2023-5-18 07:17 |

In the realm of finance, Decentralized Finance (DeFi) holds the promise of revolutionizing traditional systems. However, its journey toward mainstream adoption has encountered significant hurdles.

This article explores the challenges hindering growth, specifically the slowdown in user acquisition and the struggle to generate substantial value. By delving into these roadblocks, we aim to uncover strategies and solutions that can revitalize the sector.

Decentralized Finance strives to disrupt traditional (and outdated, inefficient) financial systems. However, its journey toward mainstream adoption has encountered significant obstacles. One crucial challenge is the need for user-friendliness, expanding DeFi’s appeal beyond the crypto-native community. Presently, the intricate user interfaces of these products discourage newcomers, acting as formidable barriers to entry.

DeFi Needs User-Friendly UtilityTo truly realize its potential and reach a broader audience, DeFi must prioritize user-friendliness and overcome the complexity of its current interfaces. The intricate user interfaces of these products present a daunting barrier to entry for new users, particularly those who are not well-versed in the world of cryptocurrencies. Imagine a newcomer trying to navigate the intricacies of decentralized exchanges or struggling to understand the complexities of yield farming. It becomes apparent that simplifying the user experience is crucial in attracting non-crypto natives and encouraging broader participation in the ecosystem.

One approach to enhancing user-friendliness is through the adoption of more integrated solutions. Users can seamlessly navigate through different features and functionalities by integrating various DeFi services and applications into a unified platform. This integration can provide a cohesive user experience akin to that of traditional financial applications. For example, imagine a DeFi platform that combines lending, borrowing, and trading functionalities in a single intuitive interface. Such a platform would allow users to interact with DeFi protocols without the need for specialized knowledge or complicated processes.

Additionally, improving user-friendliness requires addressing the challenges of onboarding new users. Simplifying the registration and verification processes, providing clear instructions and guidance, and offering intuitive educational resources can significantly lower the barriers to entry. Furthermore, leveraging user feedback and conducting user testing can help identify pain points and areas for improvement, enabling DeFi platforms to enhance user experience.

