2024-3-20 00:42 |

Bitcoin (BTC) witnessed a significant downturn this week, with its price plunging to $63,763, marking a weekly drop of 10%. As investors brace for the upcoming Federal Reserve meeting scheduled for tomorrow, market observers are closely monitoring whether this event will serve as a catalyst for further corrections or mark the beginning of a rebound.

Source: BNC

The decline in Bitcoin’s price coincides with mounting concerns over the Federal Reserve’s stance on interest rates amidst robust U.S. economic data and persistent inflationary pressures. The central bank’s decision, expected on Wednesday, poses a potential risk for risk asset prices, with fears lingering over a less accommodative monetary policy stance.

Last week’s release of higher-than-anticipated inflation figures in the U.S. added to the market jitters, raising doubts about the Federal Reserve’s willingness to implement further monetary easing measures, including interest rate cuts.

Additionally, news of Japan’s central bank raising rates for the first time since 2007 and significant outflows from the Grayscale Bitcoin Trust (GBTC) have added to the bearish sentiment.

Tuesday was a negative flow day for the Spot Bitcoin ETFs thanks to $GBTC’s $643 million outflow day.

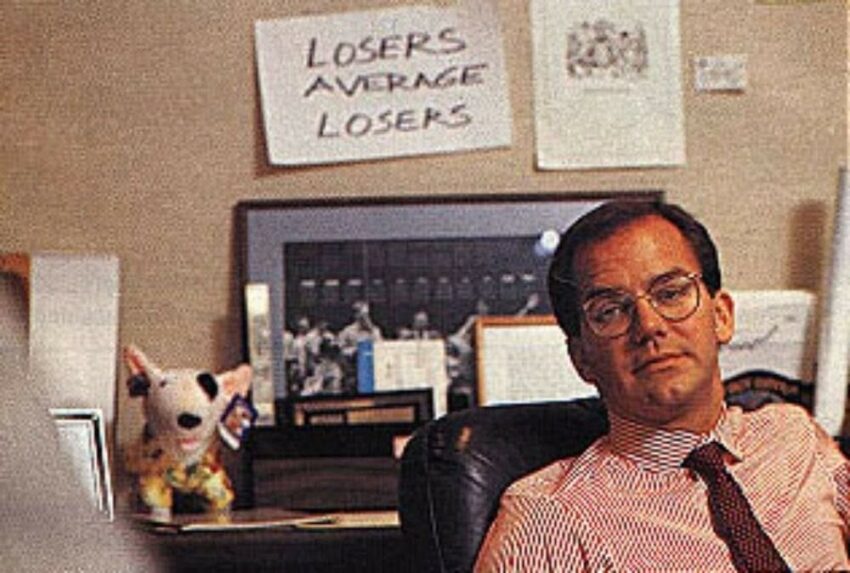

Bernstein To Buy the Dip?

Despite the recent correction, analysts at Bernstein view Bitcoin’s price dip as a temporary opportunity for investors. According to Gautam Chhugani and Mahika Sapra, analysts at the research and brokerage firm, the current consolidation phase presents a favorable buying opportunity ahead of Bitcoin’s halving event scheduled for April.

“We believe the current phase of bitcoin consolidation is temporary and offers a dip buying opportunity prior to the Bitcoin halving,” remarked Chhugani and Sapra in a note to clients. They expect the market to undergo further consolidation before the halving, followed by a continuation of the overall bull market.

Bitcoin halvings, occurring approximately every four years, are programmed to reduce the reward subsidy for miners. The upcoming halving event, slated for April 20, will see the reward drop from 6.25 BTC to 3.125 BTC per block, while miners will continue to earn additional transaction fees.

Despite concerns surrounding Bitcoin’s price action leading up to the halving, analysts remain optimistic about its long-term trajectory. Rekt Capital, a crypto analyst, pointed out that Bitcoin could be on the verge of entering a pre-halving “danger zone,” historically characterized by price retracements in the lead-up to the halving event.

Source: Rekt Capital

“In two days, Bitcoin will officially enter the Danger Zone where historical pre-halving retraces have begun,” shared Rekt Capital. Past halving events have seen Bitcoin experience significant dips, with declines of 40% and 20% observed in 2016 and 2020, respectively.

And as the chart below shows, significant corrections in a bull market, are par for the course in bitcoin’s price history.

Source: X

Despite short-term fluctuations, most analysts maintain a bullish outlook for Bitcoin, forecasting substantial price appreciation following next month’s halving. Expect volatility.

ADVERTISEMENT

Advertise with BNC

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|