2023-7-5 22:30 |

The cryptocurrency market has become increasingly precarious. The Securities and Exchange Commission’s (SEC) recent legal actions against crypto exchanges such as Binance, Binance.US, and Coinbase have thrown crypto liquidity into crisis.

These regulatory actions are fostering an environment characterized by instability and heightened risks for traders.

Market Depth of Top 10 Cryptos PlummetsA critical aspect of the SEC’s allegations involves crypto exchanges offering trading of unregistered securities. These include Solana (SOL), Cardano (ADA), and Filecoin (FIL), to name a few.

The charges, first leveled at Bittrex, have extended to include Binance and Coinbase. The lawsuits cite significant growth in the trading volumes of altcoins over traditional favorites like Bitcoin and Ethereum.

“The growth in quarterly volumes [for Binance.US] was astonishing, jumping from $5 billion, to $42 billion, to $106 billion in just three quarters. Notably, altcoin volume was greater than BTC and ETH volume combined for the entirety of the bull run, which is highly unusual for US exchanges,” reads Kaiko Quarterly Report.

The fallout from these charges has led to a drastic reduction in liquidity across all crypto trading platforms.

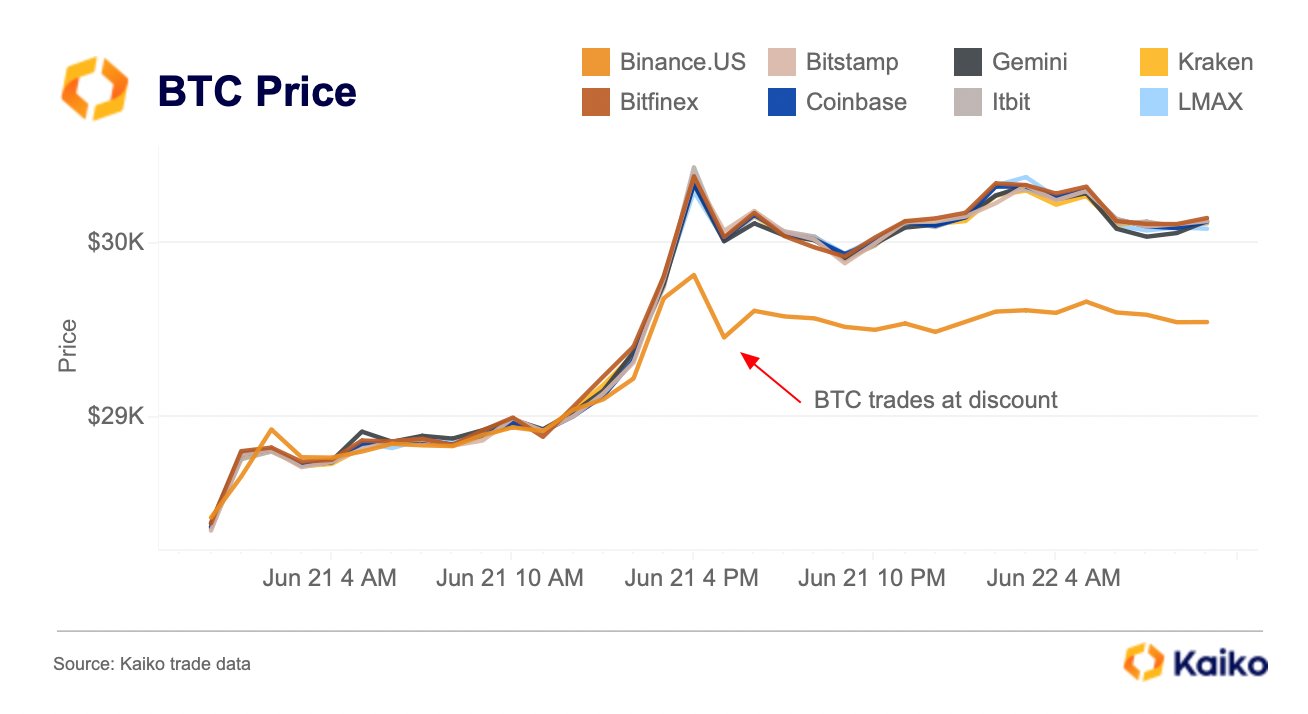

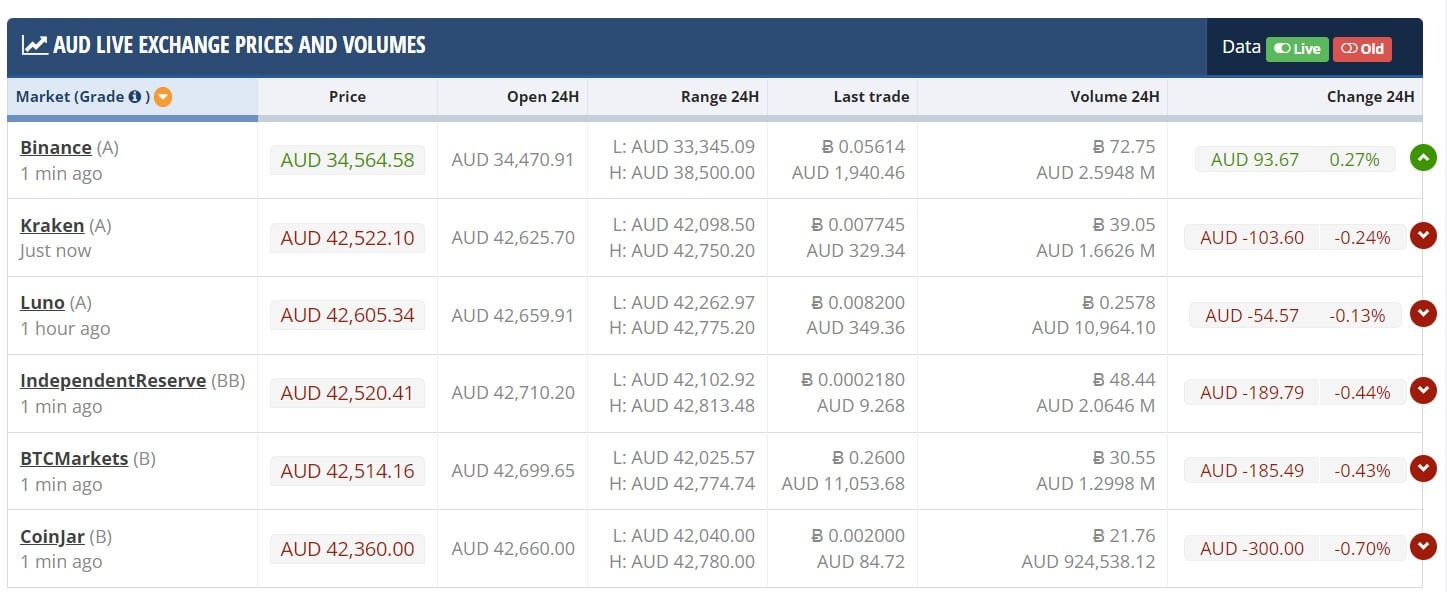

Binance.US Quarterly Volume. Source: KaikoMarket depth, an essential measure of liquidity, has suffered significantly. Notably, Binance.US’s liquidity continued to dwindle after the charges, even as Binance experienced some recovery.

On-chain data paints even a more concerning picture. Bittrex, Binance.US, and OKCoin have all seen their market depth drop substantially for the top ten cryptocurrencies.

Bittrex’s depth is down 68%, while Binance.US and OKCoin have both suffered 85% reductions year-to-date.

Read more: 9 Most Liquid Bitcoin Exchanges and Platforms in 2023

Market Depth Top 10 Cryptos. Source: KaikoThe crypto liquidity decline is also symptomatic of other issues. For instance, OKCoin, following a temporary suspension of USD deposits amid a banking crisis, has struggled to re-establish liquidity due to the unavailability of alternatives.