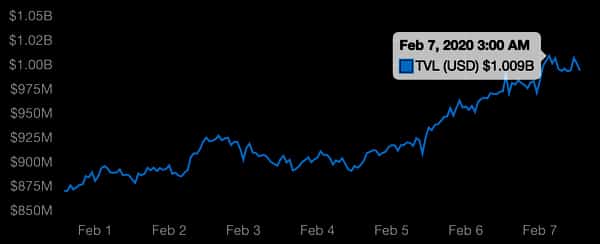

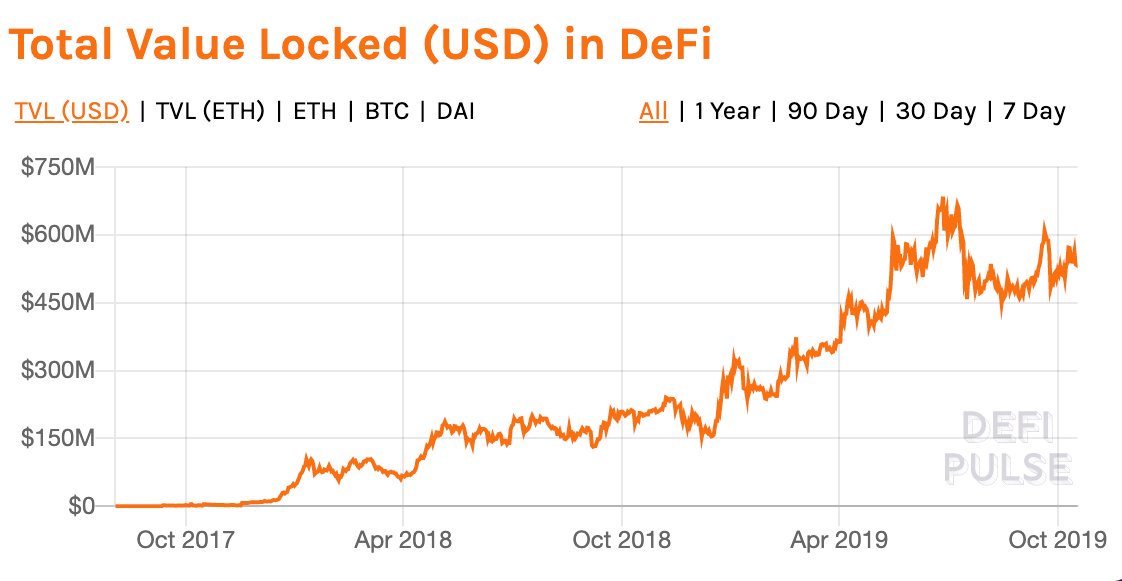

DeFi TVL 2020 – Current | DeFiLlama Unlocking Value: Addressing the DeFi DilemmaWhile DeFi holds the potential for unparalleled financial opportunities, the failure of DeFi projects to accrue value has become a pressing concern. This stagnation hampers the growth and sustainability of the ecosystem, deterring potential investors and limiting the adoption of DeFi solutions. To tackle this dilemma, DeFi must explore innovative approaches that transcend the conventional methods of value accumulation.

One avenue for unlocking value lies in creating and adopting novel token economics. Traditional cryptocurrencies often rely on price speculation as the primary driver of value.

However, DeFi can embrace alternative mechanisms that incentivize and reward token holders based on their active participation and contribution to the ecosystem. For instance, governance tokens can grant holders voting rights and decision-making power within a protocol, aligning token holders’ interests with the project’s success and growth. DeFi projects can attract long-term investors and foster organic growth by establishing clear utility and value propositions for tokens.

Moreover, interconnectivity between DeFi projects can play a vital role in unlocking value. The integration of different DeFi protocols and platforms creates a network effect where users can seamlessly move their assets and interact with various DeFi services. This interoperability expands tokens’ utility and potential value, as users can leverage multiple protocols to maximize their financial opportunities.

For example, a user could collateralize their assets on one lending protocol, borrow from another protocol, and utilize the borrowed funds for yield farming on a separate platform. This seamless integration allows for a more dynamic and interconnected DeFi ecosystem, leading to increased value creation and accumulation.

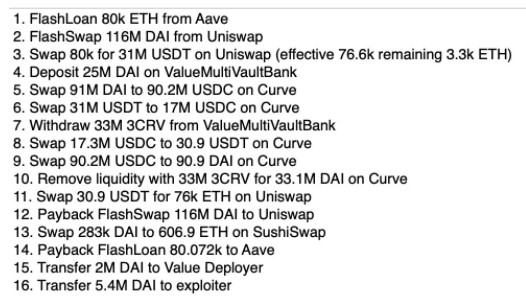

The ever-growing framework of apps, protocols, chains, and wallets that ostensibly support the DeFi sector | Coinbase Complexity Leads to AbandonmentLet’s take the example of Avalanche (AVAX) to illustrate the complexities involved in depositing on these platforms. To successfully deposit, a user must navigate through the following steps:

Swap into the specific bridgeable asset: Users need to identify which assets are acceptable for deposit and then proceed to swap their existing assets into the appropriate bridgeable asset. This requires research and knowledge about the available options.Bridge the crypto asset using a reputable bridge protocol: Once the desired asset is obtained, users must utilize a trusted bridge protocol to transfer the asset from one blockchain to another. This step involves understanding how bridge protocols work and choosing a reliable one.

Swap into AVAX for transaction payments: In order to cover future transactions within the network, users must exchange a portion of their assets for AVAX. Additionally, they would need to perform another swap if the asset they intend to earn a yield on is not bridgeable. Both of these swaps necessitate familiarity with decentralized exchanges that offer sufficient liquidity for the desired trading pairs.

Deposit the asset into a lending protocol: After completing the previous steps, users can finally deposit their assets into a lending protocol like Aave. This process involves understanding how the specific lending platform operates and executing the deposit transaction.

These steps can be daunting and overwhelming for the majority of users who are not technically proficient in the cryptocurrency space. Many individuals may abandon the process at the early stages due to the complexity involved or the lack of guidance.

The current state of DeFi, with its intricacies and technical requirements, limits its usability to a niche community. To attract a wider audience, DeFi must evolve and become more user-friendly. If it remains inaccessible in its current form, it will struggle to gain mass adoption.

