btcusd / Заголовки новостей

Bollinger Bands Inventor Foresees Bitcoin Pullback: Key Levels To Watch

Renowned financial analyst John Bollinger has recently issued a caution regarding the potential for a Bitcoin pullback. After BTC price surged from below $66,000 to almost $72,000 at the beginning of the week, Bollinger, the creator of the widely utilized Bollinger Bands indicator, pointed to specific features in the Bitcoin price chart that suggest a consolidation or pullback could be imminent, though he clarified that his perspective was not bearish on a longer term. дальше »

2024-5-22 14:00

|

|

Perennial Bitcoin Accumulators Bought Big Ahead Of Rally, Data Shows

On-chain data shows that Bitcoin addresses with zero sales histories participated in a big accumulation before this recovery run started. Bitcoin Inflows To Accumulation Addresses Sharply Spiked Recently As explained by an analyst in a CryptoQuant Quicktake post, the accumulation addresses on the Bitcoin network have shown some significant inflow activity recently. дальше »

2024-5-22 04:00

|

|

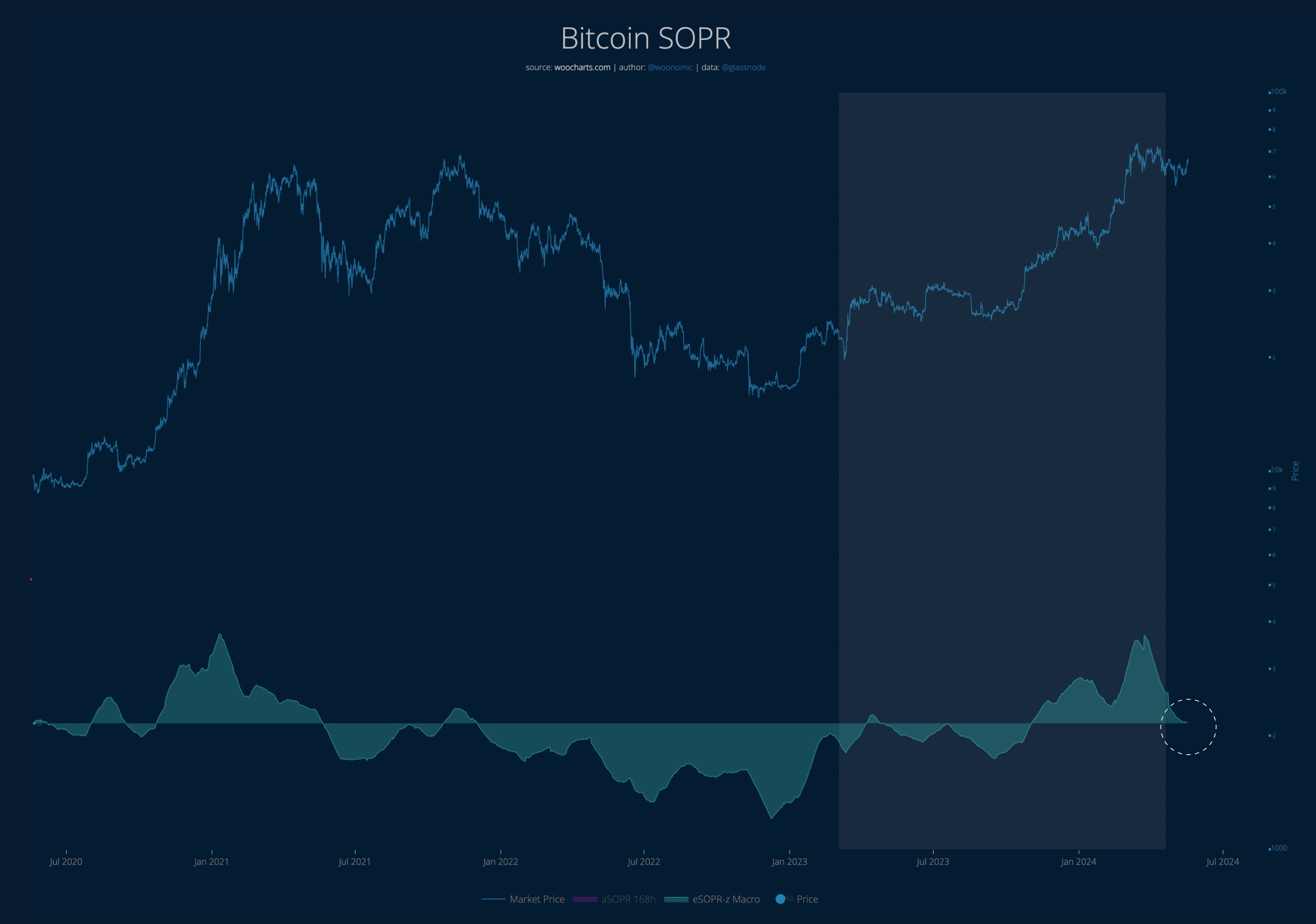

Bitcoin “Profit-Taking Has Completed,” Top Analyst Reveals

An analyst has explained how profit-taking looks to have finished for Bitcoin in what has been a “very healthy reset” for the market. Bitcoin SOPR Suggests Profit-Taking From Investors Has Cooled Off In a new post on X, analyst Willy Woo has discussed about the latest trend occurring in the Bitcoin Spent Output Profit Ratio (SOPR). дальше »

2024-5-21 22:00

|

|

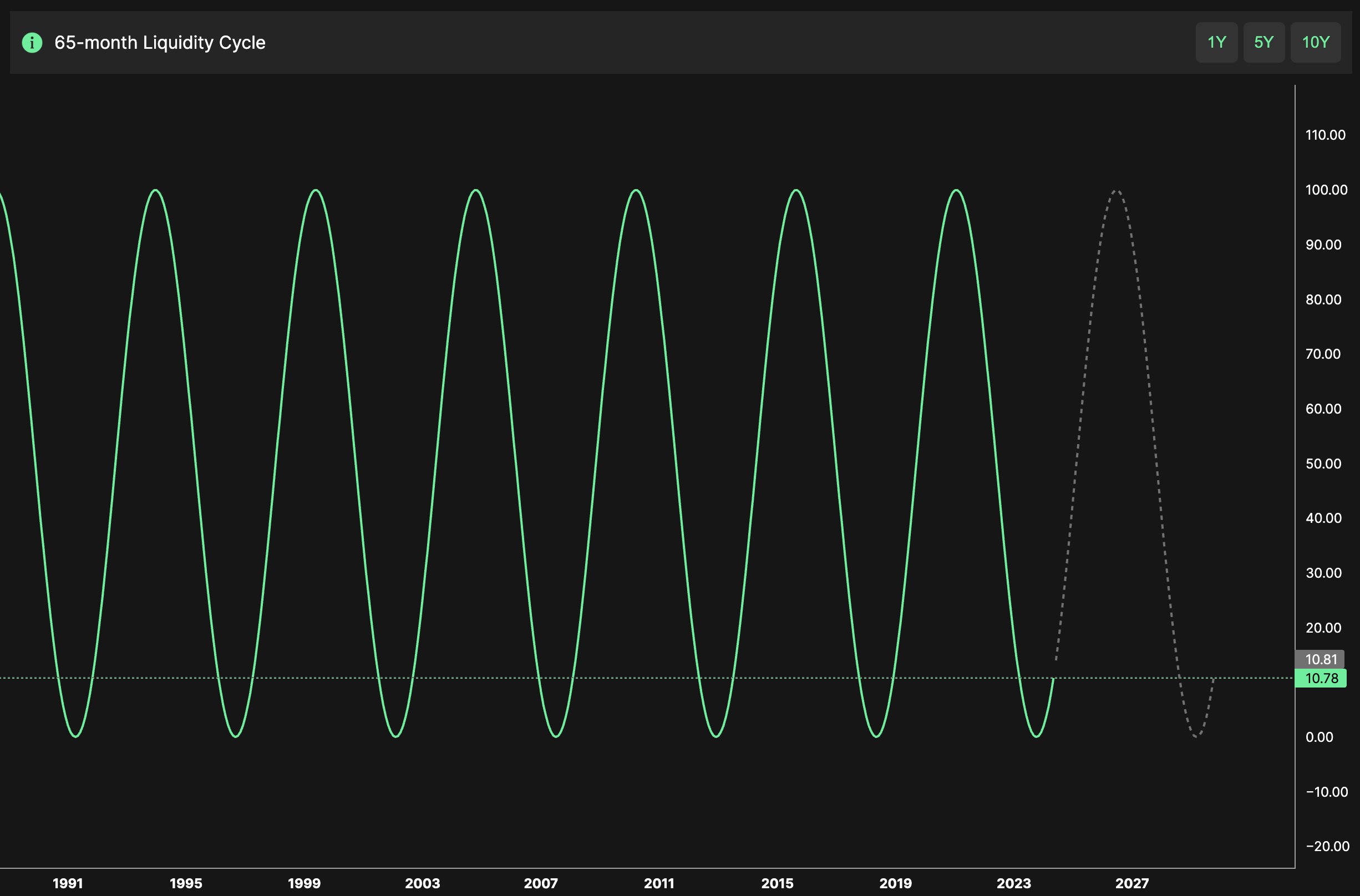

4 Key Reasons Why The Bitcoin Bull Run Is Far From Over

In an analysis shared via X, renowned crypto analyst Ted (@tedtalksmacro) has provided compelling evidence to support his assertion that the current Bitcoin bull run is far from over. Ted’s insights are based on four critical indicators related to traditional finance and crypto liquidity, each pointing to sustained growth in the near future. дальше »

