2020-2-13 22:00 |

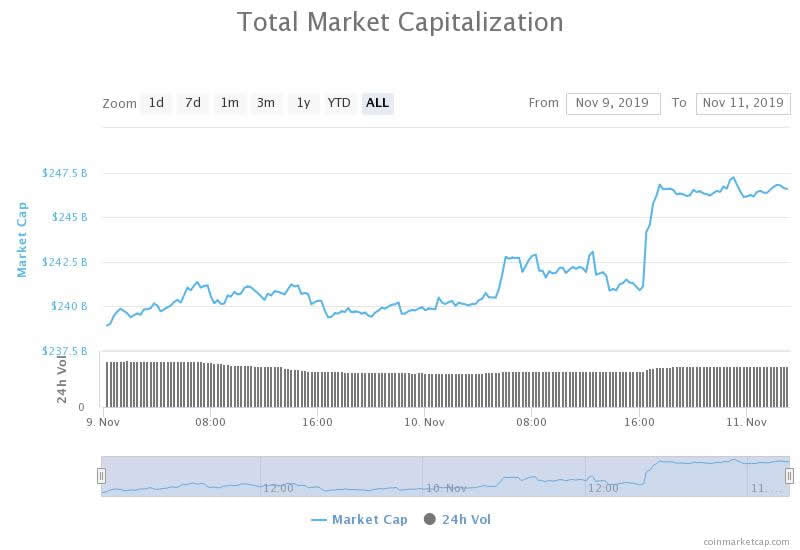

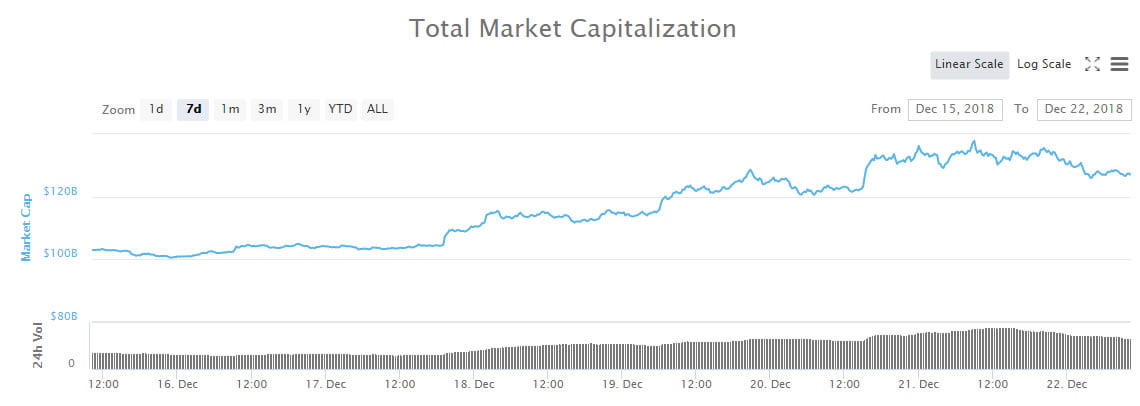

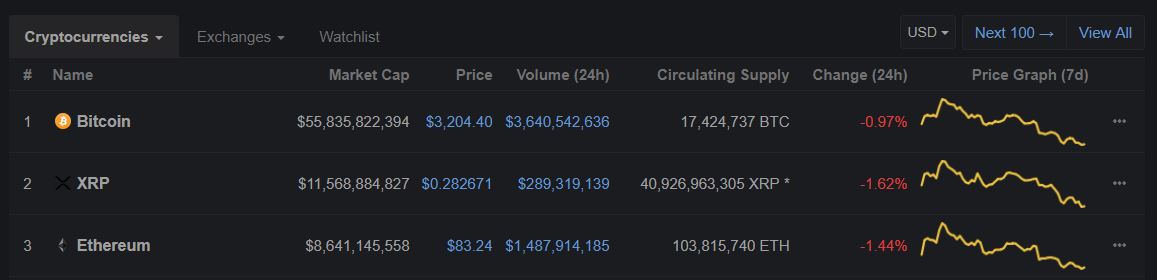

The crypto rally of 2020 is one for the history books already, with Bitcoin and altcoins rallying well over 50% year-to-date, and in some cases, specific crypto assets are up well over 1,000%. But the outrageous and irrational rally could be coming to an end soon if sell signals flashing across the market trigger a widespread selloff. Is the 2020 Rally Across Altcoins and The Rest of Crypto Ready to End? Crypto traders and analysts are regularly scouring through chart after chart, hoping to find some info that tips them off on future price movements. The tools they use involve detailed technical analysis, which utilizes chart patterns in combination with indicators and oscillators. Related Reading | Proceed With Caution: Ethereum and Altcoins Reach Critical Resistance One such tool, developed by financial analyst Thomas DeMark, called the TD9 Sequential indicator, has issued sell signals across the wider crypto market. The TD9 “sell” signal has flipped on the USD pairs of Bitcoin, Ethereum, Litecoin, Cardano, Binance Coin, Chainlink, and Monero. The indicator signal trips when a series of candlesticks closes in a particular sequence that suggests a trend is weakening, or relief in the other direction may be ahead. The indicator’s creator is known specifically for his prowess in market timing, and for using the skill to properly predict the October 2011 stock market bottom within one point of its final, exact low. Predicting the Bitcoin Top and Bottom Using TD9 If you’re questioning the tool’s use and validity in crypto markets, don’t. Thomas DeMark also called Bitcoin’s 2017 bull run top, the December 2018 bottom, and the recent June 2019 top with unmatched accuracy. DeMark’s tool may be predicting yet another top – the top of the currency crypto rally. Bitcoin is nearly 50% year-to-date, while altcoins like Ethereum are up well over 100%. Rare outliers like Tezos are up well over 400% in the new year. At the first sign of a reversal, profits that have been piling up for nearly two months now will be taken, causing a cascade-like selloff and long positions covering. Related Reading | Only Two Lines of Defense Remain Ahead of New Bitcoin All-Time High The fact that the market believed a bull run breakout was upon us, could also cause the selloff to become more severe as fears of a yet another downtrend or deep drop could reach extreme levels. However, the next dip across the greater crypto market may be the last one before the bull run truly begins. That dip may be beginning now, now that the TD9 Sequential has issued these sell signals across Bitcoin and altcoins like Ethereum and others. origin »

Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|