2025-2-6 19:30 |

For decades, corporate treasuries have relied on cash, bonds and short-term investments to preserve capital. But inflation, devaluing fiat currencies and near-zero interest rates have challenged this approach. A new dark horse is emerging and corporate finance is about to change forever.

BTC as a corporate reserve assetHistorically, corporations have kept substantial cash reserves for both stability and liquidity. However, as Michael Saylor, Executive Chairman of MicroStrategy has argued, cash is like a melting ice cube — losing its purchasing power due to monetary debasement. Bitcoin offers an alternative: an asset with a fixed supply, global liquidity and asymmetric upside.

Since 2020, MicroStrategy has aggressively accumulated bitcoin, transforming its corporate balance sheet into a quasi BTC bank. The company issues convertible debt and equity to fund its purchases, leveraging a traditional finance approach to building a bitcoin treasury. In 2024 alone, MicroStrategy acquired 257,000 BTC. This strategy has indirectly turned MicroStrategy into a publicly traded bitcoin ETF and accumulation machine, granting shareholders exposure to BTC through its publicly traded stock $MSTR. You're reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

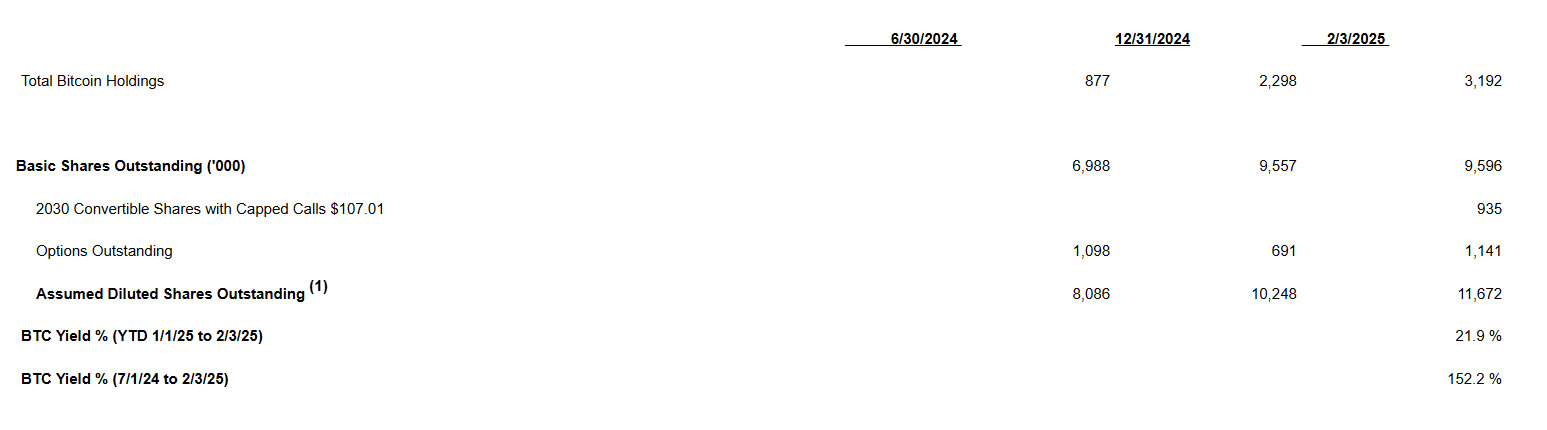

Two key metrics: bitcoin per share & BTC yieldMicrostrategy has popularized two key metrics every corporation studying this strategy needs to understand intimately: bitcoin per share (BPS) and BTC yield.

Bitcoin per share (BPS): The number of bitcoin held per outstanding share. This metric allows investors to measure a company’s indirect BTC exposure.

BTC yield: The percentage change in the number of bitcoin per share over time. This KPI attempts to reflect how efficiently a company acquires BTC.

