2021-1-25 17:03 |

Bitcoin has been the leader in generating more fees than any other network. But that has only been up until June 2020, when decentralized finance (DeFi) mania started kicking in.

Today, this DeFi craze even saw popular DEX Uniswap beating Bitcoin in daily fees of $2.3 million, as per Cryptofees.Info. While BTC only had $1.8 million, Ethereum is unreachable by collecting $8.8 million in fees.

Uniswap, which accounts for 48.5% of DEX volume market share, even without the liquidity incentives, saw $12.7b in traded volume, $36.543 million in fees, and liquidity increased to $3.6 billion over the past 15 days, as per IntoTheBlock.

Another DEX SushiSwap had just under $1 million in daily fees, followed by Synthetix and Balancer, but they only had about $100k to $200k.

In the past week, Ethereum did more than 3x of Bitcoin’s 7-day average fees of just over $3 million, while Uniswap recorded $2.4 million.

“It’s the first DeFi protocol, but not the last. The key feature here is that fees in DeFi benefit not only miners but also LPs and token holders,” noted Santiago R Santos, a partner at ParaFi capital.

Ethereum entered the space in 2015, and its daily total fees in USD surpassed Bitcoin’s several times since then. But it wasn’t until DeFi exploded that ETH was able to beat the world’s largest network by a wild margin.

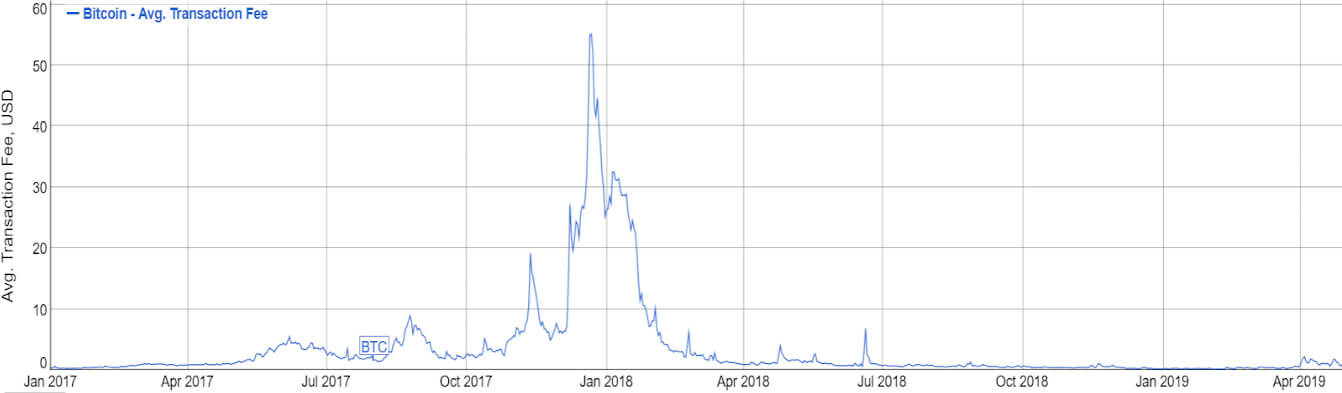

During the peak of the 2017 bill market, Bitcoin did nearly $21.4 million in total fees, while at its peak, Ethereum did only $4.55 million.

But earlier in June 2020, compared to Bitcoin’s $383k in total fees, Ethereum recorded a whopping $3.55 million. From here, as DeFi gained more traction, so did Ethereum fees, and this gap between BTC and ETH fees continued to grow.

At the peak of DeFi mania in Sept. 2020, the Ethereum network was used so much that it became unusable as the average fees and gas prices continued to hit new highs. On Sept. 1st, the Ethereum network received more than $17 million in total fees compared to $1.48 million on Bitcoin.

Bitcoin overtook Ethereum for a brief period, a fortnight and a small margin, from late October to early November.

Since then, Ethereum continues to generate millions of dollars in fees every day, setting yet another new record at $21.38 million on Jan. 11, the day the crypto market saw a sell-off.

Uniswap/USD UNIUSD 11.4840 $1.10 9.61% Volume 5.45 b Change $1.10 Open$11.4840 Circulating 286.49 m Market Cap 3.29 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=UNI&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~UNI~USD"); The post Uniswap Generating More Network Fees than Bitcoin; Total Fees on ETH Reaches BTC All Time High first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|