2024-5-20 11:15

|

|

Bitcoin Not Out Of Danger Yet, NVT Golden Cross Warns

On-chain data shows the Bitcoin Network Value to Transactions (NVT) Golden Cross still has a high value, a sign that may be bearish for BTC. Bitcoin NVT Golden Cross Is Still Near Historical Top Zone In a CryptoQuant Quicktake post, an analyst discussed the recent trend in the NVT Golden Cross for BTC and its implications for the price. дальше »

2024-5-16 05:00

|

|

Bitcoin Hash Ribbons Form Capitulation Signal: What It Means

On-chain data shows the Bitcoin Hash Ribbons have recently gone through a crossover. Here’s what it could mean for the cryptocurrency. Bitcoin Hash Ribbons Suggest Miner Capitulation Is On As explained by CryptoQuant community manager Maartunn in a Quicktake post, miners are capitulating right now if the Hash Ribbons indicator is to be believed. дальше »

2024-5-15 19:00

|

|

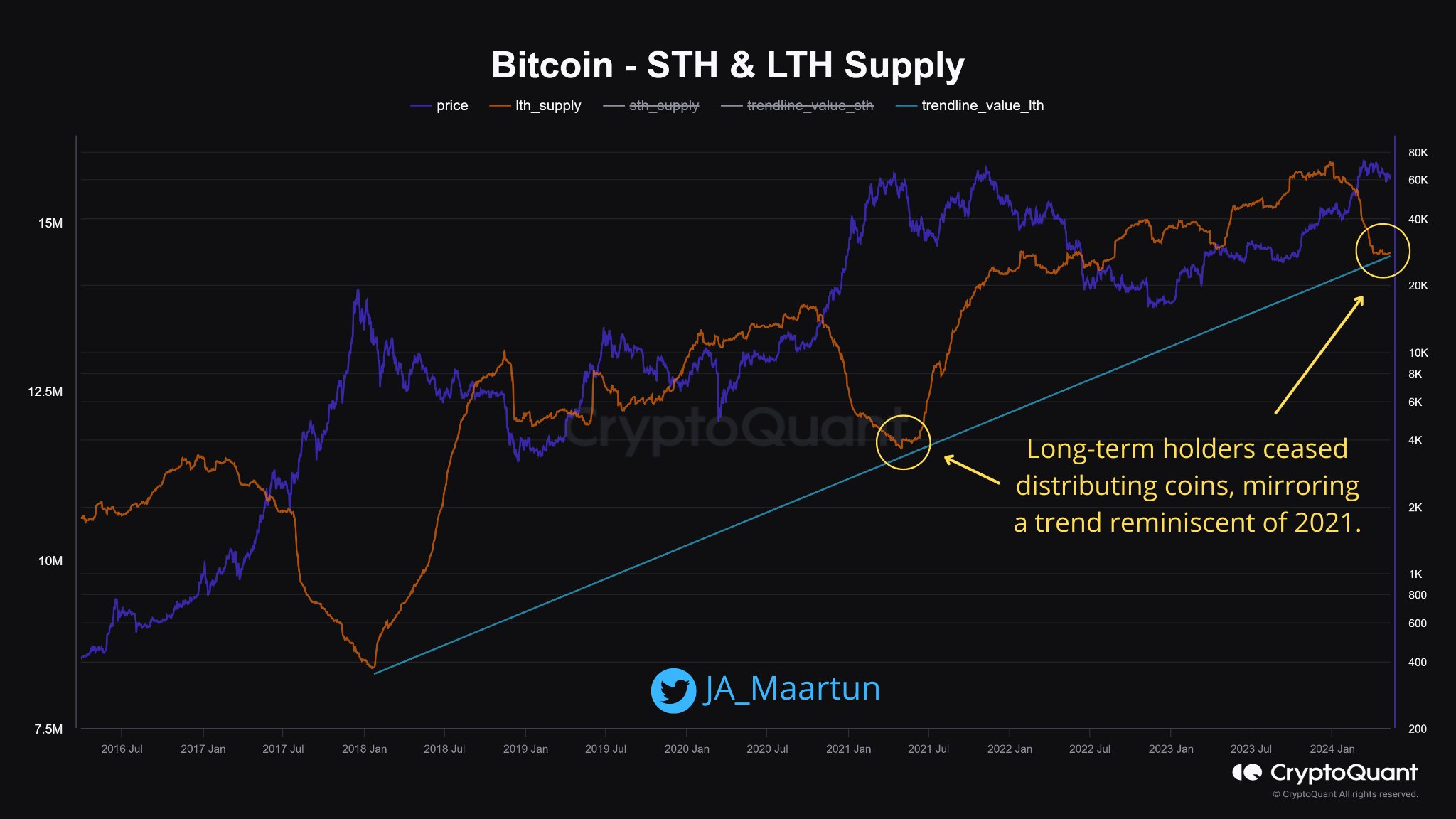

Bitcoin Deja Vu: Indicator Mirrors Pattern That Led To 2021 Top

On-chain data suggests a Bitcoin indicator is currently mirroring the same trend that led to the top of the bull run in 2021. Bitcoin Long-Term Holder Distribution Appears To Be Ending As explained by CryptoQuant community manager Maartunn in a post on X, the BTC long-term holders are currently showcasing a trend that’s reminiscent of […] дальше »

2024-5-14 01:00

|

|

Bitcoin HODLer Profit-Taking Calms Down After Wild Selling Spree: Green Sign For Rally?

On-chain data shows the Bitcoin long-term holders have finally cooled off their profit-taking after showing a wild selloff just earlier. Bitcoin Coin Days Destroyed Has Calmed Down For BTC Recently As pointed out by BTC on-chain research account “The Bitcoin Researcher” in a post on X, the Coin Days Destroyed In Profit metric has declined […] дальше »

2024-5-7 19:00

|

|

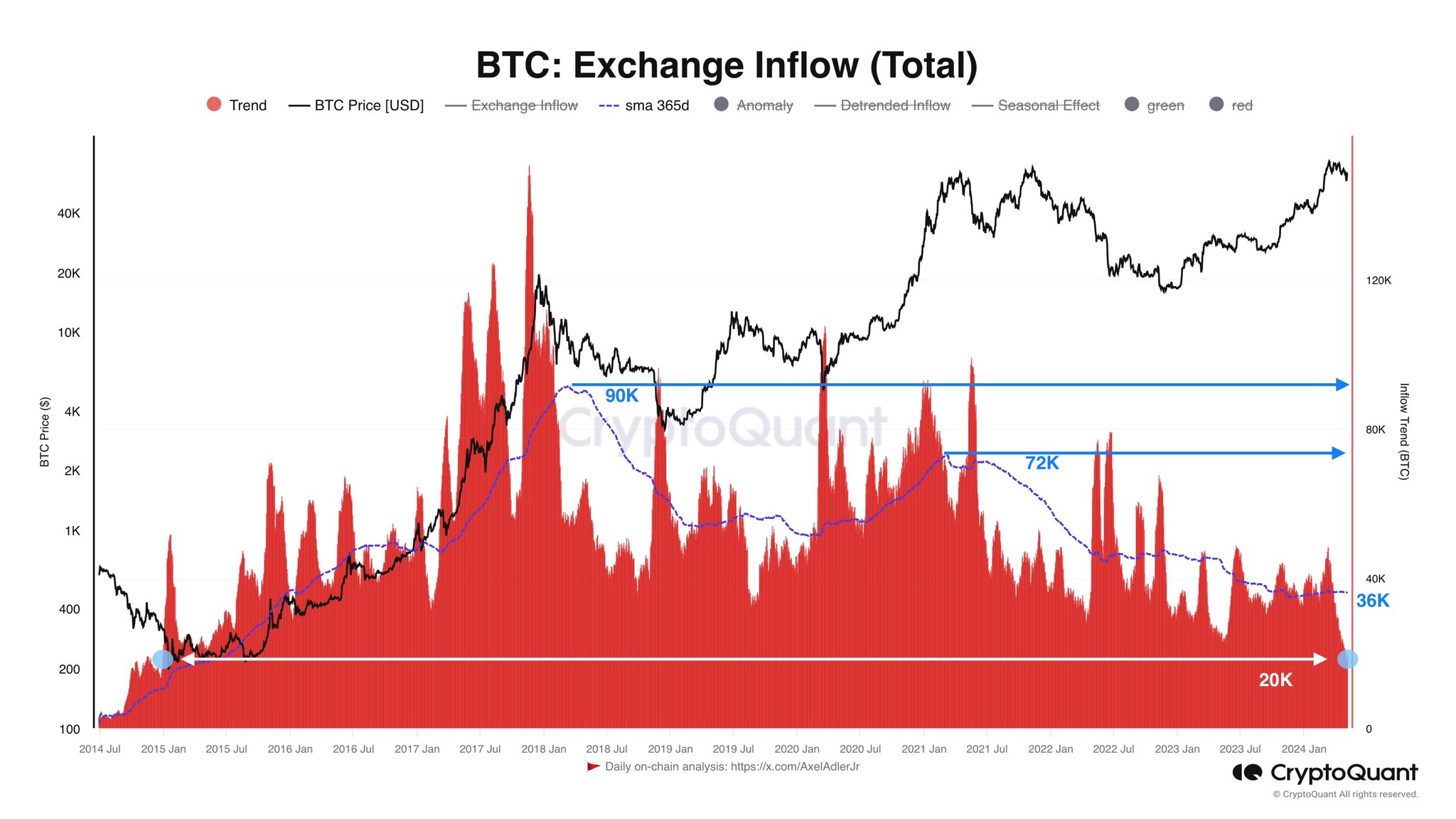

Bitcoin Supply Shock: Exchange Inflow Trend Lowest Since 2015

On-chain data shows the Bitcoin exchange inflow trend has been at its lowest in almost a decade recently, a sign that may be bullish for the asset. Bitcoin Exchange Inflows Have Been On The Decline Recently As pointed out by CryptoQuant author Axel Adler Jr in a post on X, the BTC exchange inflows have […] дальше »

