2025-5-14 17:10 |

Amid global financial volatility, Bitcoin is emerging as a business strategic asset. A report by Bitcoin investment firm River shows a significant increase in companies’ Bitcoin accumulation, with adoption rising 154% from 2024 to the present.

This article analyzes the growth, the reasons behind this trend, and the latest insights from experts and companies.

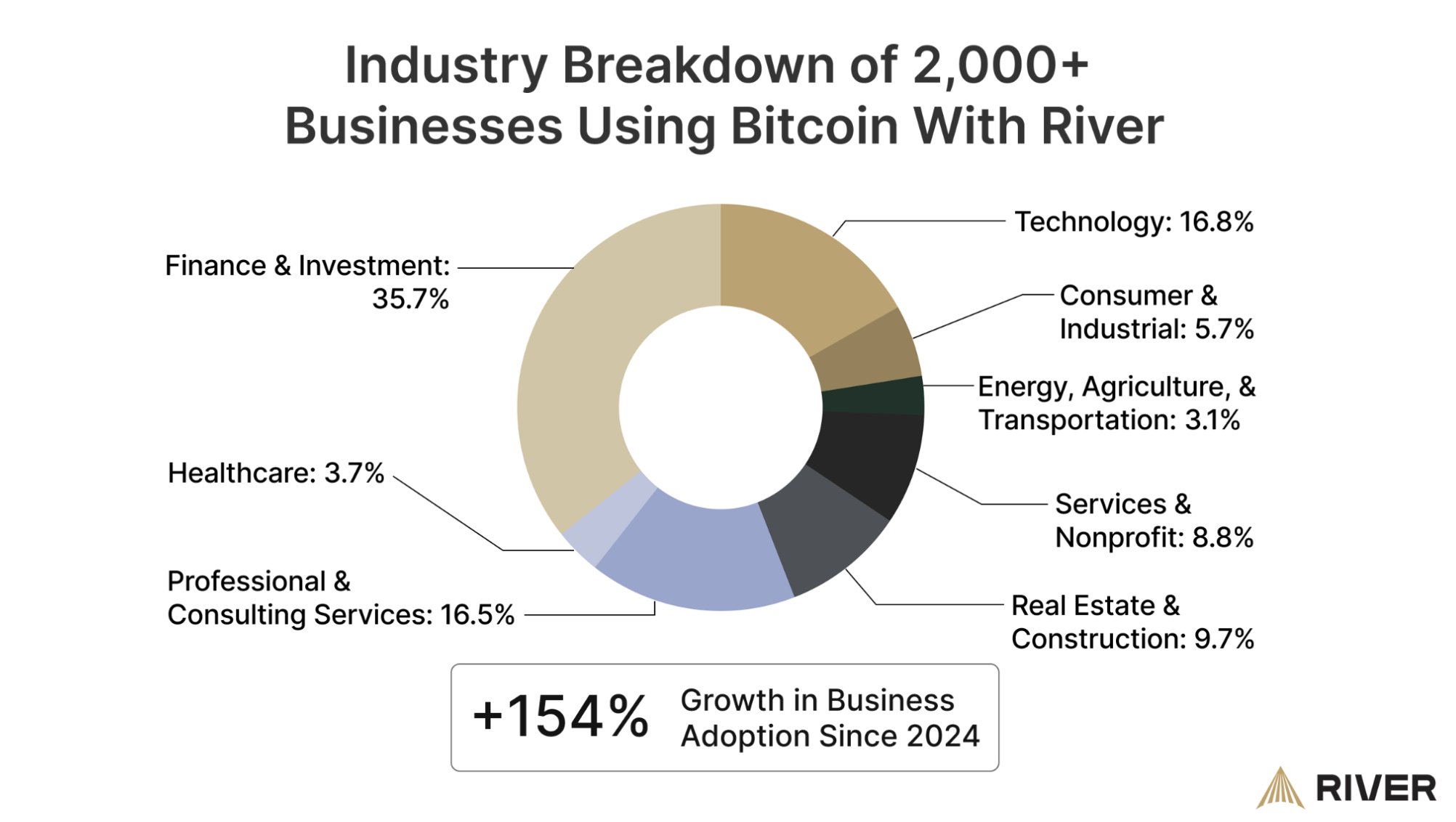

Growth in Bitcoin Accumulation Among BusinessesAccording to River’s statistics, over 2,000 companies are using the platform to accumulate Bitcoin, an impressive 154% growth since 2024.

