2021-10-8 12:25 |

The total value locked (TVL) across all decentralized finance (DeFi) platforms has tapped a record high this week as crypto markets continue to build on previous gains. The total amount of collateral locked in DeFi has tapped $200 billion according to analytics platform DeFi Llama.

The milestone was also noted by Chinese blockchain news outlet 8BTC in a Tweet on Oct 8.

“According to Defi Llama, the current TVL of DeFi is $208.39 billion, which not only hit a record high in TVL, but also surpassed the $200 billion mark for the first time.”

TVL has increased by a whopping 825% since the beginning of the year when there was just $21.4 billion locked in DeFi protocols. Around $90 billion has been added since the middle of July.

DappRadar and DeFiPulse are reporting lower TVL figures but they don’t list as many protocols as DeFi Llama.

Top DeFi ProjectsStablecoin staking platform Curve Finance has the most locked up with a TVL of $15.7 billion and an 8% market share. Several other protocols rely on Curve’s liquidity and yield pools so much of that collateral may have come indirectly from them.

Flash loan platform Aave is a close second with $15.1 billion locked up and wallet provider Instadapp is in the third spot with a TVL of $12 billion.

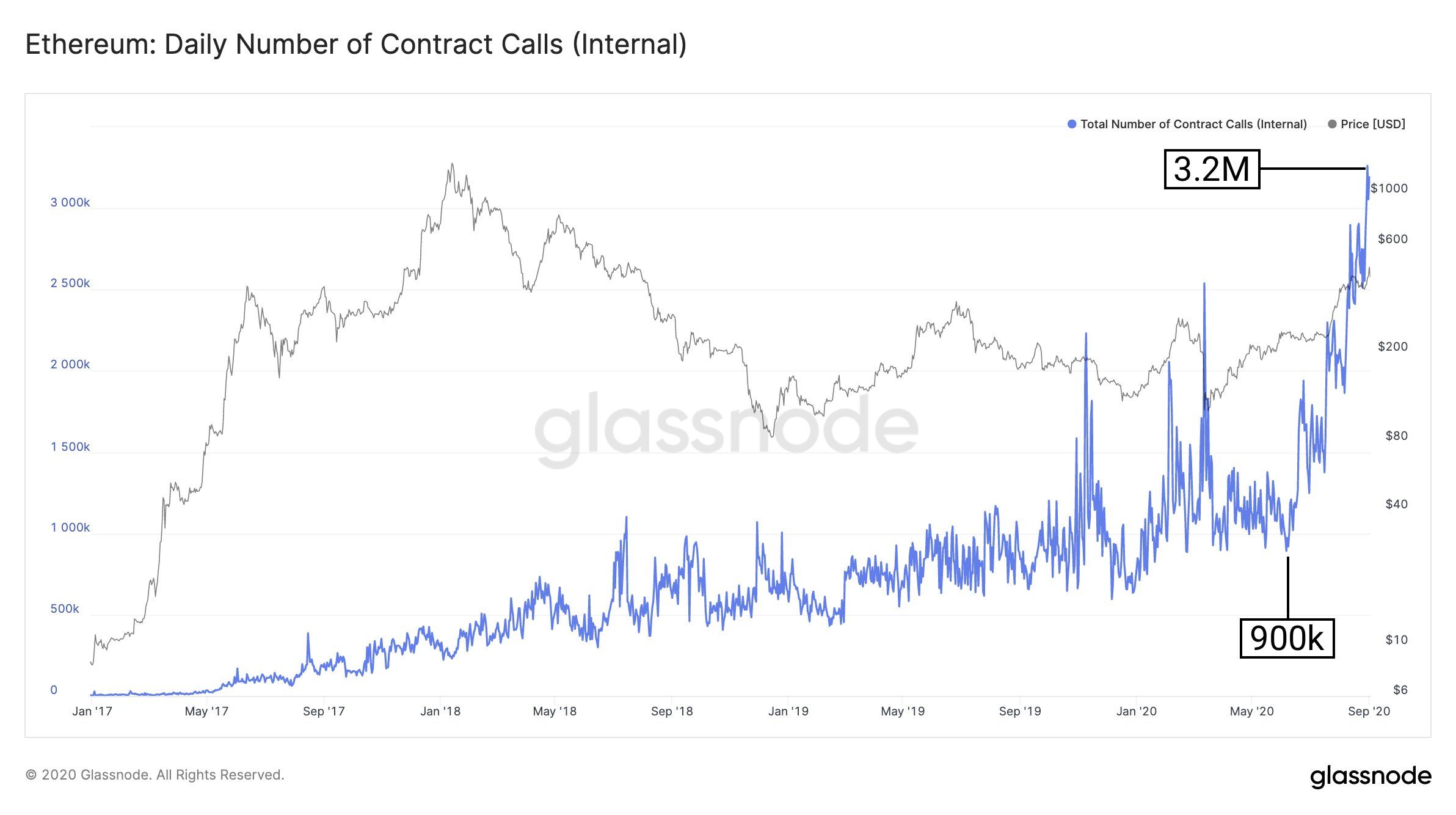

Platforms based on Ethereum are clearly dominant with 72% of the total collateral being based on them. Binance Smart Chain is the second most popular network for DeFi with $17.4 billion in TVL while the PancakeSwap decentralized exchange is its most popular DEX with a TVL of $4.9 billion.

Enterprise blockchain platform Solana is third according to DeFi Llama’s rankings with $10.7 billion TVL. The Fantom blockchain has just seen a TVL spike over the past 24 hours and it now has just over $8 billion in collateral.

Token TVL at $131BCoinGecko is currently reporting that the market capitalization of all the DeFi tokens is $131 billion or around 5.5% of the total. The entire crypto market was worth the same amount in March 2019 which is a testament to the monumental growth of the sector.

Terra’s LUNA is the top token by market cap with $18.8 billion. It has gained 11.6% over the past 24 hours to reach a price of $47. Uniswap’s governance token UNI is the second largest with a $13 billion market cap though it’s trading flat on the day. Chainlink’s LINK token is ranked as third in terms of DeFi market cap with $12 billion.

The post DeFi Total Value Locked Reaches Milestone High of $200B appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|