2019-4-9 00:30 |

Bitcoin [BTC], the first and largest cryptocurrency in the market, has been in the news since it breached the $5,000 mark. This breach contributed to several other coins gaining momentum in the market, with many rising by double-digits. Notably, Bitcoin continued to move upwards, with the 24-hour difference still in green.

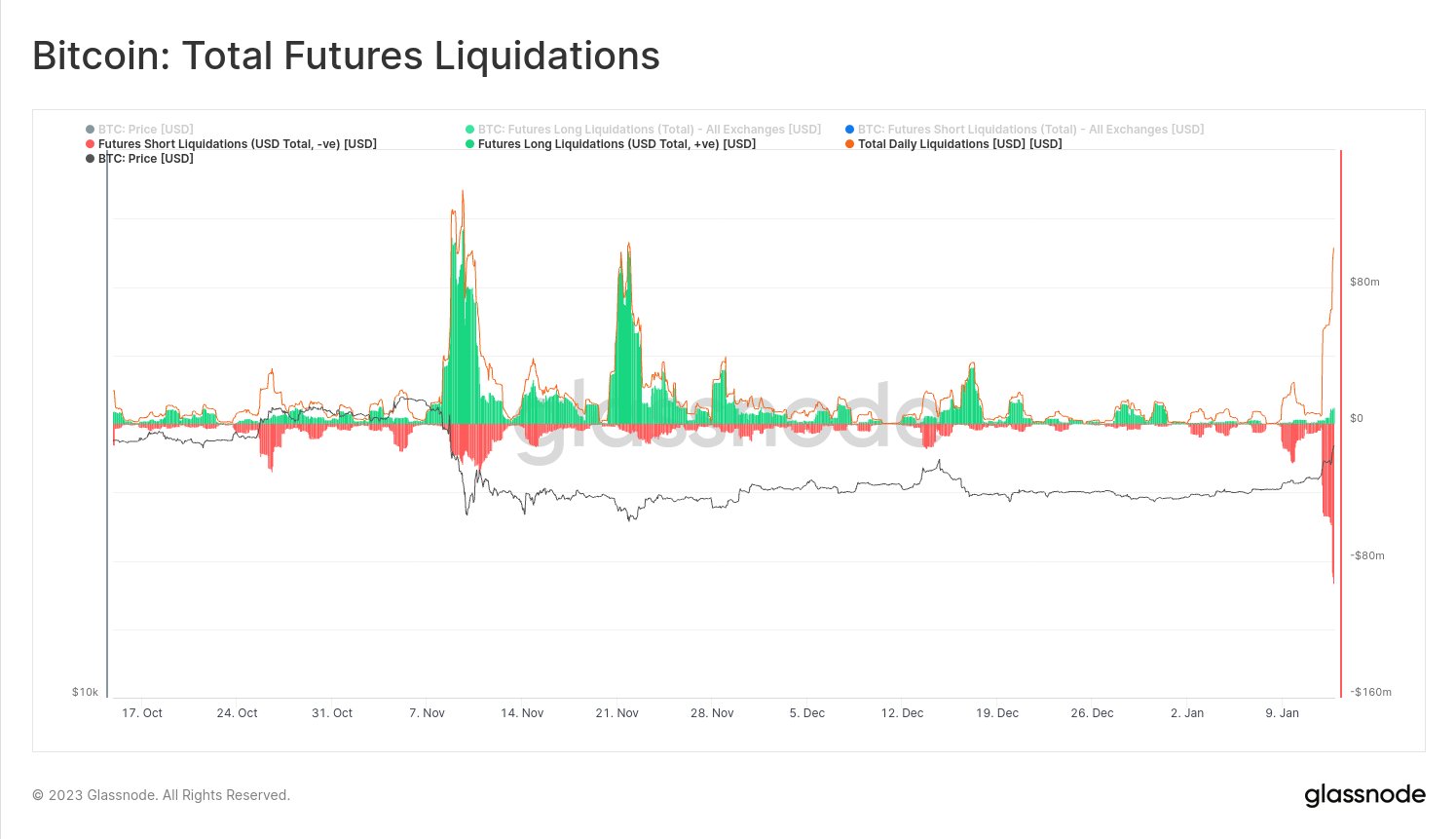

Interestingly, the unforeseen rise of the coin had a negative effect on short traders as several positions were liquidated in a short span. According to reports, the $5,000 breach resulted in the liquidation of over $400 million shorts on BitMEX, a Bitcoin Mercantile Exchange. According to a post on Reddit, around $30 million in shorts were closed on Bitfinex, a leading cryptocurrency exchange platform, a 27% drop approximately.

Source: TradingView

Notably, the drop was the lowest of Bitcoin shorts for over a year, with March 2018 recording the same level as the current one.

Richard Heart, a Twitter user, commented,

“[…] someone closed 5k #Bitcoin of shorts at $5,255 without hitting the order book (closed into his own account.) That’s $26,275,000 of shorts you can’t squeeze anymore.”

Short sellers, contrary to long sellers, make a profit by borrowing funds when the Bitcoin market is following a bullish trend, following which the assets are sold in the market. These assets are then recovered when the Bitcoin market follows a bearish trend. Contrarily, long sellers are those that profit by selling their assets when the market is following a bullish pattern and buy when the market is following a bearish market.

Zatline, a Redditor, said,

“If leveraged shorts are low meaning nobody profits if prices crash thats usually when matkets tend to crash .. this is more bearish than bullish”

The post Bitcoin [BTC] shorts: $30 million in shorts closed on Bitfinex; exchange records 20% drop appeared first on AMBCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|