2023-5-30 12:01 |

Binance has cited reduced liquidity in Australian Dollar (AUD) pairs as the cause for trading discounts of Bitcoin (BTC) and other digital assets on its Australian platform, according to an emailed statement to CryptoSlate.

A spokesperson for the crypto exchange explained that some users “have been withdrawing their AUD holdings from the platform in anticipation of the platform’s AUD withdrawal services suspension, referred to as “off-ramp closure,” on June 1. Consequently, Bitcoin and other digital assets paired with the national currency face reduced liquidity, affecting their prices.

The exchange added:

“We will be delisting [the] remaining AUD pairs in line with the closure of fiat off-ramp services. We remain focused on securing additional fiat relationships to service our users.”

Bitcoin, others trade at a discountMeanwhile, several Australian crypto traders have identified the massive arbitrage opportunities available from the discount.

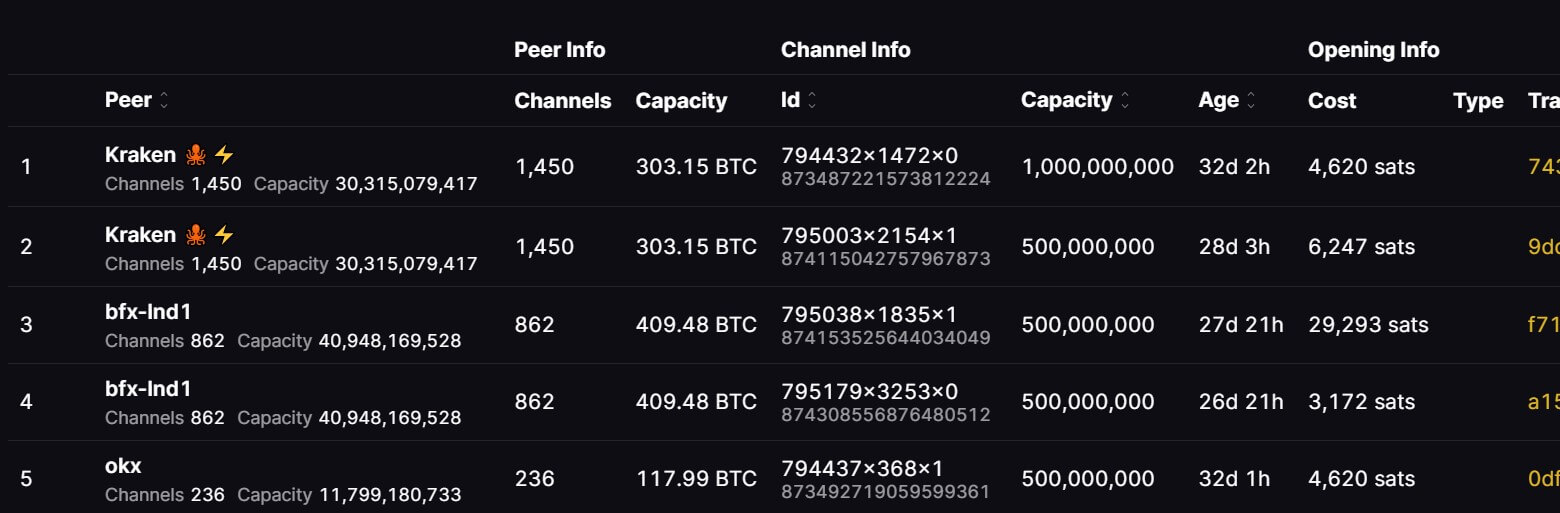

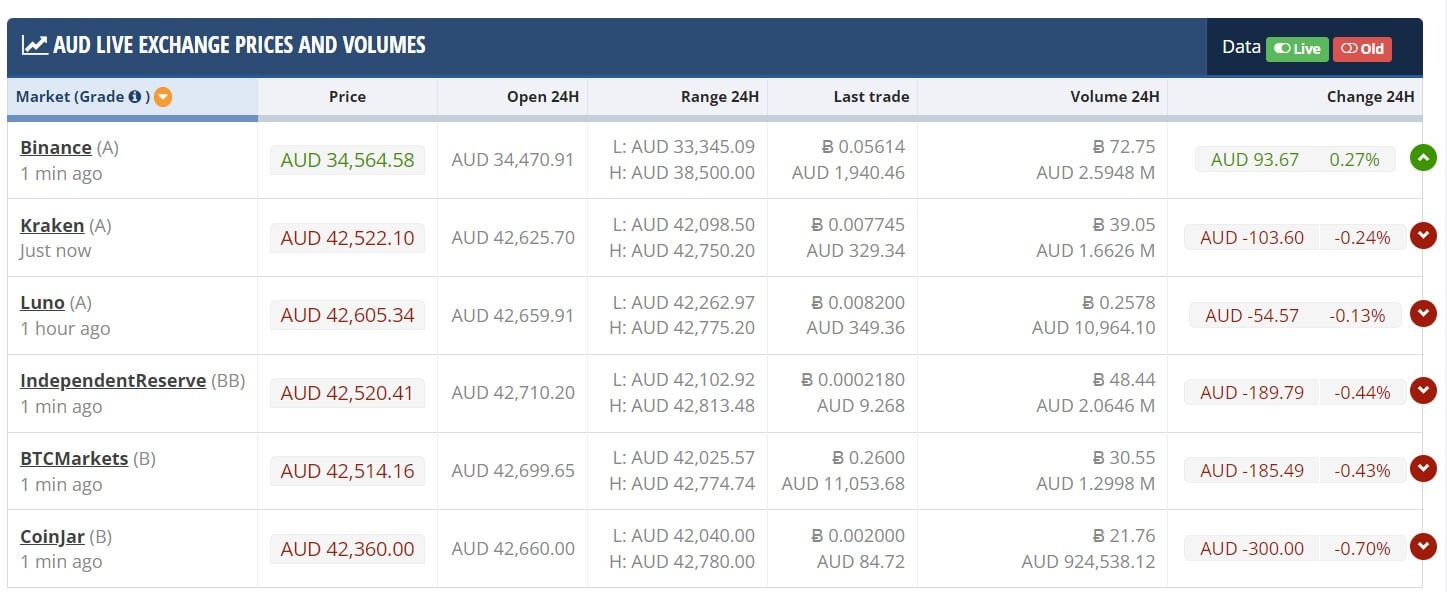

Data from CryptoComapre shows that the flagship digital asset was trading at AUD $34,250 (USD $22,345) on Binance Australia as of press time. This is significantly lower than what it is trading on other exchanges like IndependentReserve, Luno, and Kraken, exchanging hands for over AUD $42,000 (USD $27,401).

Source: CryptoCompareThe discount is also evident on other digital assets like Ethereum (ETH). Ether is trading at AUD $2,375 on Binance Australia, while it is over AUD $2,900 on rival exchanges, according to CryptoCompare data.

Binance Australia’s banking woesOn May 18, Binance Australia said it could no longer process Australian Dollar (AUD) deposits for users because its third-party payment service provider Cuscal stopped providing its services to the firm. On the same day, Australia’s oldest bank, Westpac, banned crypto transactions to unnamed exchanges.

In response to these issues, Binance Australia started gradually restricting its users from spot trading activities with the AUD. On May 26, the exchange announced it would stop Bitcoin spot trading activities with the fiat currency on June 1.

Meanwhile, the exchange has maintained that users can continue trading the affected assets on other trading pairs within its platform.

The post Binance Australia blames AUD liquidity drop for Bitcoin discount appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Australian Dollar (AUD) на Currencies.ru

|

|