2021-3-2 04:00 |

Data shows that Bitcoin miners have ceased taking profit and have started to once again hoard BTC for the first time since mid-to-late December 2020.

What’s notable about this, is the fact that the leading cryptocurrency by market cap appreciated in price by more than double during the sustained selling. If that’s the case, what happens now with miners once again withholding any BTC from entering the already limited supply available to buyers?

Bitcoin Miners Go Back To Holding After Selling Since DecemberBitcoin isn’t just an asset, its a blockchain ecosystem kept in operation by a process called proof-of-work. Miners provide computer processing power through converted energy, and in turn they receive a reward of 6.25 BTC as an incentive for their efforts and related costs.

Related Reading | Record Coinbase BTC Outflows Are The Strongest Bullish Signal “Ever”

When it comes time to pay bills or cover the costs of other operations, miners must sell the BTC they’ve generated into cash, bringing fresh supply into the market. When miners do sell, it can be a short-term turning point for uptrends.

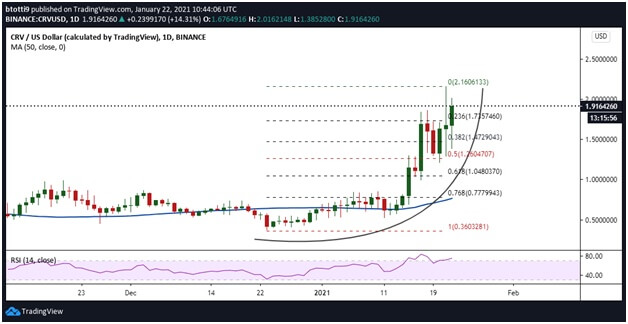

BTC miners "net position" has turned green for the first time since December | Source: glassnodeMiners, alongside whales, have been responsible for each correction in the crypto market over the last few months, when selling began ramping up in mid-to-late December 2020. Miners started selling BTC following the all-time high being cracked, and have kept taking profit all the way up since then.

According to data from blockchain analytics firm Glassnode, Bitcoin miners are now holding their BTC, rather than selling it into the market to cover operations or to take profit.

Crypto Liquidity Crisis To Kick Into Overdrive Without Incoming BTC SupplyBear markets cleanse the cryptocurrency’s underlying ecosystem of the weakest participants. Weak-handed investors sell their coins, and underfunded or under-resourced miners – or those with poor access to low energy costs – must close up shop and capitulate.

When the process is said and done, what is leftover is a stronger set of hands, and miners better equipped for a stronger uptrend – the results of which are bearing its fruit now.

If Bitcoin price has doubled per coin while miners were selling, what happens next? | Source: BTCUSD on TradingView.comInvestors have done their job and held their coins strong as prices began trending, leaving few BTC available for institutions to buy. Miners have been dumping this entire time, keeping price action at bay.

Related Reading | Why March Is The Bloodiest Month In Bitcoin History

With no coins left on exchanges, and no coins coming in from miners, all that’s left is mania-induced, parabolic price appreciation. Where does the leading cryptocurrency by market cap go next from here?

Featured image from Deposit Photos, Charts from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

Chronobank (TIME) на Currencies.ru

|

|