Source: MSTRtracker.com

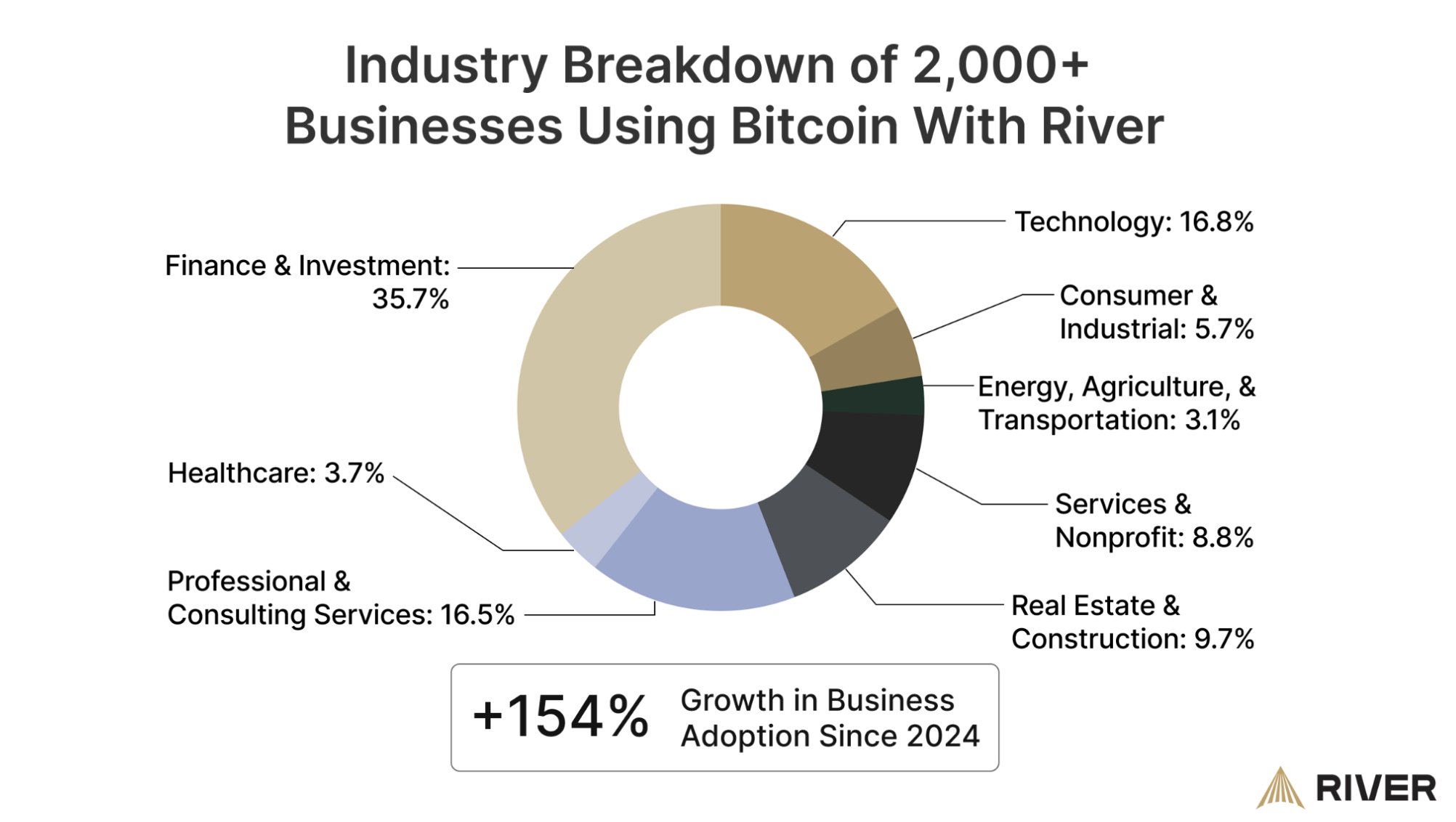

The corporate supercycleWhile many corporations maintain traditional treasury strategies, a fundamental shift in corporate finance is emerging. Over 70 publicly traded companies now hold bitcoin on their balance sheets, including Tesla, Coinbase and Block. Even companies outside the technology and finance sectors are adopting this approach, demonstrating its broad applicability across industries.

This adoption represents more than a trend — it's a transformation in how companies can create and preserve shareholder value. The regulatory environment is evolving to support this shift in three critical ways:

SAB21's reversal has fundamentally enhanced bitcoin's utility as a treasury asset. By enabling regulated financial institutions to provide custody services, corporations can now leverage their bitcoin holdings more efficiently through established banking relationships.

The FASB's landmark accounting changes create a more accurate reflection of bitcoin's economics on corporate financial statements. Under these rules, companies accumulating bitcoin can now recognize appreciation in their earnings statements, providing a clear mechanism for value creation through strategic bitcoin acquisition.

The proposed Bitcoin Act 2024 and broader regulatory clarity signal growing institutional acceptance, reducing systemic risks for corporate adoption.

Companies can now generate earnings growth through strategic bitcoin accumulation while simultaneously building a position in an asset with significant potential for appreciation. This combination of current earnings impact and future value potential echoes classic Warren Buffett principles of finding businesses that can both generate current returns and reinvest capital at attractive rates.

The transformation ahead isn't merely about adding bitcoin to balance sheets — it's about fundamentally rethinking corporate treasury management for an era of digital scarcity. Companies that understand this shift early will have a significant advantage in building treasury positions at attractive prices, much like early internet adopters.

We’re entering a new era in corporate finance, where bitcoin's unique properties combine with evolving financial infrastructure to create unprecedented opportunities for value creation and preservation.

The companies that recognize and act on this shift early will likely emerge as the Berkshire Hathaways of the digital age.

origin »Bitcoin (BTC) на Currencies.ru

|

|