![Bitcoin’s [BTC] rise precipitates new all-time high rekts shorts; $131.4 million in shorts liquidated on BitMEX](http://ambcrypto.sfo2.digitaloceanspaces.com/2019/05/8p5hvscqqm031.jpg)

2019-5-27 17:30 |

Bitcoin [BTC], the largest cryptocurrency by market cap, made another record for the year yesterday as the price surpassed its previous all-time high for the year. The coin marked a new resistance level as it closed in on the $9000 level, hours after it broke through the $8500 level.

According to CoinMarketCap, at press time, the largest cryptocurrency was trading at $8717.71 with a market cap of $154 billion. The 24-hour trading volume of the cryptocurrency was $30.791 billion and the coin recorded a hike of over 10 percent in the past seven days.

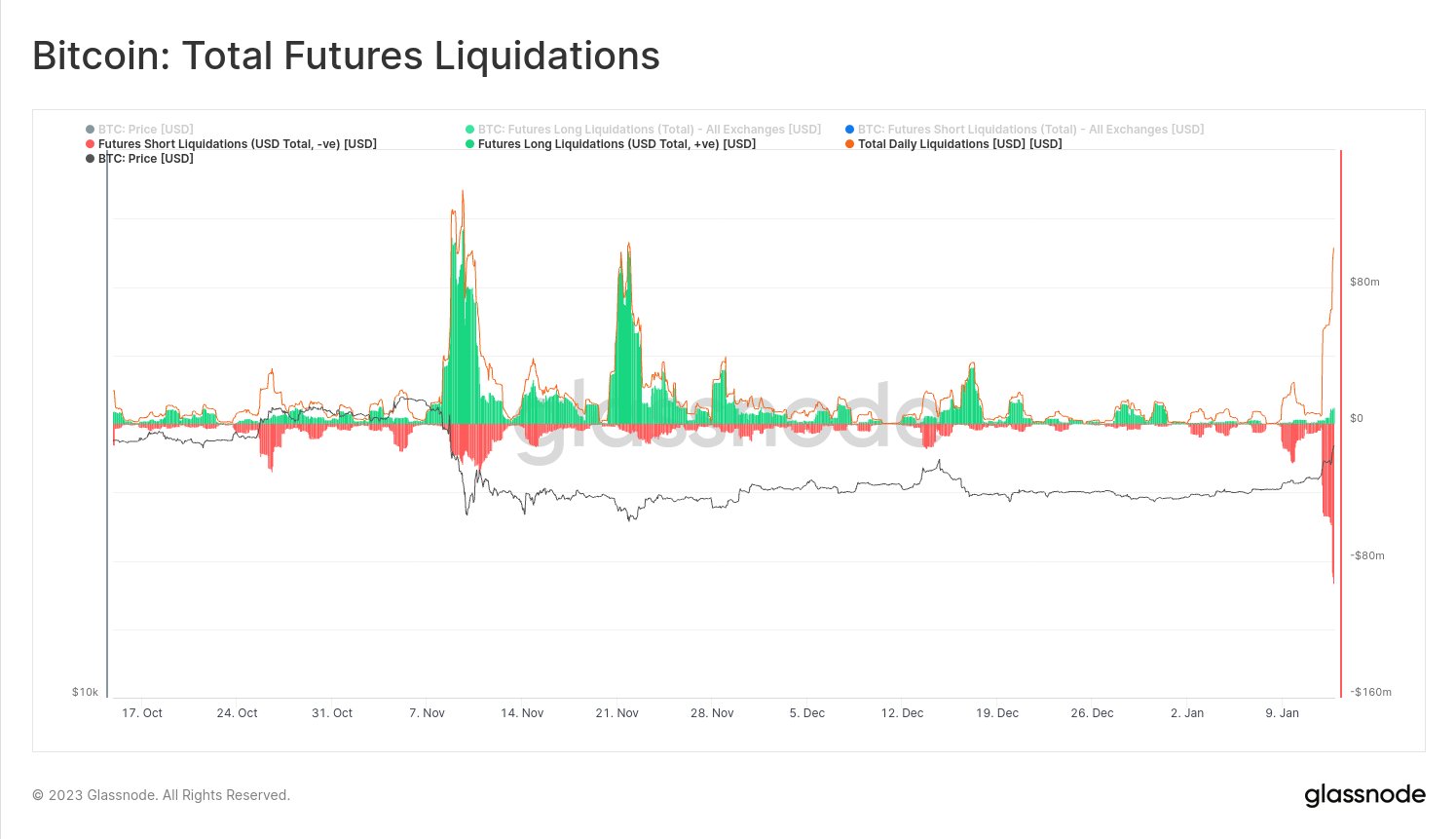

This parabolic rise of Bitcoin however, continues to be fatal for Bitcoin short traders. With the coin reaching its all-time high, around $131.4 million shorts were liquidated on BitMEX, a leading cryptocurrency exchange and derivatives trading platform. The trading platform enables traders to either short or long their Bitcoin, based on the market condition, with the exchange providing leverage of up to 100x on some of its products.

Source: Reddit

Bitcoin-panda, a Redditor said,

“Before crypto, retail never had such an easy way to trade with margin. And now all the noobs are getting rekt. It just shows how “trader” psychology works.”

On one hand, long sellers are those traders who bet on Bitcoin’s bullish future as they gain profits by selling their coin when the price is high and buying the asset when the price is low. On the other hand, short sellers are those that make a profit by borrowing funds when Bitcoin’s price is high. These borrowed assets are then sold in the market, post which they are bought back when the price of the coin is low. Basically, shorts sellers are the ones that bet on a bearish trend for Bitcoin, while long sellers are the one that bet on a bullish trend for Bitcoin.

LongDong69, another Reddit user said,

“People get REKT investing in shitcoins at the top People get IMPATIENT waiting for even People get LIQUIDATED attempting to quickly make back their losses People WATCH bull market return and cry”

Toplelkekfag said,

“Bitmex is the biggest winner of this whole market. These guys are making a sick amount of money.”

The post Bitcoin’s [BTC] rise precipitates new all-time high rekts shorts; $131.4 million in shorts liquidated on BitMEX appeared first on AMBCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Level Up Coin (LUC) на Currencies.ru

|

|