2021-1-29 14:17 |

Decentralized finance aggregator Yearn Finance has re-launched its popular Ethereum vault but initial yields appear to make it a non-starter.

DeFi protocol Yearn Finance has breathed some life back into its yETH vault to accommodate the high demand that it had originally.

Yearn added that the vault will remain a v1 pool with the implementation of a buffer for withdrawals and more efficient debt management.

Upon initial glance, the yields are reporting a paltry 1.6%, meaning that this will not be economically viable for smaller depositors when considering current gas prices and Yearn’s fees.

1/ We are excited to announce the re-launch of our v1 ETH yVault. This vault has been revamped and is able to accommodate high demand that our v1 yVault experienced. Further, we have implemented a buffer for withdrawals and more efficient debt management. pic.twitter.com/Q22bFL21bO

— yearn.finance (@iearnfinance) January 28, 2021It is likely that these early yield figures will improve once the vault gains more liquidity.

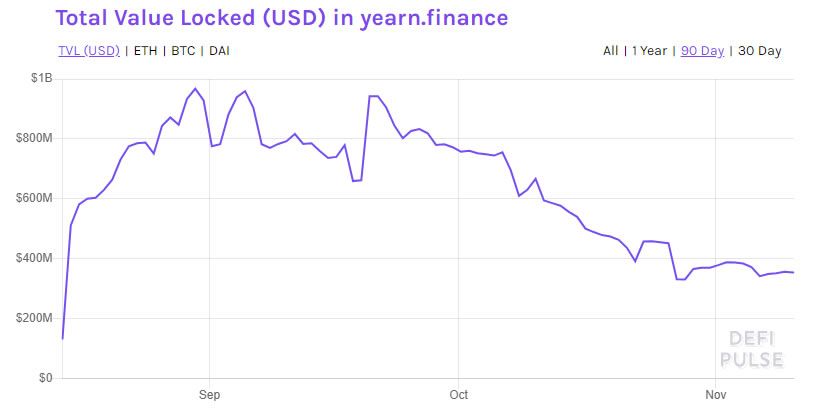

State of the Yearn VaultsThe first iteration of the yETH vault, launched in early September 2020, surged in popularity as it initially offered over 80% annual returns just for depositing ETH. It survived its first market blip when Ethereum prices dropped sharply and accrued around 400,000 ETH in deposits within a few days.

However, things started to turn sour fast as annual percentage yields plunged to eventually bottom out below 1%. The inevitable liquidity exodus occurred leaving most out of pocket having been stung on gas and Yearn’s 0.5% withdrawal fee.

The protocol suspended the vault while new strategies were sought. According to Yearn Finance stats, there are just 22,700 wrapped ETH in the vault at the time of press.

Yearn added that the relaunched vault will have additional built-in slippage safeguards that will protect users from experiencing unusually high slippage.

Withdrawal fees have been temporarily waived, it added, and only a 5% fee on subsidized gas costs remains. The vault, as before, uses ETH to mint DAI from MakerDAO and earns CRV via the 3pool on Curve Finance.

The currently reported 1.6% yield is even far below the ETH 2.0 staking rewards of 9.3%, though assets need to be locked for over a year with this option.

At the time of press, there were still only four v2 vaults operating; USDC, Hegic, Dai, and steCRV — the latter reporting an impressive 33% APY. These yields are dynamic and adjust over time but the lowest-performing at the moment is still yETH.

YFI Price UpdateYearn’s native YFI token is back to trading at $30,400 again as crypto markets bounce back from another dip. YFI is down around 7% on the week but up around 34% so far in January.

YFI is lagging behind some of its DeFi brethren such as UNI and AAVE, however, which have both notched up recent all-time highs. YFI, which may undergo a supply increase, is still 32% down from its high from mid-September 2020.

The post Yearn Finance Revives yETH Vault but Early Yields Disappoint appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Vault Coin (VLTC) на Currencies.ru

|

|