2021-3-12 13:19 |

It’s been one year since the COVID-19 pandemic really took hold and sent global markets into a tailspin. Things have largely recovered since, but the crisis has caused many to seek out alternative investments — particularly in cryptocurrencies.

This increasing demand for cryptocurrencies is evidenced by the explosive rise in prices across the crypto markets. While some have done considerably well, not every asset is seeing a seamless transition.

Bitcoin (BTC)Exactly one year ago, Bitcoin was briefly trading below $4,000 after freefalling from the $8,000 level.

Its steady increase in adoption price over the past year can be attributed to a number of factors. As workers were sent home due to the lockdown from the Coronavirus, many started dipping their toes into the markets. In the United States, this was compounded by many receiving stimulus checks.

Institutional investors began growing concerned over the dollar’s potentially shrinking leverage. At the same time, the U.S. Federal Reserve continued pumping money into the economy to stave off a COVID-induced recession.

Many investors, both large and small, began turning to bitcoin as a hedge against inflation. This philosophy has been expounded by MicroStrategy CEO Michael Saylor. His company first started acquiring bitcoin in August 2020, and currently holds 91,064 BTC. Since then, high-profile acquisitions from Elon Musk’s Tesla, and Jack Dorsey’s Square have strengthened its prospects.

Ethereum (ETH)Although bitcoin saw greater momentum, it was only natural that the rally would spread throughout the crypto markets. This obviously also helped to boost the second-ranked Ethereum. However, it also had help from the growing popularity of ETH applications, in particular, decentralized finance (DeFi) and non-fungible tokens (NFTs).

According to DeFi Pulse, the total value across all DeFi protocols was a mere $680 million at the beginning of 2020. By the end of the year, it had reached $15 billion — a 2,100% increase.

Last year, the total value of transactions in the NFT sector surged by 299% on a year-on-year basis. This value reached more than $250 million, according to a joint study by NonFungible.com and foresight company L’Atelier BNP Paribas. Fast forward to the present day, and we can see multiple instances of NFT art selling for millions of dollars apiece.

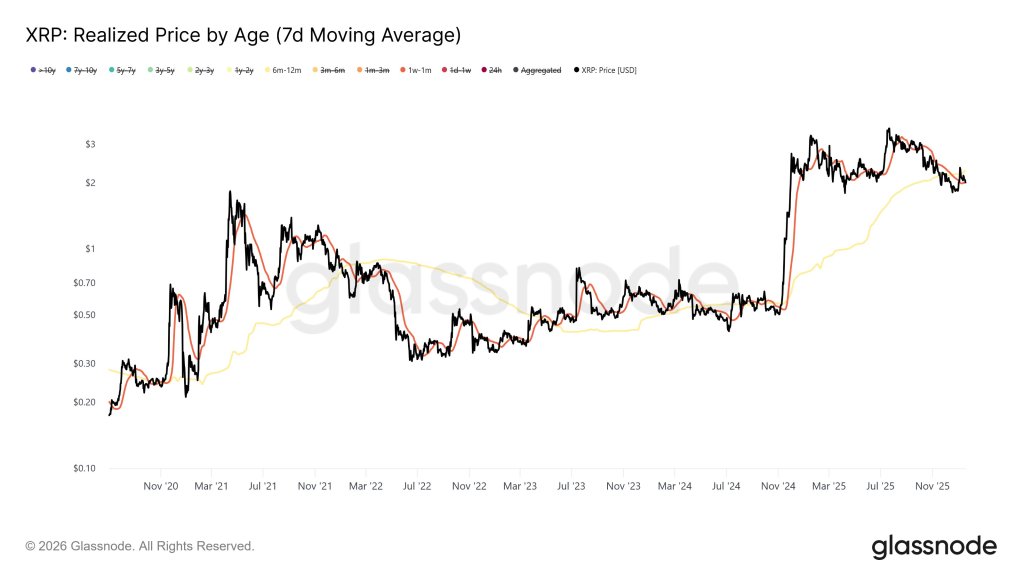

Ripple (XRP)Meanwhile, XRP hasn’t fared as well as its former crypto podium pals. Its reputation took a significant hit when the U.S. Securities and Exchange Commission (SEC) formally indicted Ripple Labs Inc. and its former and current CEO.

The company and its executives have worked hard to combat the charges, but the damage seems to have already been done. While XRP is no doubt doing better than it was a year ago, its comparative market cap has fallen significantly. It currently ranked number in terms of market cap at $20 billion.

A brief overview of the three shows that while BTC has increased roughly 1,000% year-to-date, ETH has actually performed even better, at over 1,500%. Meanwhile, XRP shows a “mere” 232% increase to show for the past year.

Source: TradingViewThe post Crypto Market Update on COVID-19 Crash-iversary appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|