2024-5-7 06:00

|

|

Bitcoin To Reach Escape Velocity? Analyst Makes The Case

An analyst has explained how Bitcoin seems to be showing a good setup to reach escape velocity based on the trend in this indicator. Bitcoin VWAP Oscillator Has Been Showing A Bullish Divergence As explained by analyst Willy Woo in a new post on X, a bullish divergence has appeared to be forming in the Volume-Weighted Average Price (VWAP) oscillator of the cryptocurrency. дальше »

2024-5-7 05:00

|

|

Bitcoin Bull Run Over? Analyst Predicts What To Expect Now

The recent plummet in Bitcoin’s value below the $60,000 mark has sparked widespread speculation within the crypto community, raising questions among investors and market watchers about the future direction of its price. дальше »

2024-5-2 14:30

|

|

Bitcoin Greed No More: Sentiment Back At Neutral After $57,000 Plunge

Data shows that Bitcoin sentiment has cooled off to neutral from greed following the asset’s latest plunge to the $57,000 level. Bitcoin Fear & Greed Index Has Returned To Neutral Levels The “Fear & Greed Index” is an indicator created by Alternative that shows the average sentiment among investors in the Bitcoin and wider cryptocurrency market. дальше »

2024-5-1 19:00

|

|

If History Repeats, This Is How Bitcoin Price Will Perform In The Next 6 Months

In a recent thread on X (formerly Twitter), renowned on-chain analyst Checkmate provided an analysis regarding the future trajectory of Bitcoin. Currently, the premier cryptocurrency hovers around the $60,000 mark, a pivotal moment that echoes historical patterns within the Bitcoin market cycle. дальше »

2024-5-1 11:20

|

|

This Legendary Bitcoin Metric Is Giving Green Light For Bullish Action, Quant Explains

A quant has pointed out that a popular on-chain indicator for Bitcoin gives the asset the green light to experience bullish price action. Bitcoin Puell Multiple Has Observed A Plunge Recently As explained by an analyst in a CryptoQuant Quicktake post, the Bitcoin Puell Multiple is currently in the “safe to buy zone.” The “Puell […] дальше »

2024-5-1 00:30

|

|

First In History: Bitcoin Miners Now Need More Than 1 EH/s Of Power To Mine 1 BTC

On-chain data shows that, for the first time in history, Bitcoin miners require more than 1 EH/s of daily computing power to mine just 1 token of the asset. Bitcoin Hashcoin Has Set A New All-Time High Now As explained by CryptoQuant head of research Julio Moreno in a post on X, the BTC Hashcoin […] дальше »

2024-4-30 06:00

|

|

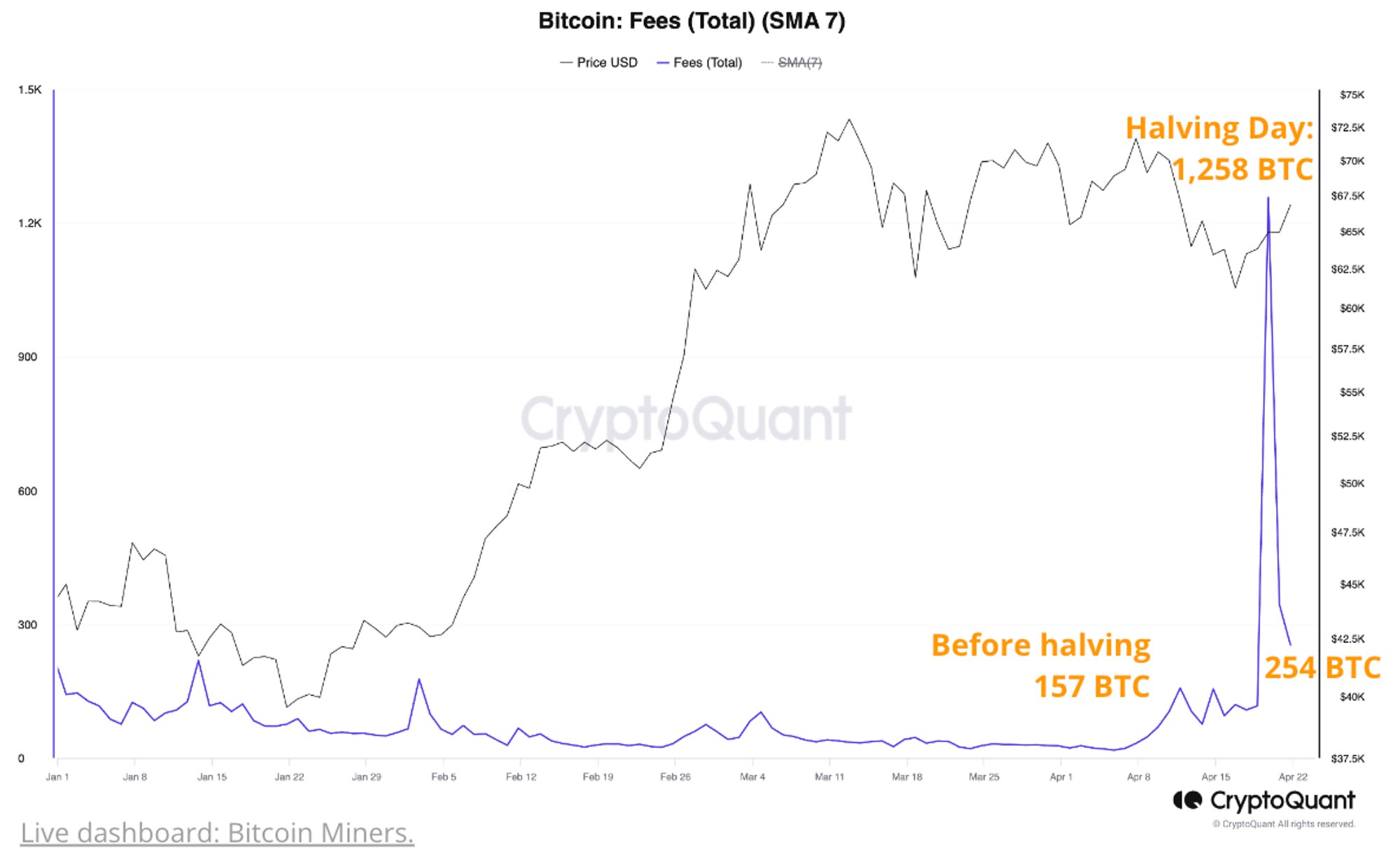

Bitcoin Runes Hype Dissipates: Why This Makes Life Difficult For Miners

Data suggests the hype around the new Bitcoin Runes has severely dropped, something that’s not a good sign for miner revenues. Bitcoin Halving Effect Settles In On Miner Revenue As Runes Interest Drops A few days back, the much-anticipated Bitcoin Halving went through. дальше »

2024-4-27 03:00

|

|

Bitcoin Forms Death Cross & TD-9 Sell Signal: Brace For Impact?

