2026-2-11 21:32 |

Chicago-based Jump Trading, a long-established proprietary trading firm that trades its own capital and often serves as a market maker across financial markets, is poised to acquire small equity stakes in prediction market platforms Kalshi and Polymarket through market-making agreements tied to providing liquidity, according to a recent report.

People familiar with the discussions told Bloomberg the stakes are expected to be relatively modest and linked to ongoing trading activity rather than structured as traditional venture investments. The structure reflects a familiar derivatives market playbook in which exchanges align early liquidity providers with long-term platform development.

Institutional liquidity itself is not new to prediction markets. Bloomberg previously reported that Jump had already been acting as a market maker on Kalshi before the latest equity discussions. The latest talks appear aimed more at structuring that relationship than changing the firm’s trading activity.

Market makers central to both platforms’ trading modelsJump’s proposed equity arrangements would differ between the two platforms, according to Bloomberg’s report. Jump’s agreement with Kalshi is said to involve a fixed equity stake, while its potential ownership in Polymarket could increase over time based on how much trading capacity and liquidity the firm provides to the exchange’s U.S. platform. The structure suggests a more traditional strategic stake in Kalshi alongside a performance-linked incentive model for Polymarket.

Like traditional derivatives exchanges, both Kalshi and Polymarket’s global platform rely on professional market makers to provide continuous buy and sell quotes, helping maintain liquidity, narrow spreads and support price discovery in event contract markets. Proprietary trading firms often fill that role, particularly during high-volume political, economic and sports-related events where institutional liquidity can stabilize order books.

Polymarket’s established international platform operates on a central limit order book (CLOB) model with API access designed to support independent and algorithmic market makers, according to company documentation. The platform also runs liquidity incentive programs to encourage continuous quoting, though specific institutional market-making firms have largely not been publicly identified.

Kalshi uses a similar CLOB exchange model and has actively recruited professional liquidity providers through incentive programs aimed at maintaining tight spreads and consistent market depth. The exchange publicly confirmed proprietary trading firm Susquehanna International Group as its first dedicated institutional market maker in 2024, highlighting a deliberate push to bring traditional derivatives liquidity into event contract trading.

In late 2025, Bloomberg reported that Galaxy Digital, a digital-asset investment firm active in trading and market making, was exploring becoming a liquidity provider for Kalshi and Polymarket, but no subsequent reporting has confirmed the firm has taken an active market-making role.

