2023-3-28 23:11 |

Investors put $160M into crypto investment products amid concerns around traditional finance. Bitcoin recorded the largest inflows of $128 million as a six-week streak of outflows ended. Digital assets manager CoinShares also says Solana, Polygon and EXP recorded inflows.

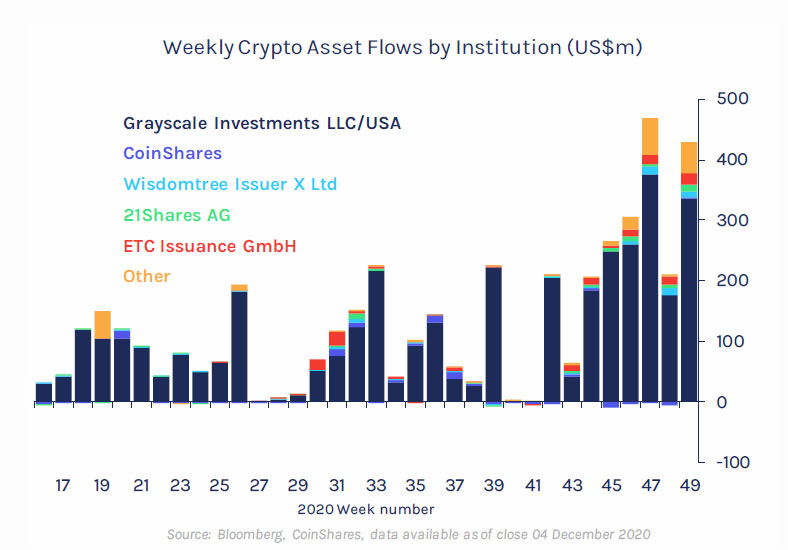

Inflows into digital asset investment products totaled $160 million last week, with the latest market report from digital assets manager CoinShares showing the largest share of inflows went into Bitcoin.

CoinShares’ Digital Asset Fund Flows Weekly Report published Monday 27 March also highlighted that crypto investment products had ended a six-week streak of outflows.

Digital asset investment products saw largest inflows since July 2022According to CoinShares Head of Research James Buttefill, crypto investment products had recorded outflows totaling $408 million over the past six weeks.

However, last week saw institutional investors put the most funds into crypto-related products for the sector to register its largest weekly inflow in eight months. The last time more institutional flows hit the crypto investment space was in July 2022.

The inflows come a while after Bitcoin rallied to highs near $29,000, with prices of Ethereum and other altcoins also witnessing significant upsides. However, BTC has shed some of the gains and remains below $28k.

Butterfill notes that inflows came “relatively late” compared to the rest of the crypto market, noting this is likely a reaction by investors to the recent chaos within the traditional financial markets.

Bitcoin recorded $128 million in inflows, but Ethereum saw a 3rd week of outflowsBitcoin saw the most inflows last week, with $128 million poured into BTC investment products as some CoinShares clients expressed sentiment of BTC being a safe haven. However, Bitcoin also continued to attract negative sentiment, with short-bitcoin inflows hitting $31 million last week.

Meanwhile, Ethereum recorded outflows for the third consecutive week, with $5.2 million exiting Ether investment products. CoinShares believes there are jitters around Ethereum’s highly anticipated network upgrade Shanghai, which is expected around 12 April.

Among altcoins, the top three coins to see inflows were Solana ($4.8 million), Polygon ($1.9 million) and XRP ($1.2 million).

The post Crypto saw $160 million in institutional inflows last week appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|