2018-12-3 06:57 |

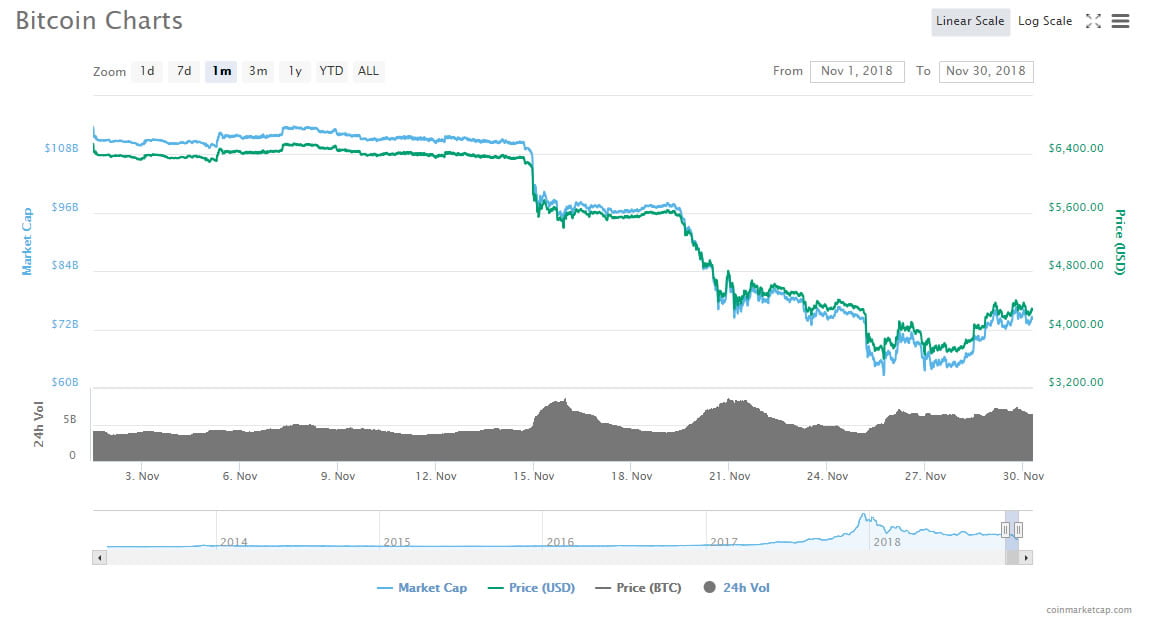

November has been historically one of the worst month in the history of Bitcoin. The month began around $6,400 mark before falling to $ $5,600 in couple of weeks. It was stable around $5,500 range when it fell $1,000 again and was trading below $3,600. This was one of the fastest decline wiping off $1,000 in just a few hours. It managed to rally back again to stick around the $4,000 mark. The month ended with nearly 38% drop making it one of the worst month in the history of the cryptocurrency.

It appears, in November, many large-scale bitcoin miners threw in the towel throughout November, with JPMorgan Chase strategists writing in a report that “prices have declined to a point where mining is becoming uneconomical for some.” While the decline may have partially resulted from miners switching to other cryptocurrencies, JPMorgan Chase & Co. says some in the industry are losing money after Bitcoin’s price tumbled.

CEO of Genesis Global Trading, Michael Moro said

“it didn't take much for the price to break down after bitcoin failed to stay above the key support level of $5,850. It's unclear if this is a ‘bottom' or a brief period of consolidation before next move down, but buyers are still maintaining some cash on the sidelines in case it does go lower.”

Even though the situation looks very dire, the month had many bright spots too. Cryptos got the backing of Jeff Sprecher, chairman of the New York Stock Exchange. In january, a version of bitcoin futures through is going to be released by The Intercontinental Exchange in a partnership with a startup called Bakkt.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|