An analyst has explained how Bitcoin is forming both a death cross and TD sell signal, which may lead to potential dips in these targets. Bitcoin Looking In Trouble As 12-Hour Chart Forms Two Bearish Signals In a new post on X, analyst Ali discussed two signals that have recently formed in Bitcoin’s 12-hour chart. дальше »

2024-4-26 00:00

|

|

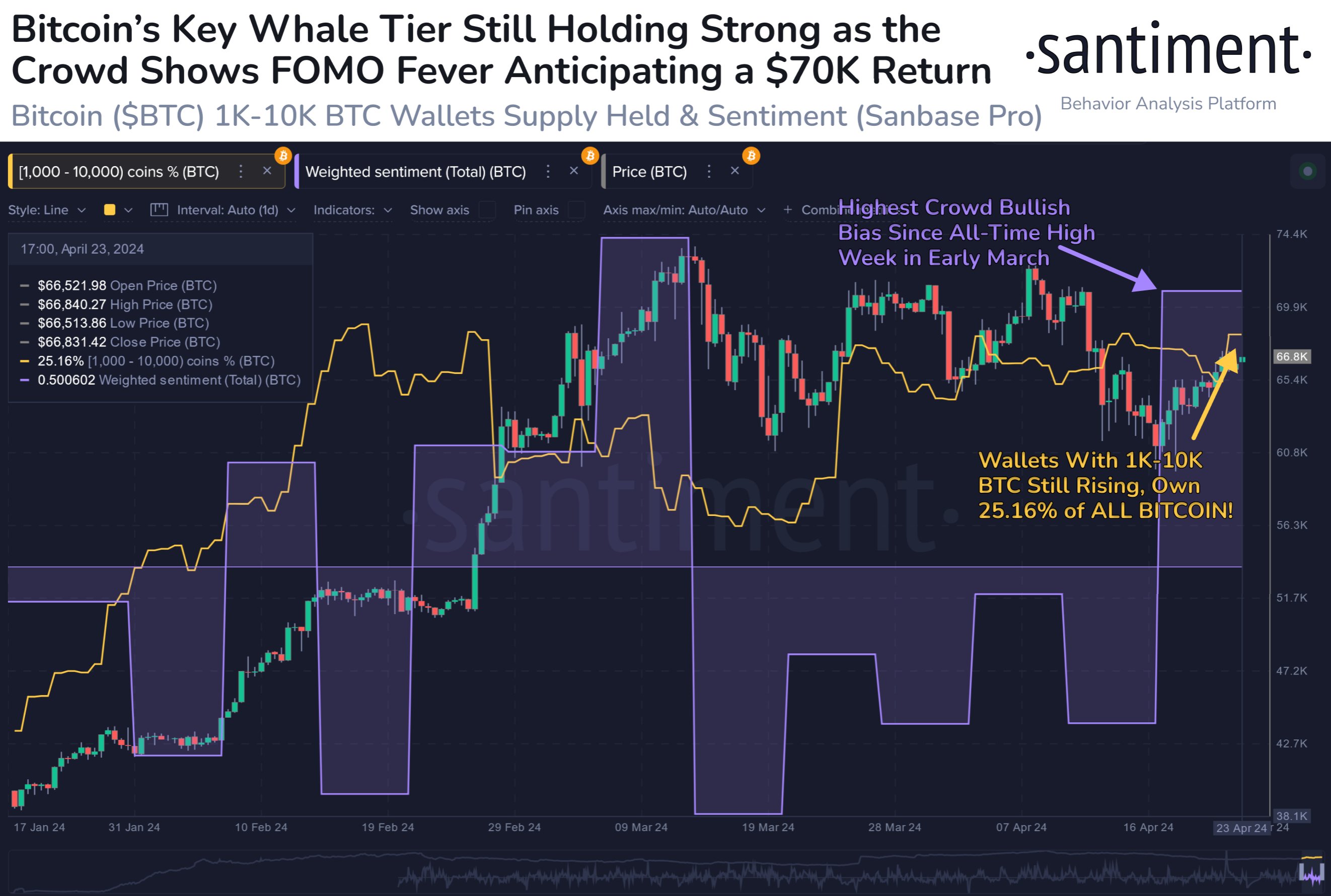

Bitcoin Whales Continue Buying, Now Hold 25.16% Of All Supply

On-chain data shows that the Bitcoin whales’ holdings have grown to 25. 16% of the entire supply, and their net accumulation has continued recently. Bitcoin Investors With 1,000 To 10,000 BTC Have Continued To Buy Recently According to data from the on-chain analytics firm Santiment, the BTC whales have accumulated more than 266,000 BTC since the start of the year. дальше »

2024-4-25 06:00

|

|

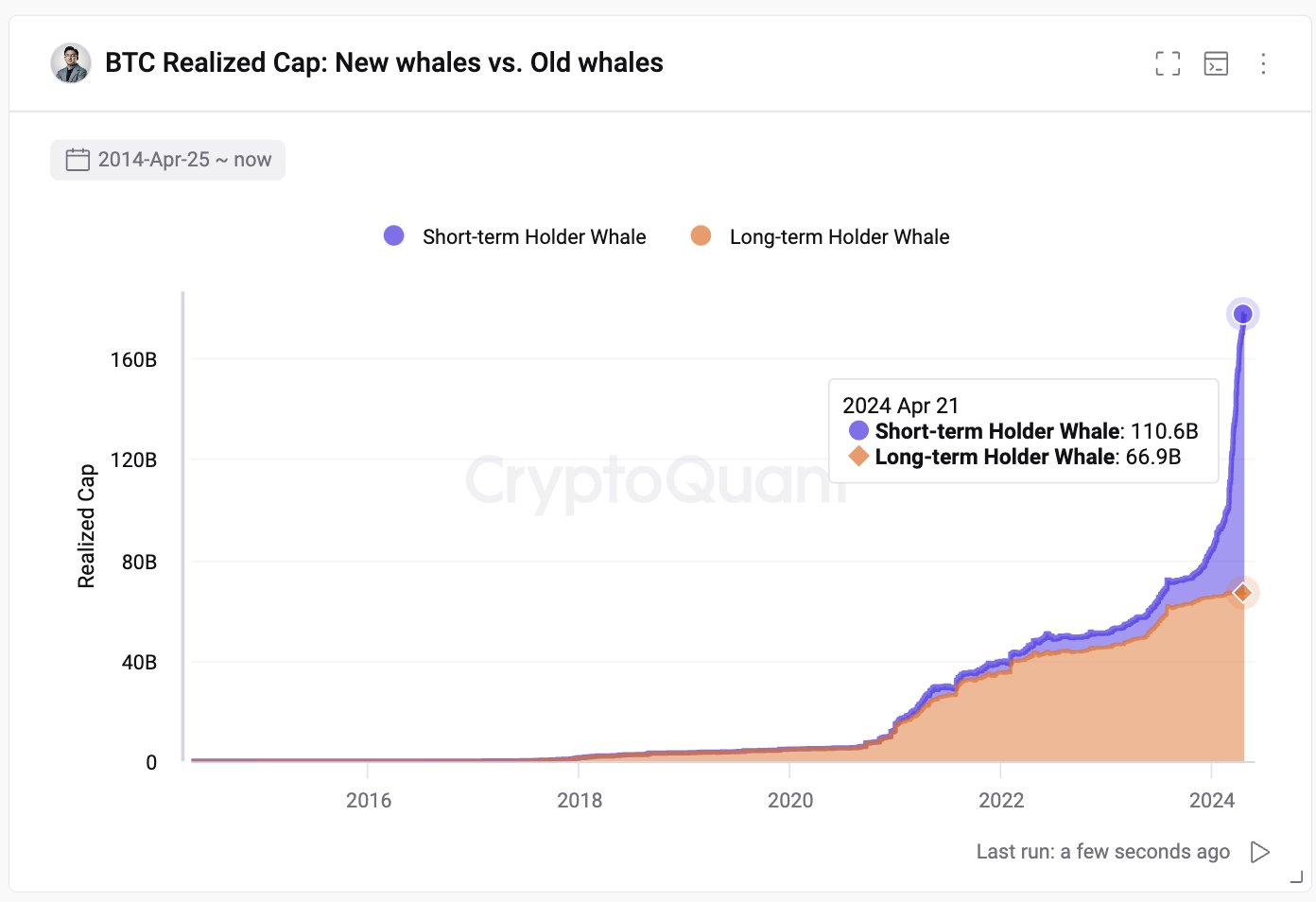

Newbie Bitcoin Whales Hold 2x As Much As Veterans: What’s Behind This Trend?

On-chain data shows the new whale entrants in the Bitcoin market now hold almost twice as much as the veterans. Here’s what could be behind this shift. Bitcoin Newbie Whale Holdings Have Been Rapidly Growing Recently In a new post on X, CryptoQuant founder and CEO Ki Young Ju has discussed about how the holdings of the new whales compares against the old ones in the market right now. дальше »

2024-4-24 20:00

|

|

Is The Bitcoin Top Already Here? This Historical Pattern Says So

A historical pattern currently forming in a Bitcoin on-chain indicator could suggest that a top may be near for the asset, if not already in. Bitcoin SOPR Ratio Is Forming A Historical Top Pattern Right Now In a CryptoQuant Quicktake post, an analyst has discussed about a pattern regarding the SOPR Ratio. дальше »

