2020-5-10 21:37 |

Earlier this week, bitcoin broke the important psychological level, $10,000 and hovered around this level for two days only to make a retreat today.

Currently, we are trading around $9,500 while managing the daily trading volume of just $2 billion, yet again slowing down on the weekend.

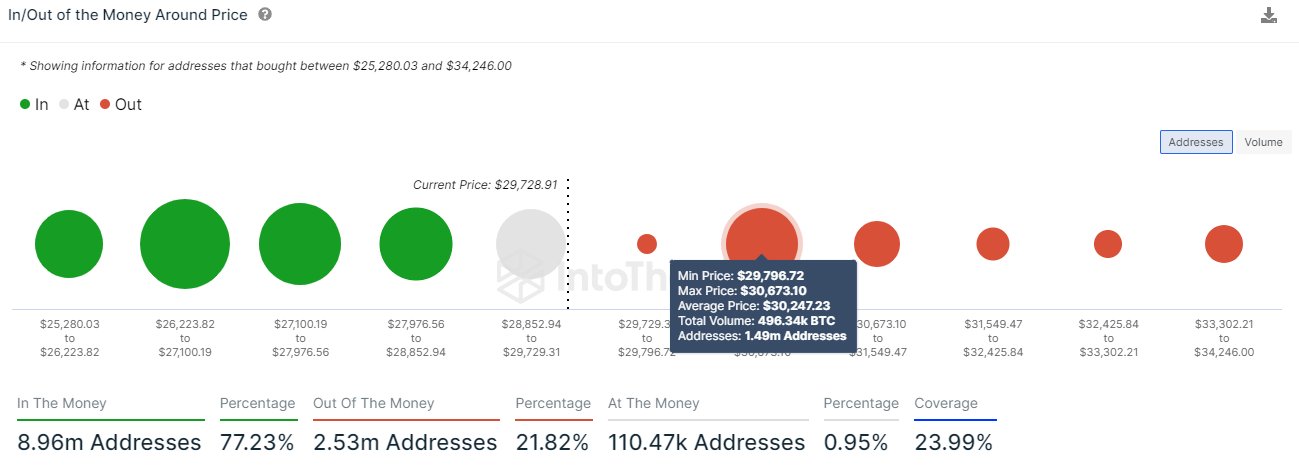

The good thing is bitcoin is leaving the exchanges, moving in the opposite direction to the bitcoin price, which means instead of selling, investors have taken to HODL their BTC.

Also, the Guppy indicator which identifies changing trends and breakouts in the price of an asset has flipped green on the bitcoin daily. Historically, these green flips have led to higher prices every single time. Stackin’ Bits said, Though it is likely we will be going higher,

“One thing that probably needs to be taken into consideration on this move is the extreme volatility. Price leads MA’s, and in such extreme volatility it wouldn’t surprise me to see some aggressive deviation over the next couple of moves as the volatility cools down.”

The realcap-weighted HOLD wave is yet another chart dominating similar setup patterns that were last seen in the past bull markets.

A bitcoin enthusiast notes that for a third time it occurred this spring. Currently, we are in the blow-off period with halving next week which if leads to another accumulation it could indicate a new bull market.

Yet another bullish chart that reflects the previous bull market is the number of active bitcoin addresses. These addresses have reached 1 million, last time hit in November 2017. Glassnode noted,

“The number of active addresses (and entities) has increased to levels not seen since the 2017 bull market – as has the number of new addresses – suggesting an increase not just in activity, but also in adoption.”

The market is ripe with bullish charts and the market sentiment has also finally turned into “greed” after over two months of “extreme fear.” The rising price of bitcoin is also backed by the solid volume with open interest on CME hitting a new all-time high.

The interest in “bitcoin halving” has also skyrocketed with searches on Google now 4x the 2016 halving.

Meanwhile, long term bitcoin investors continue to accumulate bitcoin, despite the prices rising up to the early highs from February.

Amidst this trader Galaxy has shared a chart, yet another dose of hopium for people, stating the flagship cryptocurrency could very well make its way to a new all-time high of $20,000 from here in another pattern not seen since the parabolic run of 2017.

The $BTC chart looks like it is going to explode straight to $20,000.

Honestly. pic.twitter.com/7Ur9cC2ukm

— Galaxy (@galaxyBTC) May 8, 2020

In response to this chart, trader Crypto King wrote,

“I’m waiting for that green dildo to the moon. Liquidation dip occurred, volume dropped. Consolidating, spring coiling….”

Not to mention, high net worth individuals (HNW) and family officers are also getting in bitcoin.

When bitcoin rallies to the high of $20k, retail will start paying attention once again just like in 2013, when “the early rally was driven by Silicon Valley angels (smart money), by the end of the year retail piled in,” said Tuur Demeester.

Bitcoin (BTC) Live Price 1 BTC/USD =$8,727.1406 change ~ -11.97%Coin Market Cap

$160.33 Billion24 Hour Volume

$14.12 Billion24 Hour VWAP

$9.51 K24 Hour Change

$-1,044.8718 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD"); origin »Level Up Coin (LUC) на Currencies.ru

|

|