2018-12-12 14:20 |

Bitcoin has continued to plunge since January 2018, with no respite in sight. Bitcoin shorts reached all-time highs on BitMex and other exchanges which offer derivatives. That said, a phenomenon called a ‘short-squeeze’ could score a savvy trader a tidy profit.

An oft-ignored, yet blaring feature of the cryptocurrency markets is the trading action on a particular asset largely affects prices, regardless of strong fundamentals, positive news, and noteworthy developments. In addition, the overall market is firmly anchored to Bitcoin’s price movements, meaning a plunge is likely to cause price dips across the board, and vice-versa.

Trading markets have become more sophisticated over the years as well. While Bitcoin could only be bought and sold in its initial days, the advent of futures trading, perpetual swaps, short positions, and leverage trading have mirrored most financial products seen in traditional markets. Take for example BitMEX, a derivatives crypto-exchange that conducts billions of dollars in XBT trades per day. The exchange is also notorious for impairing traders through unforeseen maintenance updates.

As more institutional traders move towards trading cryptocurrencies and amateur Bitcoin enthusiasts pick up tricks from the traders’ handbook, the business of shorting a digital token has led to profits, regardless of the direction of price movements. Falling prices may no longer lead to long positions which show significant, unrealized losses. Instead, shorting a particular digital asset with a basic trading strategy may equate to thousands of dollars in profits per trade on each price movement.

Keeping the aforementioned points in mind, we may wonder if all short cryptocurrency traders are making money. The answer is no. Enter the phenomena of the “short squeeze” and “dead cat bounce,” which can easily take a leveraged cryptocurrency trader from a good year to a terrible year.

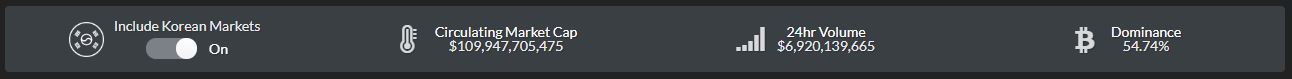

In terms of today, short positions for Bitcoin have reached an all-time-high on Bitfinex (BFX), the world’s fifteenth largest cryptocurrency exchange as per data from CoinMarketCap. The activity is well positioned for the market to experience a quick jump in prices followed by an absurd dip, effectively creating the textbook “short squeeze.”

As Investopedia explains:

“A short squeeze is a situation in which a heavily shorted stock or commodity moves sharply higher, forcing more short sellers to close out their short positions and adding to the upward pressure on the stock.”

A quick look at BFX shorts shows a peculiar pattern forming:

Source: TradingViewCompare that with the prices of BTCUSD:

Source: TradingViewIs this a terminal error? No. That’s just the market reacting in an opposite direction to Bitcoin shorts on Bitfinex.

Moving the market and getting the Bitcoins at cheap prices are “whales,” or investors with large amounts of digital tokens who are able to move the price, rather than everyday traders. Basically, with the sheer number of over-leveraged shorts trading the market, a whale, or a pod of whales, can quickly move prices up and leverage their positions to make significant profits. After all, buying pressure is absent when shorts are at an all-time high, making the market ripe for a quick price slap followed by an actual short.

Meanwhile, few in the cryptocurrency community believe these exchanges could be the whales in question during such price movements. One Reddit user noted:

“There have also been some conspiracy theories that certain exchanges are doing this themselves to liquidate people trading on their platforms, from which they obviously profit.”

However, they point out that people collectively could form a whale, in theory, meaning the herd mentality of following others’ positions could be leading to rapid price movements in either direction.

Nonetheless, the market looks alluring for a short squeeze taking place sooner rather than later. As always, the best practice is to adhere to stop-losses with appropriate risk management before risking your investment in the volatile crypto markets.

The post Bitcoin Shorts Reach ATH, is a Short Squeeze Incoming? appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|