2024-4-24 21:00

|

|

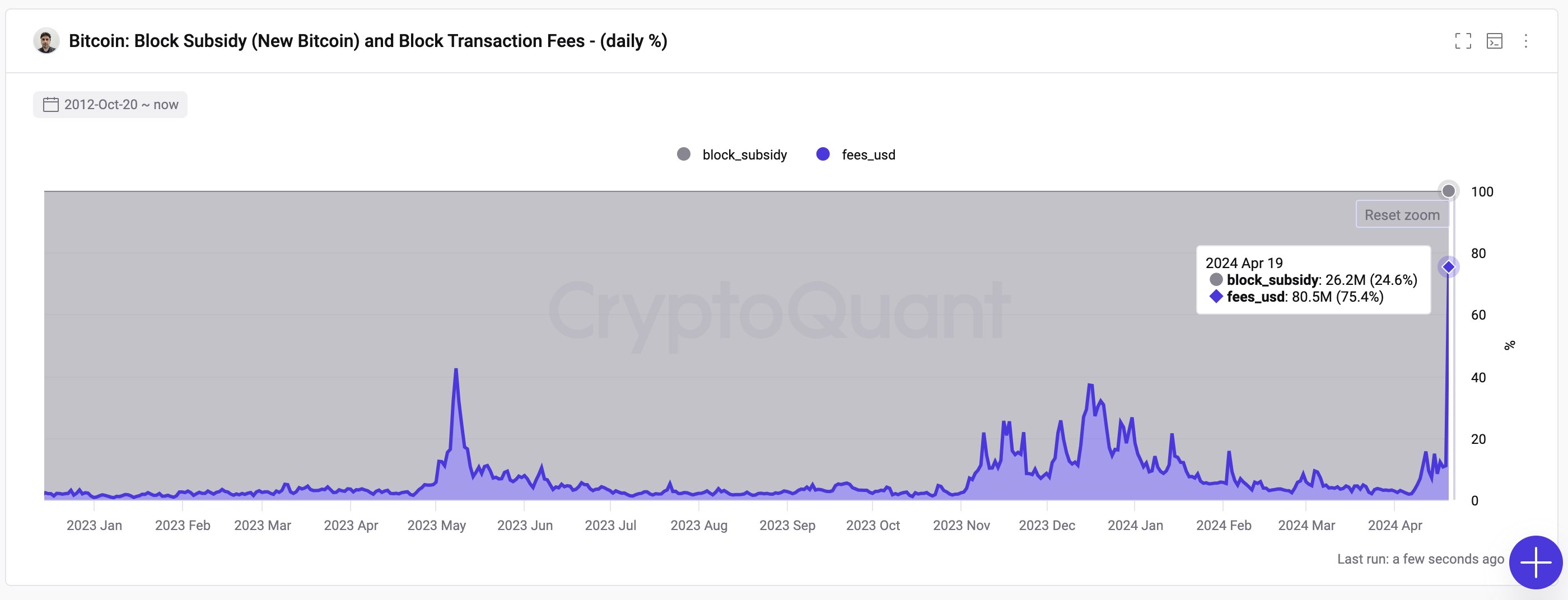

Bitcoin Miner Revenue From Fees Explodes: What’s Driving This?

On-chain data shows the Bitcoin miner revenue percentage from the fees has exploded recently. Here’s what’s behind this sharp growth. Bitcoin Runes Have Caused A Sudden Shake-Up In Miner Revenues A couple of days ago, the much-anticipated fourth Halving, a periodic event taking place roughly every four years where block rewards that miners receive for […] дальше »

2024-4-23 19:00

|

|

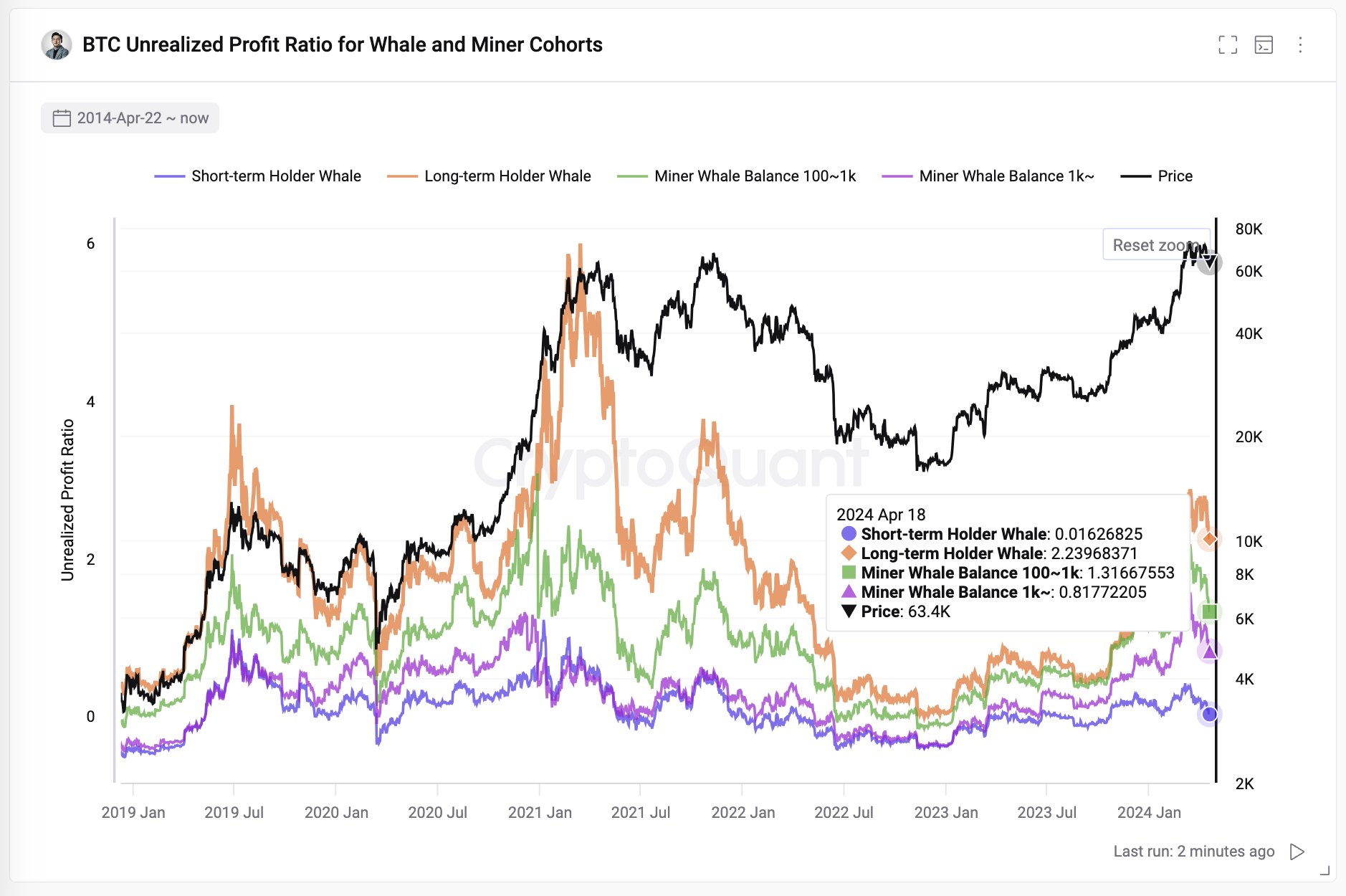

By The Numbers: How Much Profits Are Bitcoin Whales & Miners Holding?

Based on on-chain data, here’s how much unrealized profit the various Bitcoin whale and miner groups are holding right now. Bitcoin Whale & Miner Profits Compared Across Cohorts In a new post on X, CryptoQuant founder and CEO Ki Young Ju discussed the total unrealized profits currently held by the various on-chain cohorts. Ju has […] дальше »

2024-4-20 08:00

|

|

Bitcoin Mega Whales Are Buying, Time For Rally To Return?

On-chain data shows that the largest number of investors in the Bitcoin market are finally buying, which could be bullish for the asset’s value. Bitcoin Mega Whales Have Shown Net Inflows In The Past Day In the past few weeks, the Bitcoin price has struggled to mount any significant bullish momentum as it has been stuck consolidating inside a range. дальше »

2024-4-20 04:00

|

|

Bitcoin Miners Always Sell Into Halvings, Is This Time Any Different?

On-chain data shows Bitcoin miners have always sold as Halvings have occurred. With the next one just around the corner, how are miners behaving this time? Next Bitcoin Halving Is Less Than Two Days Away Now In a CryptoQuant Quicktake post, an analyst discussed Bitcoin miners’ behavior in the build-up to the next Halving. дальше »

2024-4-19 06:00

|

|

Bitcoin HODLers With Zero History Of Selling Just Bought All-Time High Amount

On-chain data shows the Bitcoin “accumulation addresses” have observed all-time high inflows following the latest asset price slump. Bitcoin Accumulation Addresses Have Aggressively Bought The Dip As an analyst in a CryptoQuant Quicktake post pointed out, the total Bitcoin inflows going towards the accumulation addresses have set a new all-time high recently. дальше »

2024-4-19 02:00

|

|

Bitcoin Displays Bullish Adam And Eve Double Bottom: What It Means

In his latest technical analysis, Christopher Inks, a recognized figure in the field of crypto analysis, points to the possible formation of a bullish Adam and Eve double bottom pattern for Bitcoin. This formation is spotted on the BTC/USD 1-hour chart and has significant implications for the cryptocurrency’s short-term price action. дальше »

2024-4-17 11:00

|

|

Bitcoin Whales Showing Different Behavior From Past Cycles, But Why?

