2023-8-4 21:55 |

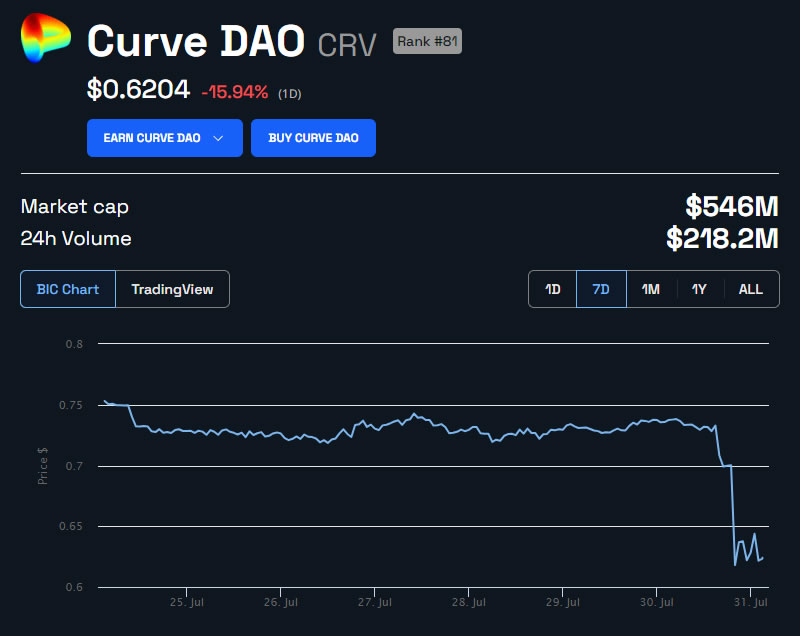

Michael Egorov, the founder of Curve, has sold an additional 7.5 million CRV in an over-the-counter (OTC) transaction and paid a $3 million debt in USDT on Aave origin »

Bitcoin price in Telegram @btc_price_every_hour

Crowdvilla Ownership (CRV) на Currencies.ru

|

|