Leading industries include finance and investment (35.7%), technology (16.8%), professional & consulting services (16.5%), real estate and construction (9.7%), and sectors like healthcare (3.7%) and energy, agriculture, and transportation (3.1%).

Industry Breakdown of Businesses Using Bitcoin. Source: River.This diversity shows that Bitcoin is no longer limited to high-tech sectors. It has expanded into a wide range of industries. One notable example is BlueCotton, a T-shirt printing company that uses Bitcoin to support its operations. Fast food chain Steak ‘n Shake also began accepting Bitcoin payments at all US locations on May 16, 2025.

Reports also indicate that businesses have become the leading buyers of Bitcoin, outpacing governments and exchange-traded funds (ETFs).

Why Are Businesses Allocating Assets to Bitcoin?Businesses accumulate Bitcoin primarily because it can hedge against inflation and preserve value.

Cash has significantly lost value as inflation rises and governments continue to print money. River calculated that a company investing 3% of its assets in Bitcoin earned a 20% inflation-adjusted return between 2021 and 2025. In contrast, holding only cash led to a 19% loss, while money market funds saw a 6.7% loss.

Inflation-Adjusted Returns of Bitcoin Holding Companies. Source: River“Bitcoin provides a unique diversification as a liquid, scarce asset with a fixed supply of 21 million coins. This scarcity has historically allowed Bitcoin to far outperform inflation, making it an effective long-term store of value,” River’s report states.

For example, the Argentine company Belo allocated 30% of its treasury to Bitcoin to combat the 211% inflation of the peso.

Bitcoin also offers 24/7 liquidity, giving businesses access to capital anytime. This proved especially valuable during crises, such as the collapse of Silicon Valley Bank in 2023, when many companies couldn’t withdraw their cash.

Another reason is the reduction of risk from the traditional banking system. Bitcoin allows businesses to manage their assets, minimizing third-party risks.

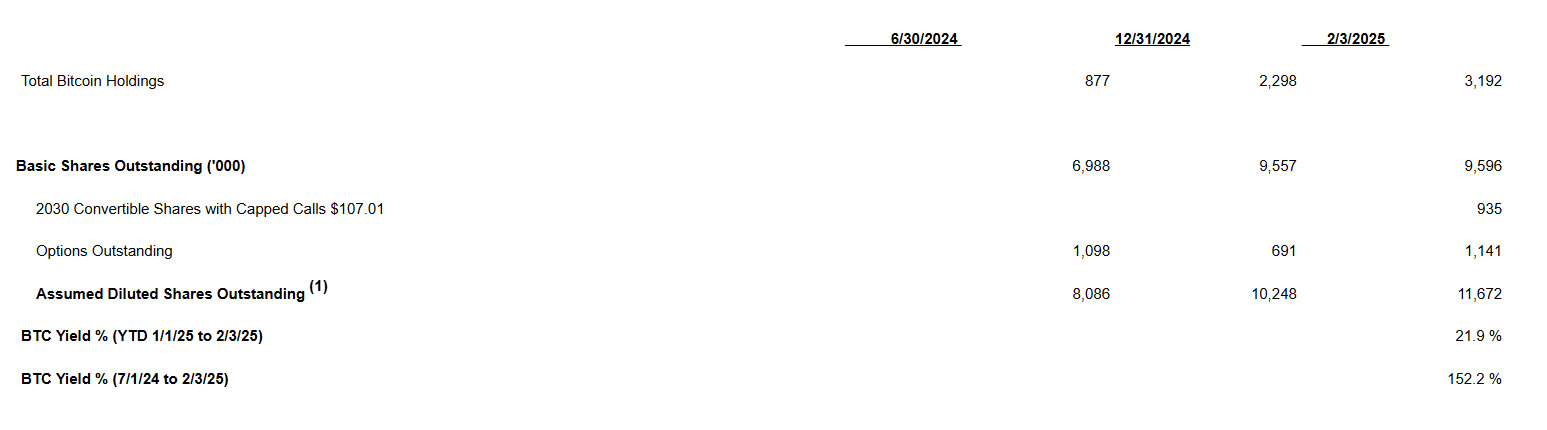

According to data from BitcoinTreasuries, private and public companies have accumulated over 1 million BTC as of 2025. Standard Chartered predicts that the accumulation activity by companies, governments, and ETFs could drive Bitcoin to $120,000 in Q2 2025.

The post Corporate Bitcoin Accumulation Trend Accelerates, Surging 154% in a Year appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|