On-chain data suggests the Bitcoin whales have been showing different behavior regarding exchange inflows from the last cycle. Here’s why this may be so. Bitcoin Whales Are Showing Different Behavior In Exchange Inflows This Time As an analyst explained in a CryptoQuant Quicktake post, the BTC whales’ movements have been different this time compared to the previous cycle. дальше »

2024-4-16 04:00

|

|

Bitcoin Rebounds After Nearing Cost Basis Of Short-Term Whales

Bitcoin has found a rebound back above the $66,000 mark following a drop towards the on-chain cost basis of the short-term holder whales. Bitcoin Drawdown Had Nearly Put Short-Term Whales Under Pressure As pointed out by an analyst in a CryptoQuant Quicktake post, BTC’s price had neared the Realized Price of the short-term holder whales during the recent drop, but had still managed to remain above the level. дальше »

2024-4-15 18:00

|

|

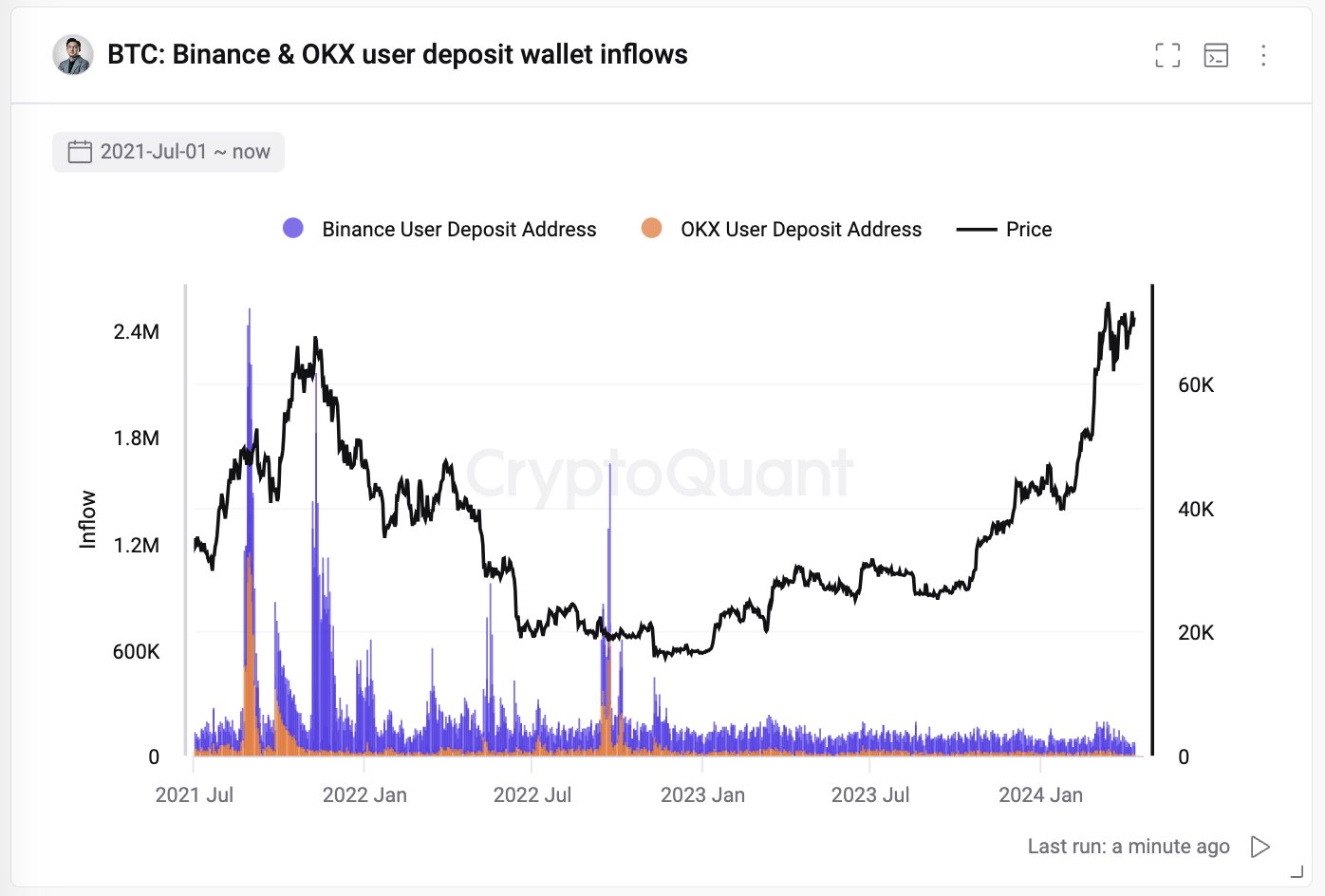

Bitcoin Exchange Deposits Stay Low: Whales Disinterested In Selling?

On-chain data shows the Bitcoin exchange inflows have remained low recently, a sign that the whales have been disinterested in selling. Bitcoin Inflows For Binance & OKX Have Stayed Low Recently As pointed out by CryptoQuant founder and CEO Ki Young Ju in a post on X, the BTC deposits for cryptocurrency exchanges Binance and […] дальше »

2024-4-12 18:00

|

|

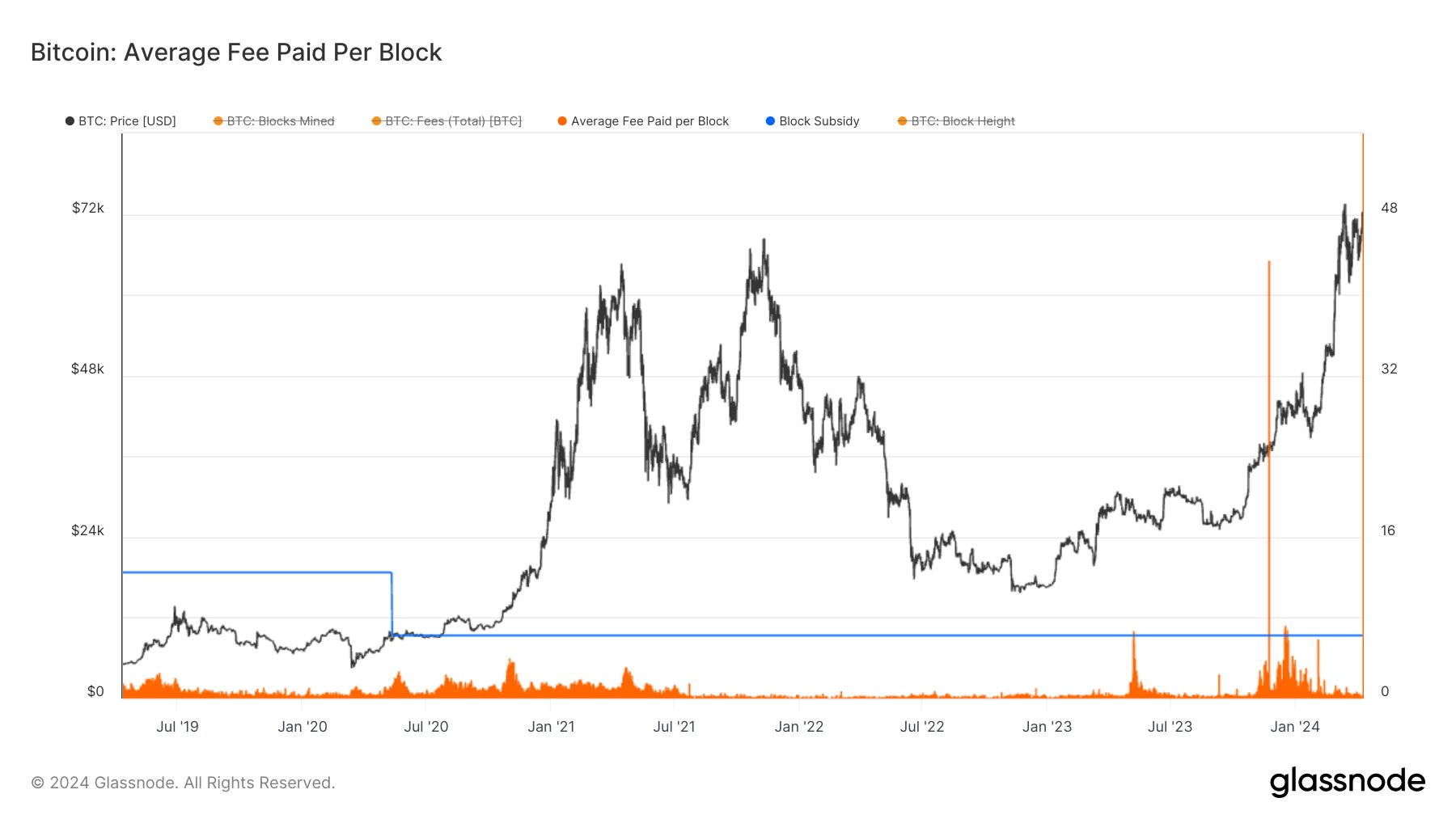

Bitcoin Fees Near Cycle Lows, Will Halving Change This?

