2023-8-1 12:49 |

Justin Sun Purchases 5M CRV from Michael Egorov Amidst High Debt APY and Market Unrest

In recent developments, Michael Egorov, the founder of Curve Finance, reportedly sold 5 million Curve (CRV) tokens to Justin Sun, the infamous blockchain entrepreneur and the founder of Tron, at an average price of $0.4 via Over-The-Counter (OTC) trading. This transaction arrives at a turbulent time for Egorov whose project and one of the backbones of DeFi, Curve Finance’s significant hacking incident in July 2023, leading to the loss of over $52 million.

The attack exploited a vulnerability in the Vyper programming language, which led to funds being drained from multiple DeFi projects including JPEG’d, Metronome, and Alchemix, in addition to a Curve liquidity pool. Following the revelation of the hack, over $1.5 billion in cryptocurrency was removed from the exchange, causing a drastic 50% drop in total holdings.

Justin Sun: A Troublesome Figure in CryptoJustin Sun, the founder of TRON, has frequently found himself in controversy’s crosshairs. His troubled history begins with a botched Tesla giveaway in 2019, which raised questions about his leadership skills.

The following year, he won a charity lunch with Warren Buffett, only to have it postponed due to tension between the US and China. Ignoring official warnings led to the detention of several top Tron employees and his father, further tarnishing his reputation.

More serious allegations include insider trading, with accusations of Sun’s team buying large amounts of tokens to manipulate prices. He also faced criticism for launching the BitTorrent Token (BTT) without proper classification as a utility token, thereby avoiding potential regulatory issues.

Further darkening Sun’s profile is his association with a Ponzi scheme connected to TRON, resulting in significant investor losses and even a tragic suicide. Lastly, he was accused of instigating a “governance attack,” though he denies this claim. Given this track record, caution is advisable when dealing with Justin Sun in the crypto world.