Redefining the User Experience: A Catalyst for AdoptionImproving the user experience (UX) is a critical catalyst for driving the next wave of DeFi adoption. While the concept of decentralized finance may be foreign to many individuals, offering intuitive and seamless platforms can bridge the gap and attract a broader range of users, including those who have been traditionally skeptical of cryptocurrencies.

One aspect of enhancing the user experience is providing clear and user-friendly interfaces. DeFi platforms should prioritize simplicity and clarity in design, ensuring that users can easily navigate through different functionalities and understand the actions they are taking. Thoughtful user interface design, with intuitive icons, clear labels, and concise instructions, can significantly enhance the overall usability of DeFi applications.

DeFi’s Moment to Shine: Unfulfilled ExpectationsIn a world rife with mounting anti-bank sentiment and escalating inflation, the stage seemed set for DeFi to ascend and redefine the financial landscape. However, despite the potential, it has yet to seize its moment to shine. Leaving many to wonder why it has fallen short of expectations.

One contributing factor is the abstract nature of DeFi itself. For many individuals, the concepts and underlying technology of decentralized finance remain elusive and complex. The complexities of blockchain, smart contracts, and decentralized protocols can be daunting for newcomers. To overcome this, DeFi must demystify its operations and simplify its concepts for a wider audience.

Paving the Way for ResurgenceRevitalizing DeFi demands a comprehensive and multi-faceted approach that addresses the challenges of user acquisition and value accumulation head-on. To ensure the resurgence of DeFi, it is essential to prioritize user-friendly utility and embrace integrated solutions that extend the ecosystem’s reach to non-crypto natives and encourage broader participation.

Utility entails streamlining the onboarding process and simplifying the overall user experience. DeFi platforms should strive for intuitive interfaces, clear instructions, and seamless integration of different functionalities. By reducing complexity and minimizing barriers to entry, DeFi can attract a wider range of individuals who are eager to explore the possibilities of decentralized finance.

Educating the PublicDeFi should prioritize education and awareness to empower users with essential knowledge. Comprehensive resources like tutorials, webinars, and guides deepen understanding of DeFi concepts, protocols, and risk management. Comprehensive educational resources, including tutorials, webinars, and interactive guides, enhance individuals’ understanding of DeFi concepts, protocols, and risk management. Education fosters trust and empowers users to make informed decisions and actively participate in the DeFi ecosystem.

Simultaneously, implementing robust risk mitigation tools is crucial for DeFi’s resurgence. The decentralized nature of DeFi brings inherent risks, including smart contract vulnerabilities and potential security breaches. To instill confidence in users, DeFi platforms should prioritize rigorous security measures, regular audits, and transparent reporting.

Additionally, the development of decentralized insurance protocols and mechanisms for fund recovery can provide an added layer of protection. Assuring users that their assets are safeguarded in the event of unforeseen incidents. By fortifying the security infrastructure, DeFi can establish itself as a reliable and trusted financial ecosystem.

Customized ExperiencesFurthermore, enhancing the user experience goes beyond user-friendliness. DeFi platforms should also focus on personalization and customization to cater to individual preferences and needs. Customizable dashboards, tailored notifications, and personalized investment recommendations can empower users to have a more personalized and engaging experience.

By offering a user-centric approach, DeFi can create an ecosystem that is not only accessible. But also resonates with the unique requirements of its diverse user base.

Unlocking Potential: Embracing Innovative ApproachesIn tandem with user-friendly utility and risk mitigation, DeFi must also address the challenge of value accumulation. To unlock its true potential, projects must embrace innovative approaches that extend beyond price speculation.

Token economics that reward participation, governance rights, and ecosystem utility incentivize user engagement and contribute to project growth. Promoting interoperability and collaboration between protocols enables users to optimize financial opportunities and enhance value creation.

By prioritizing user-friendly utility, robust risk mitigation, enhanced user experience, and redefined value accumulation, the way is paved for a resurgence. This comprehensive approach positions DeFi to redefine finance, unlock its potential, and become a pillar of the global financial world. DeFi’s progress democratizes finance, empowers individuals, and revolutionizes traditional systems toward a more inclusive, transparent, and decentralized future.

The post Revitalizing DeFi: Tackling Stunted Growth and Depreciating Value appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Defi (DEFI) на Currencies.ru

|

|