On-chain data shows the Bitcoin network has been quite cheap recently, as the transaction fee per block has been near cycle lows. Bitcoin Miners Have Been Receiving Low Fees Recently As analyst James Van Straten pointed out in a new post on X, the BTC transaction fee has been floating around cycle lows recently. The […] дальше »

2024-4-11 06:00

|

|

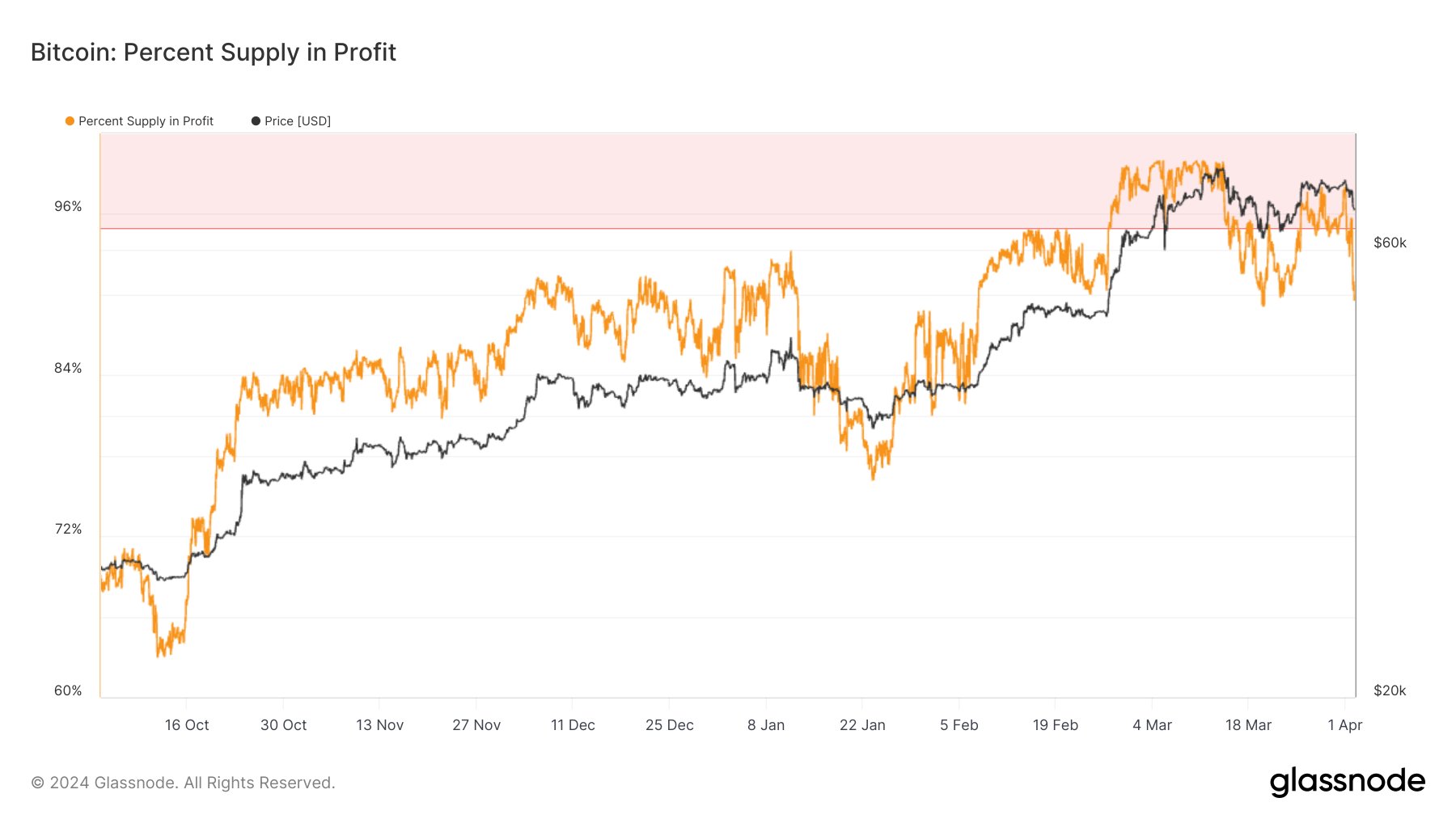

Bitcoin 2 Months Through “Euphoria Wave,” How Long Was The Last One?

On-chain data shows Bitcoin has been going through a “euphoria wave” for two months. Here’s how long it was in this phase during the last bull run. Bitcoin Has Been In Euphoria Wave Phase According To Supply In Profit According to the latest weekly report from the on-chain analytics firm Glassnode, the current BTC cycle is similar to the last one regarding the “Supply Profitability State. дальше »

2024-4-11 04:00

|

|

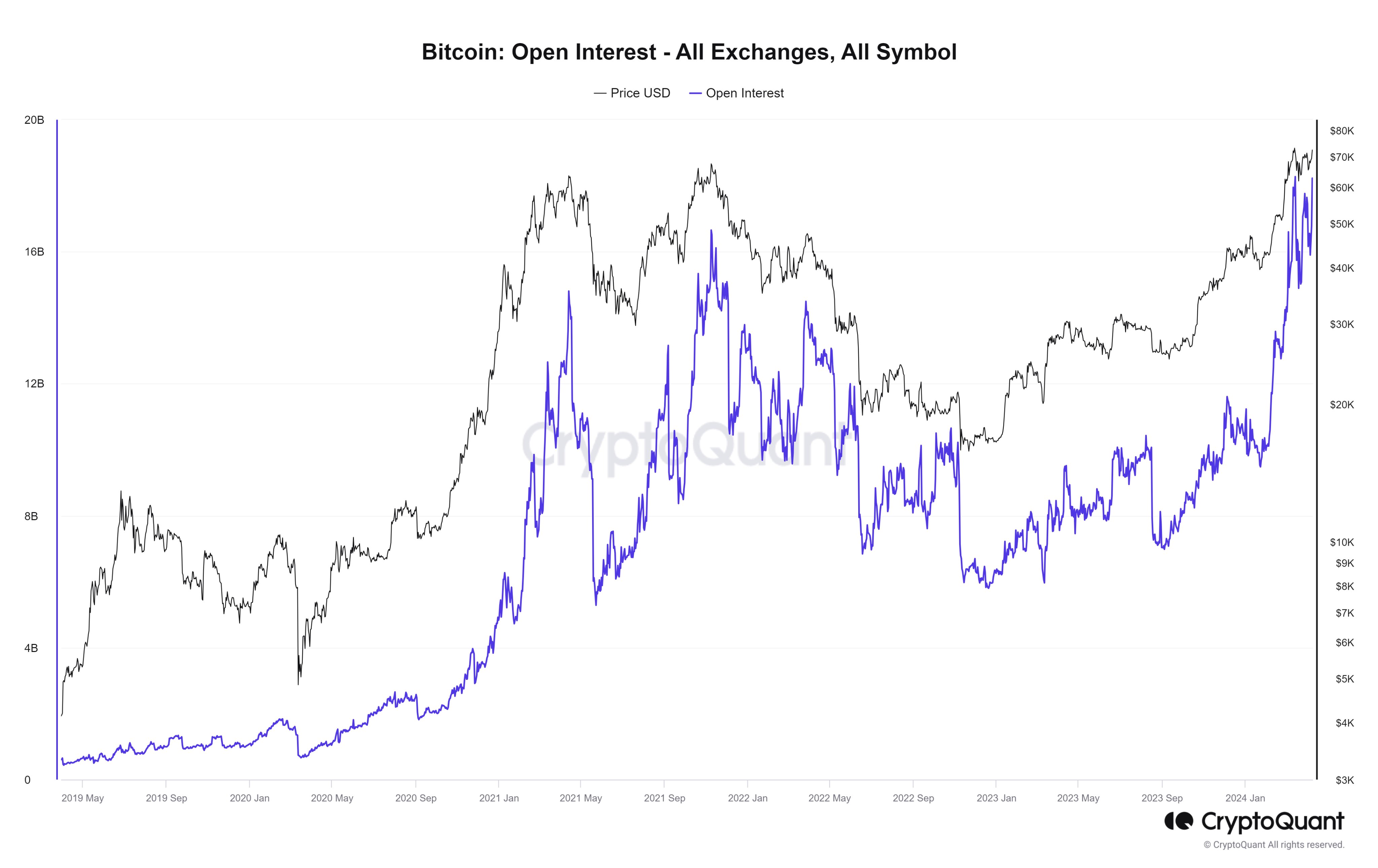

Bitcoin Open Interest Sets All-Time High As BTC Crosses $72,000

Data shows the Bitcoin Open Interest has set a new all-time high (ATH) as the cryptocurrency’s price has surged above $72,000. Bitcoin Open Interest Has Shot Up Recently CryptoQuant Netherlands community manager Maartunn explained in a post on X that the BTC Open Interest has just reached a new ATH. The “Open Interest” is an […] дальше »

2024-4-9 07:00

|

|

Bitcoin 40% Of Way Through Bull Run If This Metric Is To Go By

A pattern in the holdings of the Bitcoin long-term holders may suggest that the current bull run is 40% of the way to completion. Bitcoin Long-Term Holders Have Been Distributing Recently In a new post on X, Glassnode lead analyst Checkmate discussed the recent behavior of the long-term Bitcoin holders. дальше »

2024-4-9 05:00

|

|

This Bitcoin Indicator May Have Signaled Latest Market Downturn In Advance

The Bitcoin Network Value to Transactions (NVT) Golden Cross indicator attained overheated values coinciding with the recent local top in the price. Bitcoin NVT Golden Cross Surged To 3. 17 During Recent Peak An analyst in a CryptoQuant Quicktake post explained that the NVT Golden Cross may have served as an indicator of the recent top in cryptocurrency prices. дальше »

2024-4-5 04:00

|

|

Bitcoin Short-Term Holders Capitulate: $5.2 Billion Sold At Loss

On-chain data shows the recent Bitcoin drawdown has shaken up the short-term holders, leading them to make large exchange deposits at a loss. Bitcoin Short-Term Holders Have Transferred Huge Volume In Loss To Exchanges As analyst James Van Straten pointed out in a post on X, the BTC short-term holders have recently participated in a large amount of loss-taking. дальше »

2024-4-4 20:30

|

|

Bitcoin Realized Cap Breaks ATH As Capital Inflows At Unprecedented Rates

On-chain data shows the Bitcoin Realized Cap has set a new all-time high (ATH) as capital has been flowing into the coin at unprecedented rates. Bitcoin Realized Cap Recently Crossed The $540 Billion Mark In its latest weekly report, the on-chain analytics firm Glassnode has discussed the trend that has recently been taking place in […] дальше »

2024-4-4 02:30

|

|

Bitcoin Traders No Longer Extremely Greedy: Rebound Signal?

