and the potential for an uptrend breakout.

“This pattern has a high probability of breaking out to the upside with strong upside moves. Pattern Target: $7,000,” the post read.

Another analyst, Crypto Faibik, pointed to a multi-month trendline that Ethereum is close to breaking, projecting a $4,220 target by January 2026.

$ETH will bottom out soon.

Relief rally is coming… pic.twitter.com/gJyDvAAAYy

For now, Ethereum remains under pressure amid the broader market downtrend. Whether strong institutional conviction and emerging technical signals ultimately translate into a price recovery remains to be seen.

The post BitMine’s Ethereum Treasury Tops 4 Million ETH Amid Market Volatility appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|