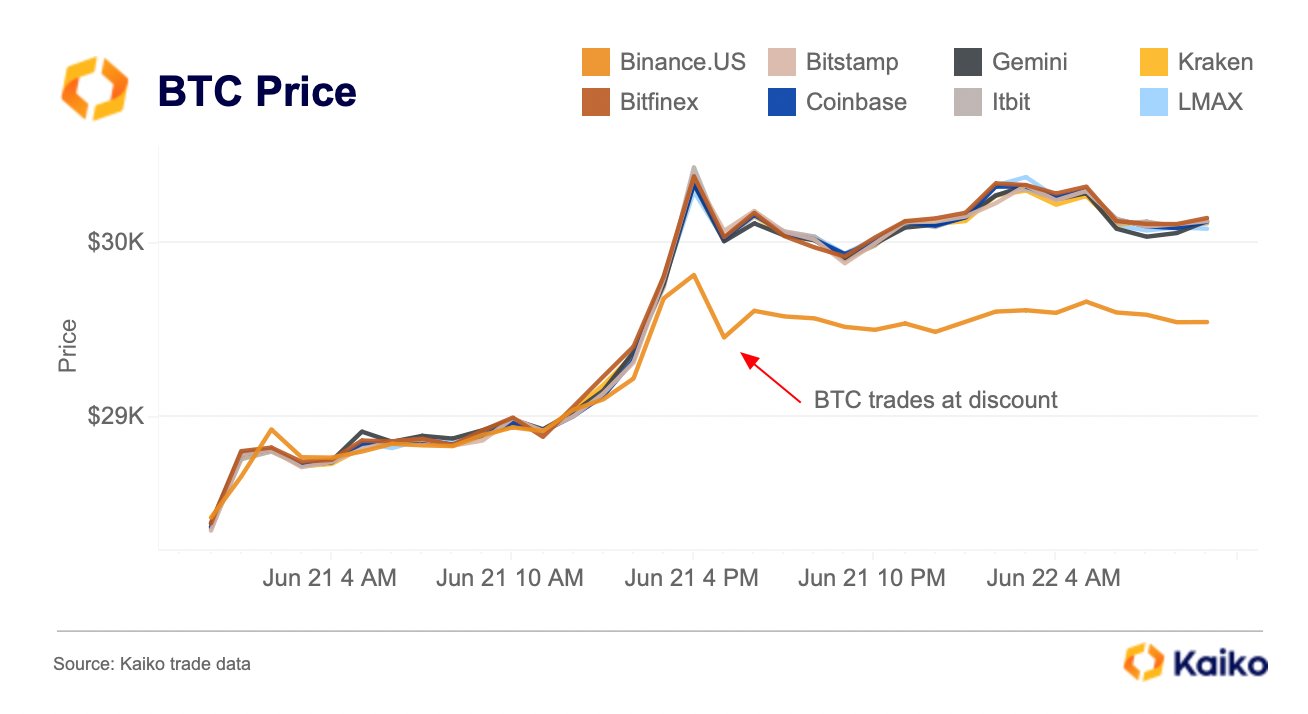

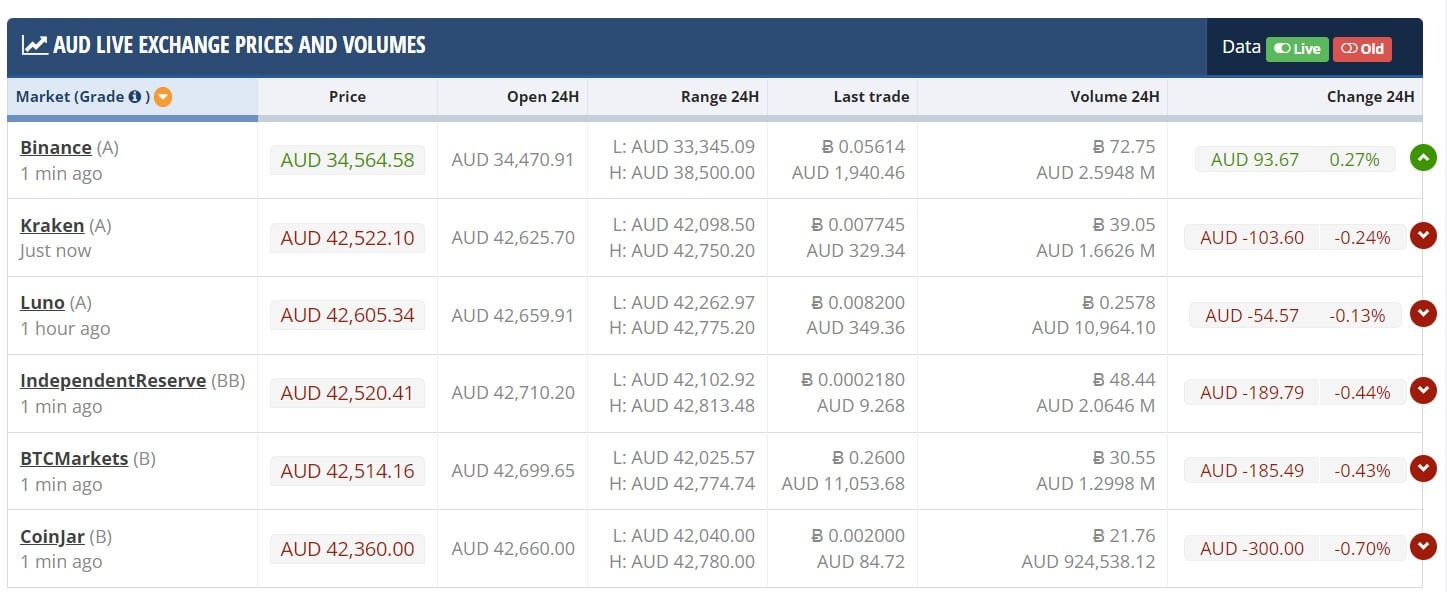

Liquidity remains a key challenge for prediction marketsPrediction markets have historically faced liquidity constraints outside major events, with trading activity often concentrated in high-profile markets such as sports events or elections, leaving many smaller markets with thinner liquidity. That can lead to more volatile pricing and less reliable probability signals for traders in some markets.

Jump’s potential equity stakes in Polymarket and Kalshi underscore how exchanges are aligning financially with liquidity providers as they seek to deepen order books and support more consistent institutional trading activity.

The dynamic reflects a long-standing practice in derivatives markets — financial markets for futures, options and other asset-linked contracts — where exchanges have used incentive programs and partnerships with market makers to deepen liquidity, particularly in newer or less actively traded contracts. Major derivatives venues including CME Group have implemented such programs to encourage more consistent order book depth and improved overall market quality, illustrating how exchanges often actively cultivate liquidity alongside market growth.

While liquidity incentives are common, direct equity alignment between exchanges and market makers is less typical in mature markets.

Margin trading push signals further institutional ambitionsKalshi is also seeking regulatory approval to introduce margin trading on its platform, a move that could further align prediction markets with traditional derivatives exchanges and make the contracts more attractive to institutional investors. The Financial Times reported earlier this month that the company has held discussions with the Commodity Futures Trading Commission over several months about allowing traders to post only a fraction of a contract’s value upfront rather than fully collateralizing positions.

Margin trading is widely viewed as a prerequisite for large hedge funds and proprietary trading firms, which typically rely on leverage and capital efficiency when deploying significant trading capital. Allowing margin trading can expand institutional participation and support deeper liquidity, reinforcing the broader push by exchanges such as Kalshi and Polymarket to attract professional market makers and larger trading firms.

The proposal would also mark a structural shift for U.S. prediction markets, which have historically required fully funded positions even on regulated venues. While approval remains uncertain, the discussions are another example of how prediction market operators are increasingly adopting infrastructure and market conventions more commonly associated with traditional futures and options exchanges.

Earlier this month, Crypto.com said its new standalone OG.com prediction market platform will offer margin trading, describing it as the first prediction market venue to do so. The announcement adds a competitive dimension to the margin discussion, as other prediction market operators continue to explore similar capabilities through regulatory channels.

Institutional interest continues to shape prediction marketsTaken together, the liquidity partnerships, potential equity arrangements and push toward margin trading suggest prediction market operators are increasingly positioning themselves alongside more established derivatives venues. Greater institutional participation can also improve trading conditions for individual users by deepening liquidity and tightening spreads, and may introduce more sophisticated competition into the markets, as well.

Whether that shift ultimately draws sustained institutional participation will depend on regulatory clarity, consistent liquidity, and broader acceptance of event-contract trading within traditional financial markets. For now, the sector appears to be moving steadily toward a more conventional exchange model, even as key questions about regulatory treatment, liquidity sustainability, and market structure remain open.

The post Equity for Liquidity: Jump Trading Set to Take Stakes in Kalshi and Polymarket appeared first on DeFi Rate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Liquidity Network (LQD) на Currencies.ru

|

|