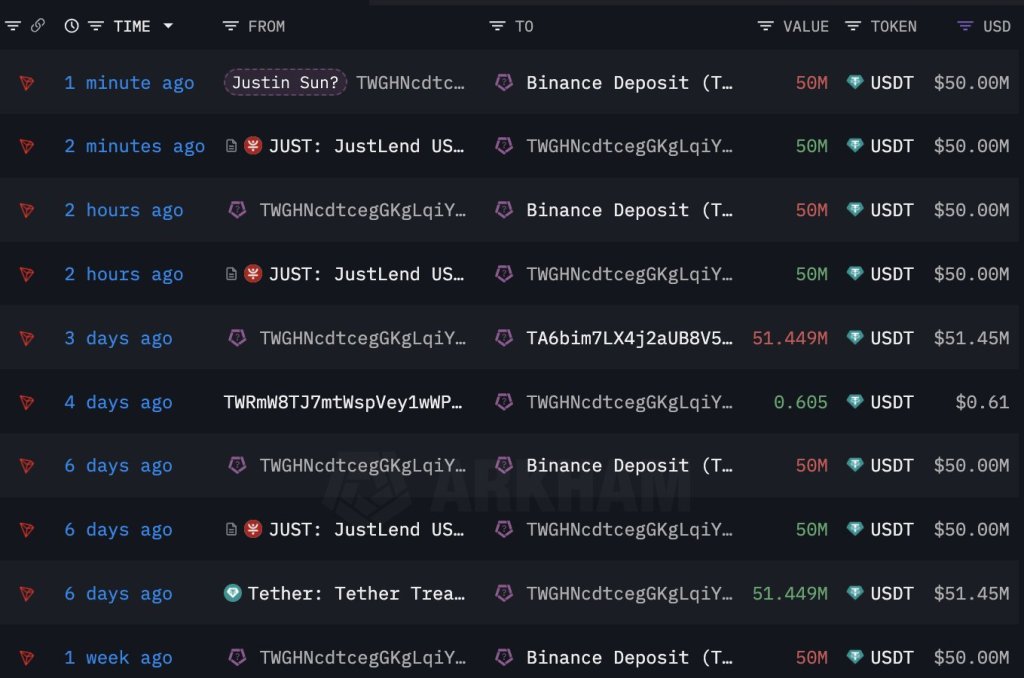

Egorov’s TroublesReports suggest that Egorov had withdrawn 40.74 million Tether (USDT) from the Aave lending platform, causing the USDT borrow APY on Aave to surge to 44%. With this level of borrowing, Egorov’s daily interest could rack up to a hefty $76k. Furthermore, his debt of 63.2 million USDT, underpinned by a staggering 427.5 million CRV tokens (about 47% of the entire CRV circulating supply), has heightened concerns regarding the stability of the Curve ecosystem. The high utilization rate on Aave and Fraxlend’s Time-Weighted Variable Interest Rate could expedite his liquidation, despite the current CRV price.

Unibot: Trading Intelligence that Makes You 7x More Successful.Discover the edge in crypto trading with Unibot – a user-friendly Telegram bot that boasts a 35% profitability rate amongst users, seven times higher than the average trader! Experience top-notch features like decentralized copytrading, DEX-based limit orders, and protection against MEV bots. Click here to register and make your trades count!

Show more +Show less –Egorov’s financial woes are exacerbated by the vulnerability of the Curve ecosystem, which has been in a state of flux since Curve’s DAO token price plummeted by 10% within the past 24 hours. The community is now anxiously eyeing the potential knock-on effects on a large part of the DeFi ecosystem, if Egorov’s positions are liquidated.

In an attempt to control the damage, Egorov has launched a new Curve pool & gauge consisting of crvUSD & Fraxlend’s CRV/FRAX Liquidity Provider (LP) token, incentivizing liquidity towards the lending market to lower utilization rates. While these measures have managed to attract $2m in liquidity and decrease the utilization rate to 89%, concerns around Egorov’s financial state and Curve’s stability persist.

The Curve DAO token associated with the protocol saw a 15% decrease in value over the subsequent 24 hours, adding to the financial strain on Egorov. This marked the second significant security incident Curve Finance faced within a year, with the first being a DNS record compromise in August 2022 resulting in user losses of approximately $612,724.16. These incidents underline the persistent risks inherent in DeFi platforms and the importance of robust security protocols within the crypto sector.

.rh-colortitlebox{margin-bottom:30px;background:#fff;line-height:24px;font-size:90%}.rh-colortitlebox .rh-colortitle-inbox{display:flex;align-content:center;padding:15px;font-weight:700;font-size:110%; line-height:25px}.rh-colortitlebox .rh-colortitle-inbox i{line-height:25px; margin:0 10px; font-size:23px}.rh-colortitlebox .rh-colortitle-inbox svg{width:25px;margin-right:10px}.rh-colortitlebox .rh-colortitle-inbox-label{flex-grow:1}.rh-colortitlebox .rh-colortitlebox-text{padding:20px}.rh-colortitlebox-text>*{margin-bottom:20px}.rh-colortitlebox-text>:last-child{margin-bottom:0}.rh-toggler-open{height:auto !important} .rh-toggler-open .rh-tgl-show, .rh-toggler-open .rh-tgl-grad{display:none !important} .rh-toggler-open .rh-tgl-hide{display:block !important} .rh-tgl-show, .rh-tgl-hide{cursor:pointer} .rh-contenttoggler *{box-sizing: border-box !important} .rh-toggler-wrapper{overflow: hidden;transition: all 0.5s ease; padding-bottom: 35px; margin-bottom:30px;box-sizing: content-box !important;position: relative;} .rh-toggler-wrapper p:last-of-type {margin-bottom: 0;}The post Just When Curve Finance Didn’t Need More Drama, Justin Sun Steps In appeared first on CaptainAltcoin.

origin »Bitcoin price in Telegram @btc_price_every_hour

SUNcoin (SUN) на Currencies.ru

|

|