2023-2-7 16:32 |

This Bitcoin on-chain metric is currently at a level that has historically provided resistance. Will BTC decline after this retest this time as well?

Bitcoin Short-Term Holder SOPR Is At The “Sell” LevelAs pointed out by an analyst in a CryptoQuant post, the bitcoin price has fallen at this level in the past. The indicator of interest here is the “Spent Output Profit Ratio,” which measures the ratio between the total profits and the total losses that Bitcoin investors are realizing with their selling right now.

When the ratio has a value lower than 1, it means the average investor is selling their coins at some amount of loss currently. On the contrary, the metric having higher values than this mark suggests the market as a whole has been displaying profit realization behavior recently.

Now, there is a cohort called the “short-term holder” (STH) group in the market, which includes all holders that acquired their coins within the last 155 days. The alternate group is called the “long-term holder” (LTH) cohort, to which STHs mature when the age of their coins becomes more than 155 days.

The SOPR discussed above was for the entire market, but it can also separately be defined for any investor segment.

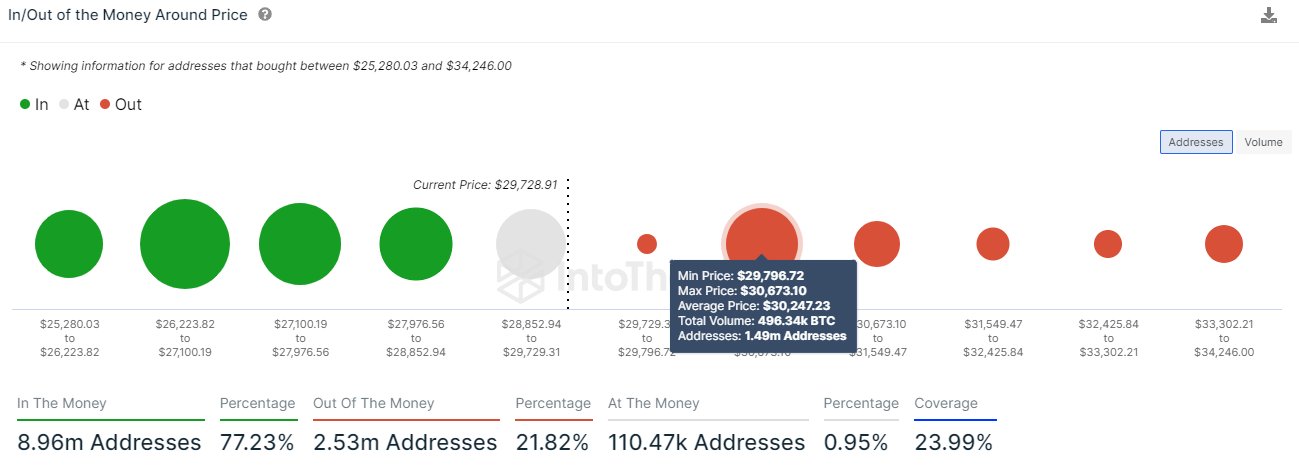

Here is a chart that shows the trend in the Bitcoin SOPR specifically for the STHs over the last few years:

In the above graph, the version of the Bitcoin STH SOPR displayed is actually the 100-day ALMA, which is a type of moving average (MA). The quant has marked the important lines for the indicator.

It looks like the value equal to 1 line has generally provided resistance to the metric whenever it has been below the level. This makes sense as the mark acts as a break-even level for the market since the profit being realized is exactly equal to the loss being realized here.

Investors find this point ideal for exiting, so a large amount of selling takes place here, and thus the price of the cryptocurrency feels some resistance. With the latest rally, however, the coin seems to have overcome this resistance.

Now the metric has surged to the 1.02 level. From the chart, it’s apparent that Bitcoin has previously faced resistance at this level as well. The latest example of Bitcoin finding rejection here was back in November 2021, when the BTC price formed its current all-time high.

If the level acting as resistance historically is anything to go by, then the STH SOPR arriving at this level may be bad news for the current rally, as the price could face a decline following a potential rejection here.

BTC PriceAt the time of writing, Bitcoin is trading around $23,000, up 1% in the last week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|