2024-6-11 23:43 |

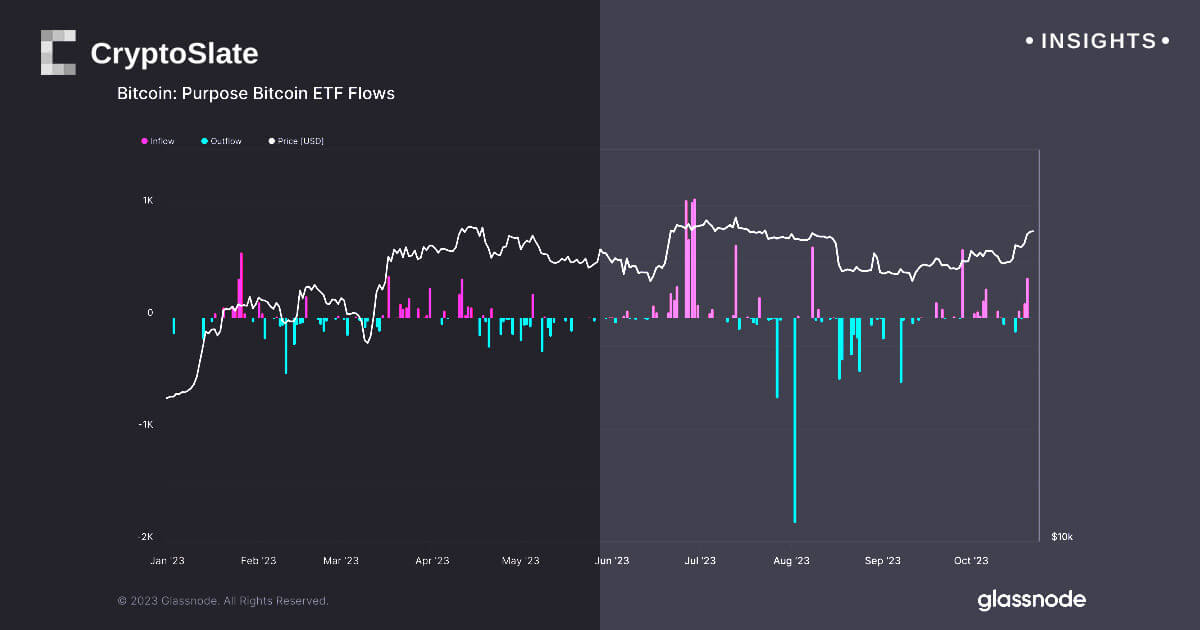

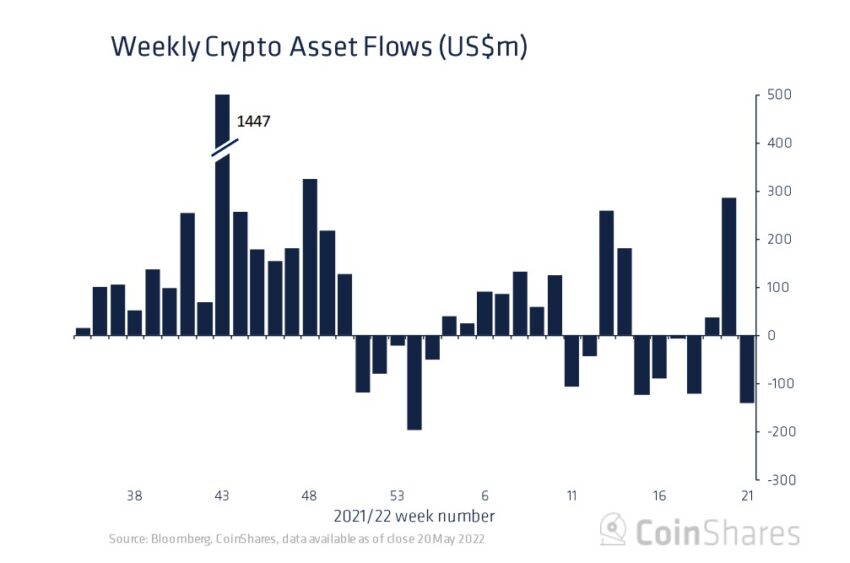

Last week, digital asset investment products experienced significant inflows totaling $2 billion, pushing the cumulative inflows over the past five weeks to $4.3 billion. Bitcoin led this influx with a substantial $1.97 billion, while Ethereum saw its largest weekly inflow since March, totaling $69 million.

Last week, digital asset investment products saw inflows totaling $2 billion, bringing the total inflows over the past five weeks to $4.3 billion. Bitcoin saw inflows of $1.97 billion. Ethereum saw its largest inflow week since March, totaling $69 million.https://t.co/L0EmvLF6Ye

— Wu Blockchain (@WuBlockchain) June 10, 2024

Analyst Ali Martinez highlighted on X that the number of daily Bitcoin addresses has broken a downtrend that began on March 5. Over the past 24 hours, 765,480 Bitcoin addresses were active, marking a surge in network activity. This uptick is a positive indicator for the continuation of the Bitcoin bull run.

The number of daily #Bitcoin addresses has broken a downtrend that started on March 5!

In the past 24 hours, 765,480 $BTC addresses were active. This surge in network activity is a positive sign that the #BTC bull run will continue. pic.twitter.com/S2Ih2FSrt5

— Ali (@ali_charts) June 9, 2024

Furthermore, the Bitcoin Taker Buy Sell Ratio on HTX Global has spiked to 730, indicating massive buy pressure and overwhelming bullish sentiment. This suggests a strong upward price movement for Bitcoin could be imminent.

#Bitcoin Taker Buy Sell Ratio on @HTX_Global has spiked to 730!

This massive buy pressure indicates overwhelming bullish sentiment, suggesting a strong upward $BTC price movement could be on the horizon. pic.twitter.com/4hNq4l4Gld

— Ali (@ali_charts) June 9, 2024

Short-term Bitcoin Holders Enter Profit PositionShort-term Bitcoin holders are currently seeing a profit margin of 3.35%, suggesting minimal risk of a sell-off. This favorable profit margin reflects the growing confidence among investors, reinforcing the bullish outlook for Bitcoin.

#Bitcoin short-term holders are seeing a profit margin of 3.35%, indicating a minimal risk of a $BTC sell-off! pic.twitter.com/ohl3lXUSl9

— Ali (@ali_charts) June 10, 2024

The next potential local top for Bitcoin is projected to be around $89,200, indicating significant room for further price appreciation. As digital asset inflows continue to surge and network activity rises, the bullish sentiment around Bitcoin remains robust.

The next potential local top for #Bitcoin could be around $89,200! pic.twitter.com/dVKmFwKnh4

— Ali (@ali_charts) June 9, 2024

These developments underscore the strong investor interest in digital assets, particularly Bitcoin and Ethereum. The sustained inflows and bullish indicators suggest that the crypto market, led by Bitcoin, is poised for continued growth and upward momentum. Investors should closely monitor these trends as they could signal further gains in the near future.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!

Image Source: igorigorevich/123RF // Image Effects by Colorcinch

origin »Bitcoin price in Telegram @btc_price_every_hour

Dix Asset (DIX) на Currencies.ru

|

|