2023-1-31 20:30 |

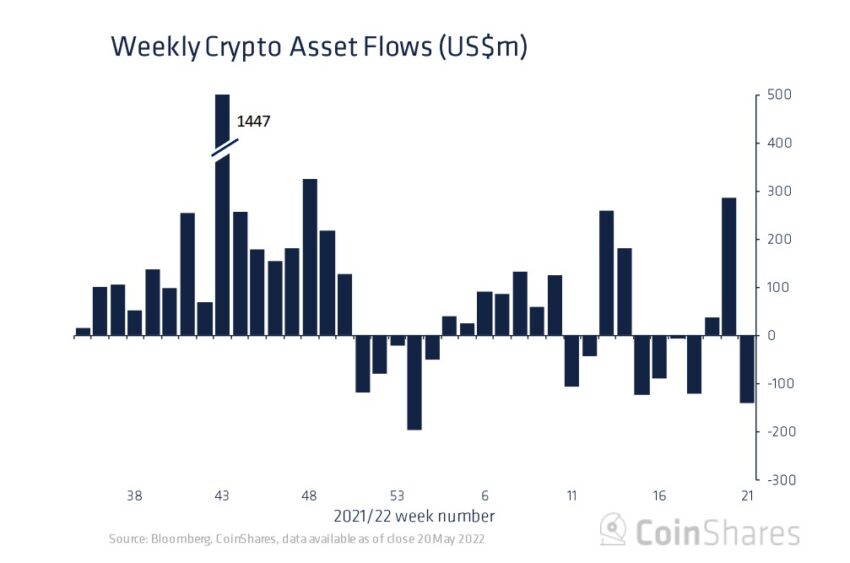

Cryptocurrency investment products saw the largest amount of inflows since July last year, as part of a recent comeback for digital assets.

Inflows into digital asset investment products amounted to $117 million over the past week, according to the latest CoinShares report. Concurrently, total asset under management (AuM) managed to reach $28 billion, a 43% appreciation from the recent nadir in Nov.

The report remarked that trading volumes had risen dramatically in the past week, reaching $1.3 billion. This figure is up 17% compared to the year-to-date average, although investment products remain only 1.4% of total volumes on trusted exchanges. Such demand is also being seen across the broader crypto markets, which have seen average weekly volumes grow some 11%.

While healthy inflows came from both North America and Europe, Germany by far saw the largest share this past week. At $46 million in inflows, this represented roughly 40% of last week’s total. Other major contributors included Canada, the US and Switzerland, which saw $30 million, $26 million and $23 million respectively. Meanwhile, Brazil saw minor outflows of $6.3 million.

Bitcoin Takes the Lion’s ShareAlmost the entirety of inflows last week went to Bitcoin-base investment products, at $116 million in inflows. However, the report pointed out that mild inflows of $4.4 million into short-Bitcoin products suggested that opinion remained polarized.

The largest outflows occurred for multi-asset investment products, which in its ninth consecutive week amounted to $6.4 million. The report said this demonstrated a preference for select investments, highlighting minor inflows for altcoins like Solana, Cardano and Polygon. Platform tokens on the other hand saw minor outflows, such as Bitcoin Cash, Stellar and Uniswap. Finally, blockchain equities achieved inflows of $2.4 million.

Crypto Rebounding?The spike in sales figures over the past week represents the resurgence cryptocurrencies have been experiencing recently finally reaching investment products. The price of Bitcoin has risen nearly 40% since the beginning of Jan., from just under $17,000 to $23,000. Ethereum has been no slouch either, rising some 30%, from $1,200 to just under $1,600. Over the past month, total cryptocurrency market capitalization has risen back above $1 trillion.

Crypto markets have also reacted favorably towards the sentiment offered by the release of recent economic figures. With inflation cooling, and the economy still in good form, markets are increasingly hopeful of a “soft landing.” The Federal Reserve and other central banks are expected to slow rate hikes at meetings later this week.

The post As Digital Asset Inflows Reach 6-Month High, Have We Finally Turned the Corner? appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Digital Rupees (DRS) на Currencies.ru

|

|