2024-10-6 21:30 |

Bitcoin’s (BTC) price recently experienced a 7.8% decline, dropping to $60,000. However, as the king of cryptocurrencies recovers from this drawdown, support from a significant group of investors could push the price higher.

Institutional investors, in particular, are playing a key role in driving Bitcoin’s upward momentum, and their influence might propel BTC toward the $70,000 mark.

Bitcoin Notes Solid DemandInstitutional investors are crucial to Bitcoin’s potential recovery and future growth. According to data from Glassnode, Bitcoin exchange-traded funds (ETFs) now hold over $58 billion worth of BTC. This volume accounts for approximately 4.6% of Bitcoin’s circulating supply, indicating strong demand for regulated exposure to the cryptocurrency.

The institutional demand suggests that large-scale investors view Bitcoin as a viable and valuable asset. As these investors continue to accumulate BTC through ETFs and other regulated means, they contribute to the coin’s long-term growth and stability. Their influence could be key in pushing Bitcoin’s price toward $70,000, especially if demand remains consistent.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

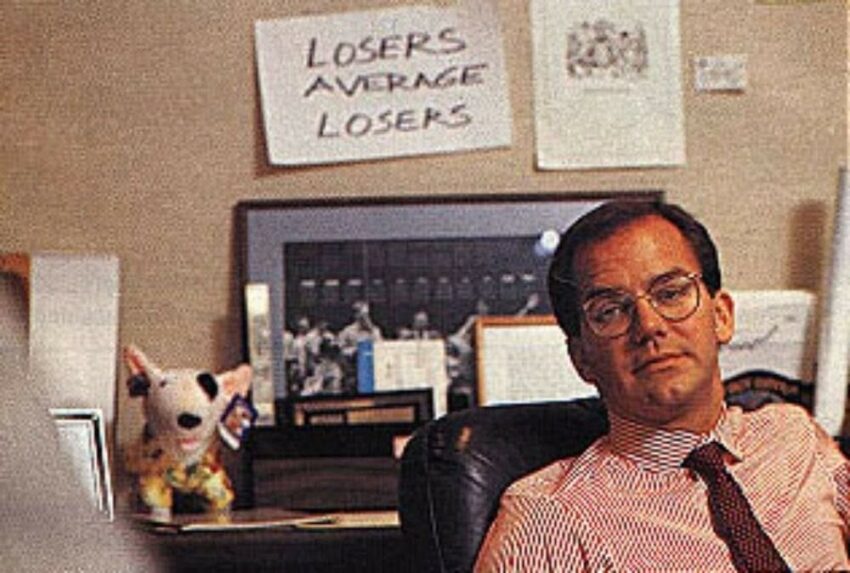

Bitcoin US Spot ETF Balance. Source: GlassnodeBitcoin’s overall macro momentum also appears favorable for a potential price rise. The net realized profit/loss indicator, which tracks investor sentiment and behavior, recently noted a downtick, signaling that profit booking is slowing down. This shift suggests that selling pressure is decreasing, giving Bitcoin the necessary breathing room for a comeback.

As selling sentiment wanes, Bitcoin’s price could benefit from a more balanced market. This reduction in profit-taking allows for a more stable price environment, increasing the chances of a sustained recovery. With institutional demand remaining strong and selling pressure subsiding, Bitcoin could be on track for a price surge.

Bitcoin Net Realized Profit/Loss. Source: Glassnode BTC Price Prediction: Rallying HopesBitcoin is currently trading at $62,353, just above the crucial support level of $61,868. While this is a positive sign, BTC still faces a significant barrier at $65,292 before it can aim for $70,000. Breaking this resistance is essential for the next leg up in Bitcoin’s price movement.

The factors mentioned above suggest that a price rise is possible, but it will require steady growth supported by continued institutional demand. If institutional investors maintain their interest in BTC, Bitcoin could breach the $65,292 barrier and move closer to $70,000.

Read more: Bitcoin Halving History: Everything You Need To Know

Bitcoin Price Analysis. Source: TradingViewHowever, if institutional demand weakens or large investors pull back, Bitcoin may struggle to break past $65,292. In such a scenario, BTC could test its support level at $61,868, potentially invalidating the bullish outlook and delaying further gains.

The post Bitcoin’s Rise to $70,000 Is in the Hands of These Investors appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|