2020-12-21 10:54 |

Decentralized finance protocol Curve Finance has launched a new pool for Ethereum and synthetic Ethereum (sETH) swaps and liquidity provision.

The pool allows liquidity farmers to deposit Ethereum and synthetic Ethereum in order to earn additional yields. sETH is essentially a soft peg of standard ETH, designed to stay as close in value as possible, though it often trades slightly lower which allows for arbitrage opportunities.

The newly launched pool contained 65% ETH and 35% sETH at the time of press, worth a combined estimated total of around $155,000 at current prices.

Finally we have a $ETH / $SETH pool! Ethereum is so good that you only may want to swap it to Ethereum.https://t.co/2fuCc9biNx pic.twitter.com/poj3NtDLmt

— Curve Finance (@CurveFinance) December 20, 2020On the downside, the interface was reporting that there was an admin fee of 0.04% and the current average transaction cost was $7.82 making this new offering only really viable for whales.

The current ETH/sETH exchange rate is 0.992 so farmers would need big bags to make a profit from arbitraging between the two assets.

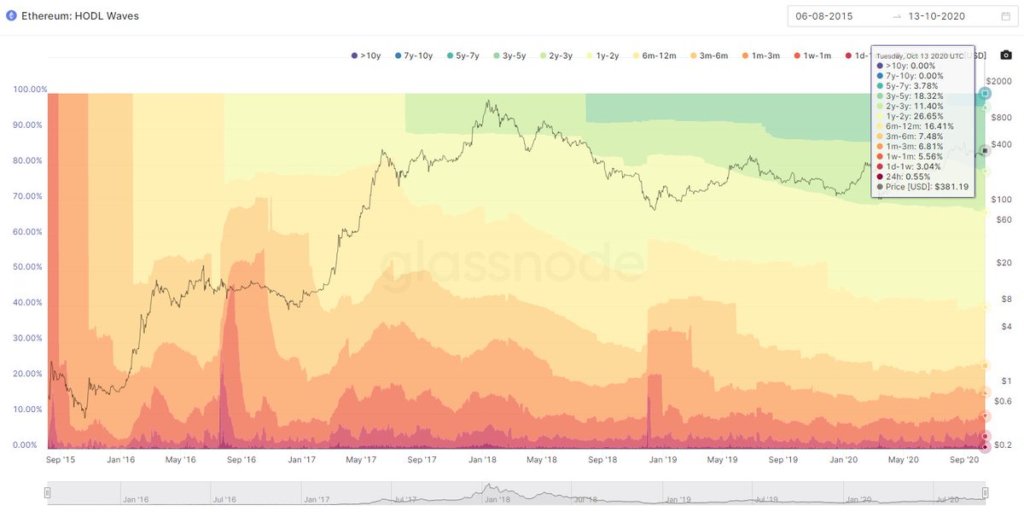

No Ethereum Yields on YearnThere has been a high demand for Ethereum-based vaults this year. The one launched by Yearn Finance in early September became a victim of its own success and was ultimately deemed a failure. Within the first day of launch, over $100 million in liquidity had been deposited, which worked out to be more than 230,000 ETH at the time.

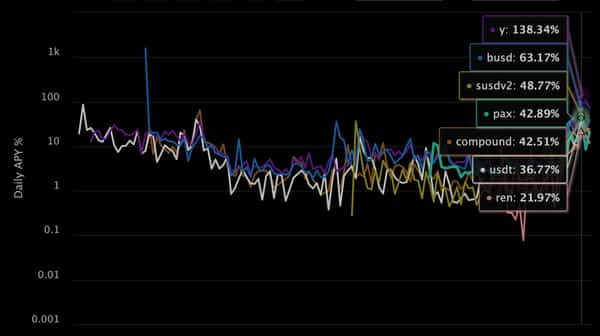

The high demand yETH vault originally touted upwards of 80% annual percentage yields just for depositing Ethereum. It survived its first price crash but was soon closed to further deposits to mitigate risks.

Even depositing a modest amount of ETH resulted in a loss after a couple of months when taking into consideration the high gas fees, pitiful returns, and Yearn’s 0.3% withdrawal fee — as many painfully found out.

At the time of press, the yETH pool was still suspended and earning a paltry 0.84% APY which would not be enough to cover the transfer fees for most. Liquidity had slumped to just 36,800 ETH worth approximately $23 million at today’s prices.

Yearn Finance, whose founder has been one of the most popular industry figures this year, has hinted at another Ethereum vault with new strategies under its version 2 vaults launch. As of yet though, nothing has been officially announced.

CRV and YFI Price UpdateLate last month, Curve Finance announced the distribution of almost $3 million in fees to CRV holders after a community vote. This has not prevented the continual decline in prices of the Curve Dao Token, however.

Today, CRV is down a further 5% to trade at $0.623 and has dumped a painful 96% since its all-time high of over $15 in mid-August.

Yearn Finance’s YFI on the other hand has recovered well and is trading flat on the day around $26,500.

The post Curve Finance Launches Ethereum Swapping Liquidity Pool appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Ethereum (ETH) на Currencies.ru

|

|