2023-10-21 22:00 |

Bitcoin has approached the $30,000 mark with a sharp rally today, but on-chain data suggests the level could provide some major resistance.

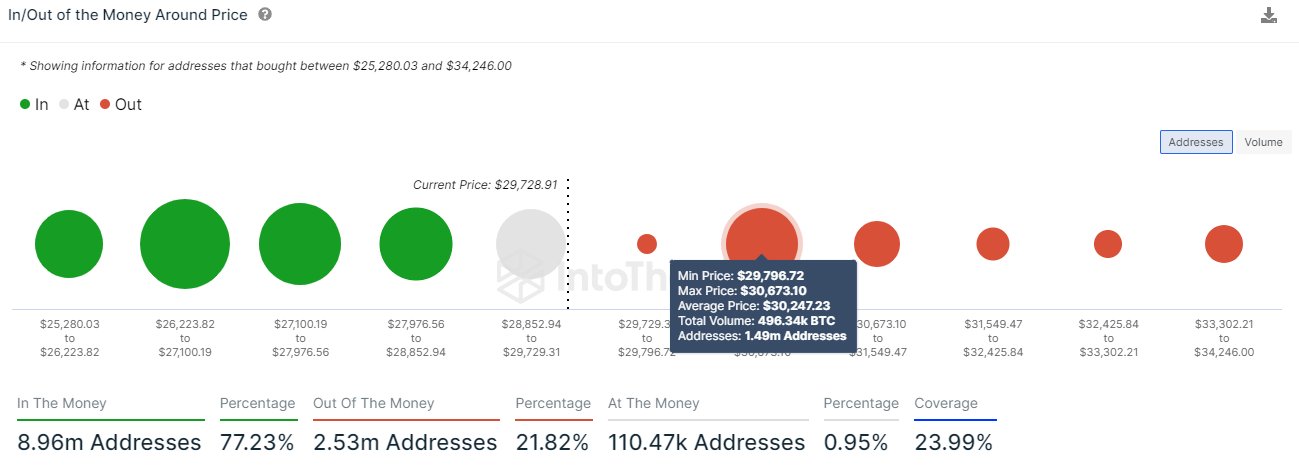

1.49 Million Addresses Bought Around The $30,000 LevelAccording to data from the market intelligence platform IntoTheBlock, the most significant potential resistance for BTC is at the current levels. The “resistance” here refers to not the technical resistance, but rather the on-chain one.

From the on-chain perspective, levels are defined as resistance/support on the basis of the concentration of investors/addresses who bought at said levels.

The below chart shows what the distribution of the holders looks like right now across the various levels of the asset:

Generally, whenever the price of the asset retests the cost basis of an investor, they may become more likely to show some kind of move. If this retest happens from below, that is, the holder had been in losses prior to this, they might be tempted to sell at break-even.

On the other hand, a decline in the price towards their acquisition price may lead to them buying more of the asset, as they might think that if these same levels proved to be profitable earlier, they could do so again in the near future.

The thicker the band of investors who have their cost basis inside a specific price range, the more pronounced effects like these would be. Thus, such ranges above the price could be looked at as sources of resistance, while those below may serve as support.

As is visible in the above graph, the $29,800 to $30,700 range is particularly rich with addresses right now. To be more particular, about 1.49 million addresses bought their coins here.

Naturally, this means that Bitcoin could find it troubling to cross above this range, as it has already happened throughout the past year. “At the same time, 73% of Bitcoin addresses are currently in profit,” notes IntoTheBlock, as the ranges below all have thick green bands currently.

While the range will be hard to clear, at least strong support below means the cryptocurrency could keep up the retests until eventually it can find a break. If BTC can indeed clear the range, it shouldn’t have much resistance at higher levels, as not many investors have their cost basis there.

One positive sign for the current rally could be the fact that it’s not driven by the derivatives side, as an analyst has pointed out on X.

In the above chart, the data for the ratio between the Bitcoin open interest and market cap is displayed. The “open interest” here is a measure of the total amount of BTC contracts open on the futures market.

The indicator’s value has declined recently, implying that the open interest has gone down relative to the market cap. This could suggest that the current rally is driven by spot buying.

BTC PriceBitcoin is currently inside the range of major resistance discussed before as its price is trading around $29,900.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|