2025-3-10 09:37 |

Bitcoin has been experiencing a sustained downtrend despite maintaining a broader macro-bullish outlook. While long-term projections remain positive, short-term weakness suggests BTC may continue to face selling pressure.

Investor behavior has not been particularly supportive, contributing to further uncertainty in the market.

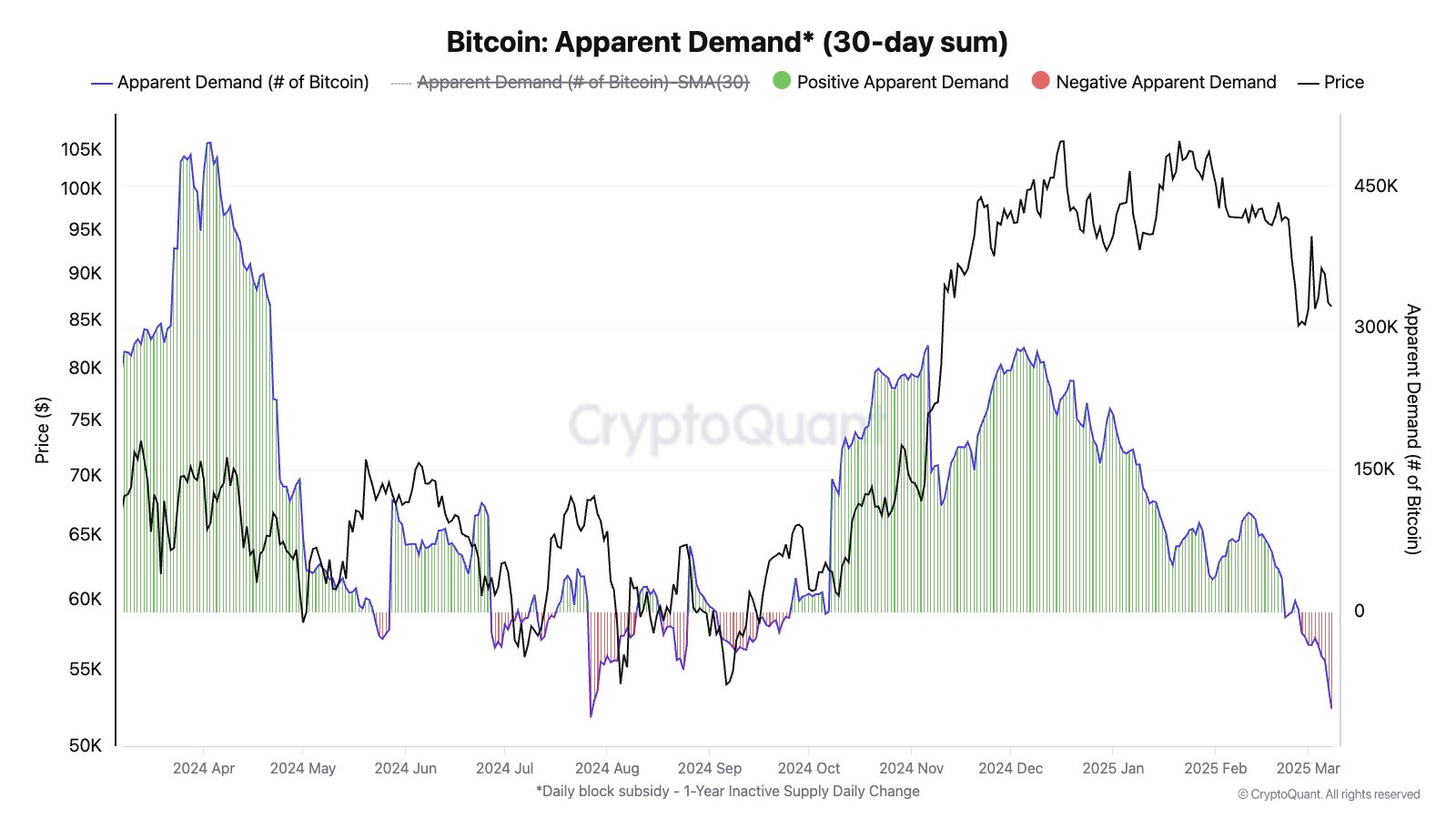

Bitcoin Needs Investors’ BackingBitcoin’s apparent demand has taken a significant hit, with spot demand contracting sharply in recent days. This contraction marks the most substantial decline since July 2024 and the first instance in over four months. The drop indicates rising skepticism among investors, leading to reduced buying interest and increased short-term bearish pressure.

A shrinking demand suggests that market participants are hesitant to enter new positions. If demand does not recover soon, Bitcoin could struggle to sustain its current price levels, increasing the risk of further drawdowns.

Bitcoin Apparent Demand. Source: CryptoQuantLong-term holders (LTHs) have shifted toward accumulation overselling, as shown by the LTH Net Position Change metric. Over the past 30 days, these investors have accumulated more than 107,413 BTC. Historically, LTH accumulation signals long-term confidence, but in the short term, it has often preceded periods of price weakness.

LTHs tend to accumulate at lower prices and begin distributing during bull runs. This pattern suggests Bitcoin might still face some downside before a meaningful recovery begins. While long-term accumulation is positive, the immediate impact could be additional short-term volatility and potential price corrections.

Bitcoin LTH Net Position Change. Source: Glassnode BTC Price Could Fall FurtherBitcoin’s price, currently at $82,305, is moving within a broadening descending wedge. While this pattern is historically bullish on a macro scale, in the short term, it indicates a higher likelihood of continued downside. BTC may need to test lower support levels before confirming a reversal.

Given the market conditions, the short term price prediction is that, Bitcoin could lose the crucial $80,000 support level and fall to test $76,741. If broader macroeconomic factors worsen, the decline could extend further, potentially reaching as low as $72,000. Such a scenario would put additional bearish pressure on the crypto market.

Bitcoin Price Analysis. Source: TradingViewHowever, a shift in investor sentiment could change this trajectory. If accumulation increases at the psychological support of $80,000, Bitcoin may regain bullish momentum. A move past $82,761 would pave the way for BTC to surpass $85,000, eventually reaching $87,041. Such a development would invalidate the bearish outlook and signal renewed market strength.

The post Bitcoin Price Short-Term Outlook: Weak Demand Suggests Drop Under $80,000 Possible appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

BTC Network Demand Set II (BYTE) на Currencies.ru

|

|