Bitcoin Exchange Reserves Nears Two Million BTCMoreover, the global liquidity of Bitcoin has fallen by over $10 million in the second quarter of 2023.

This is a worrisome trend compounded by the decision of significant market makers Jane Street and Jump to wind down their liquidity operations in the US.

Bitcoin Exchange Reserves. Source: CryptoQuantKi Young Ju, CEO at CryptoQuant, maintains that the liquidity crisis cryptocurrency exchanges are undergoing is even more notorious when looking at the sell-side and buy-side liquidity of the two largest cryptocurrencies by market cap and all major stablecoins.

“Crypto sell-side liquidity [is] declining, but buy-side liquidity experiencing even sharper decline. BTC exchange reserve down 20% in a year, ETH down 40%, stablecoins down 52%,” said Ju.

Stablecoins Exchange Reserves. Source: CryptoQuantThis diminishing liquidity poses significant risks to traders. Low liquidity allows market manipulators to exploit asset prices, causing fluctuations that enable “pump and dump” schemes.

Traders also face “slippage,” where the difference between the intended and actual execution prices of assets can result in unexpected losses. Finally, crypto traders may struggle to exit positions due to a lack of counterparties on low-liquidity exchanges.

Risk Management Is KeyHowever, it is not all doom and gloom. Traders can take several steps to mitigate the dangers of low liquidity. Trading on exchanges with high trading volumes and narrow spreads can offer more stability.

Monitoring market depth and order books can help crypto traders to gauge liquidity levels, while using limit orders instead of market orders can minimize slippage. Lastly, diversifying trading activities across multiple crypto exchanges can help avoid overexposure to a single platform.

Read more: How to Choose The Right Crypto Exchange

While the trading landscape has undoubtedly become riskier due to falling crypto liquidity, these challenges are not insurmountable. Traders must stay informed, use reliable platforms, and employ smart trading strategies to navigate the current uncertainty in the crypto market.

The post Trading Cryptos Has Never Been So Risky: Exchange Liquidity Dries Up appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|