Data shows that Bitcoin investor sentiment has cooled to the lowest level since February, something that could facilitate a rebound in the price. Bitcoin Fear & Greed Index Now Points At Just ‘Greed’ The “Fear & Greed Index” is an indicator created by Alternative that tells us about the general sentiment among investors in the Bitcoin and broader cryptocurrency sector. дальше »

2024-4-4 22:30

|

|

Asia’s Bitcoin Volatility Linked To Algos Tracking ETF Flows

Recent Bitcoin price volatility in Asia has been closely linked to automated trading algorithms that monitor flows in US exchange-traded funds (ETFs). According to Bloomberg, this algorithmic trading response to daily US ETF flow data is causing pronounced swings in Bitcoin prices during Asian trading hours. дальше »

2024-4-3 11:40

|

|

Bitcoin Supply In Loss Hits 10% After Crash: What Happened Last Time

On-chain data shows the Bitcoin supply in profit has plunged following the latest crash in the asset’s price towards the $65,000 level. Bitcoin Supply In Profit Is Now Down To Around 90% As analyst James Van Straten pointed out in a post on X, around 10% of the BTC supply is now in a state of loss. дальше »

2024-4-3 03:00

|

|

Bitcoin Traders Spread “Buy The Dip” As BTC Plunges Below $66,000

Data shows “buy the dip” calls for Bitcoin have spiked around social media following the plummet the asset has seen below the $66,000 level. Bitcoin Social Volume For Terms Related To Buy The Dip Has Shot Up According to data from the analytics firm Santiment, Bitcoin investors have more heavily reacted with bullish calls than bearish ones despite the sharp decline the asset has observed. дальше »

2024-4-3 18:00

|

|

Start Selling Bitcoin When This Happens, This Quant Says

A quant has explained that the past pattern in the Bitcoin taker buy-sell ratio metric may suggest the best window to start selling the asset. Bitcoin Taker Buy Sell Ratio May Reveal Selling Opportunities In a CryptoQuant Quicktake post, an analyst discussed the trend in the Bitcoin “taker buy sell ratio. дальше »

2024-4-2 22:30

|

|

What’s A Simple Strategy For Buying & Selling Bitcoin? This Analyst Answers

An analyst has revealed a simple strategy for buying and selling Bitcoin using the historical pattern followed by two BTC on-chain indicators. These Bitcoin On-Chain Indicators Have Followed A Specific Pattern Historically In a post on X, CryptoQuant author Axel Adler Jr. дальше »

2024-3-31 04:00

|

|

Bitcoin Difficulty Drops: Miners Hesitant To Expand Ahead Of Halving?

On-chain data shows the Bitcoin difficulty has seen a drop in the latest network adjustment, suggesting the miners have stopped their expansion. Bitcoin Difficulty Drops 1% As Hashrate Remains Flat The “difficulty” is an in-built feature of the Bitcoin network that controls how hard the miners would find it to find blocks on the chain […] дальше »

2024-3-29 02:30

|

|

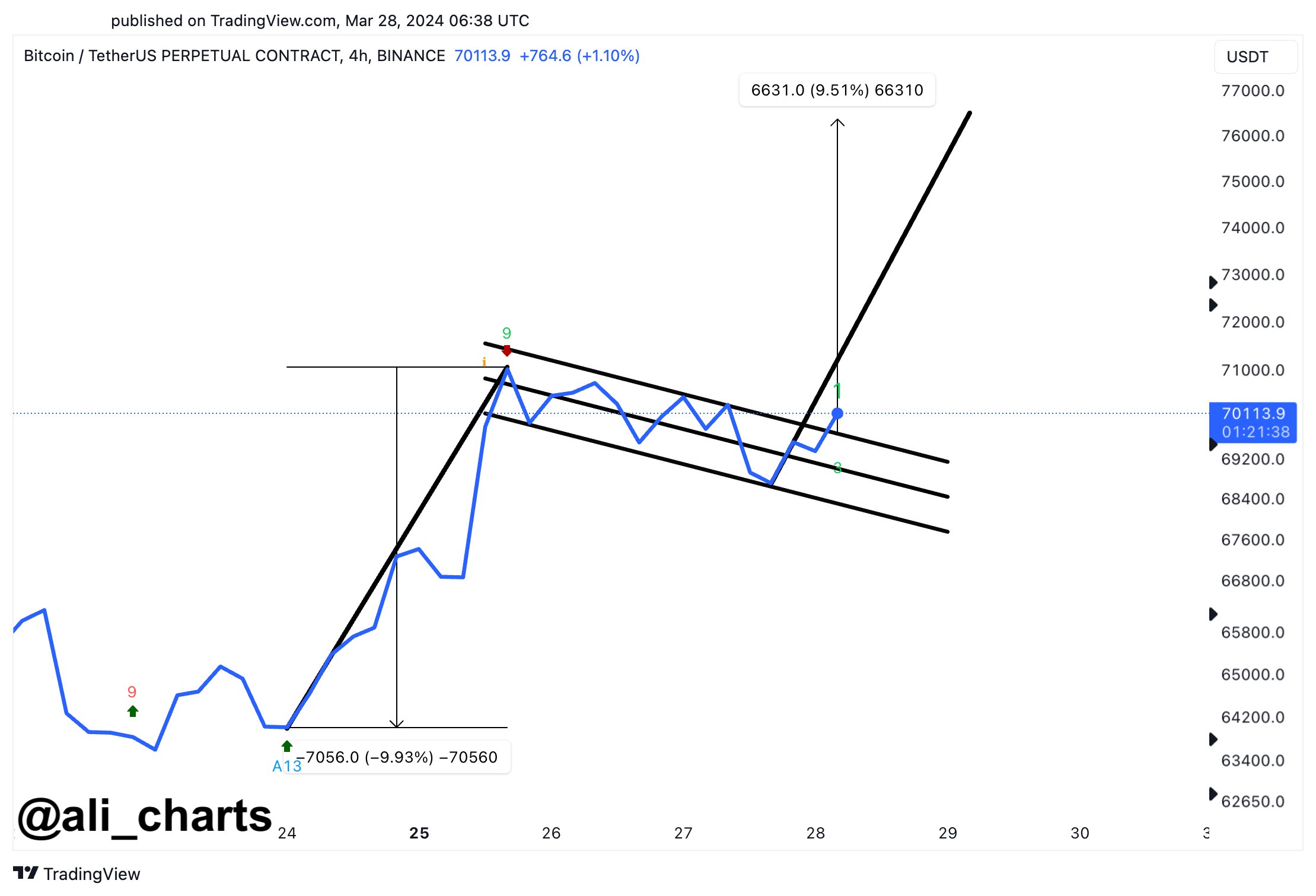

Bitcoin Bull Flag Could Predict 10% Surge To $77,000, Analyst Explains

An analyst has explained that a breakout from a bull flag pattern could lead Bitcoin to surging towards a new all-time high of $77,000. Bitcoin Has Been Forming A Bull Flag Pattern Recently In a new post on X, analyst Ali has discussed about a bull flag recently forming in the 4-hour price of the cryptocurrency. дальше »

2024-3-29 02:00

|

|

Bitcoin Sentiment Returns To Extreme Greed As BTC Breaks $71,000

Data shows the Bitcoin market sentiment has returned to the extreme greed territory as BTC has registered its rally beyond the $71,000 level. Bitcoin Fear & Greed Index Now Points To “Extreme Greed” The “Fear & Greed Index” is an indicator made by Alternative that tells us about the general sentiment among the investors in the Bitcoin and wider cryptocurrency market. дальше »

2024-3-26 20:00

|

|

Bitcoin Shatters Profit-Taking Streak From 2021 Bull Run

On-chain data shows the recent Bitcoin consecutive profit-taking day streak has now surpassed the longest run from the 2021 bull rally. Bitcoin Has Now Seen 157 Straight Days Of Net Profit-Taking As analyst James Van Straten explained as a new post on X, BTC has already surpassed the longest profit-taking spree from the previous bull […] дальше »

2024-3-26 01:00

|

|

Did This Bitcoin On-Chain Metric Predict Recovery In Advance?

On-chain data indicates that Bitcoin had retested a historically relevant line right before the latest recovery had come. Bitcoin Adjusted SOPR Retested The 1.0 Level Prior To Recovery When Bitcoin was declining, the cryptocurrency had dropped to a low of $60,600, which appears to have been the bottom, at least so far, given that the […] дальше »

2024-3-22 01:00

|

|