2019-4-10 11:30 |

Bitcoin [BTC] has reinvigorated the hopes of cryptocurrency proponents through its recent price rally. The coin’s unexpected ascendance over $5,000 has caused several researchers to mull the future market and infrastructure prospects of the collective industry, one among them is Seeking Alpha’s Victor Dergunov.

Following what many have claimed to be the breaking of the “Bitcoin Bottom,” Dergunov contends that this is the best time to get into Bitcoin as the price will skyrocket. The crypto-winter has passed, in his opinion, with the coin trading at a 40 percent incline against its December 2018 low.

Given the upcoming price surges and possibly a crypto-spring, investors will stand to gain a substantial amount. Dergunov added that this will be “an excellent time to build exposure to Bitcoin.”

He said that the most recent price pump is an indication of things to come, with several technical similarities being drawn between this rally and previous bull-runs. Furthermore, Dergunov stated that this rally is likely the “beginning of Bitcoin’s next bull market.”

Several comparisons have been drawn with Bitcoin’s April 1 upswing and the remarkable December 2017 bull-run which saw the king coin almost touch $20,000. In Dergunov’s opinion, if the current bulls continue to reign, the $20,000 ceiling could be broken.

In his own words:

“If we look at a long-term chart of Bitcoin we can see a clear pattern of bull cycles turning into bear cycles and vice versa. Nevertheless, we can see that in each wave, as Bitcoin’s popularity gains more momentum, the bull market peak is always significantly higher than the previous one.”

The analyst further pointed out that several indications reveal a bullish swing for the market. He specified the increasing daily transactions and hash rate, which indicated long-term bullish movement.

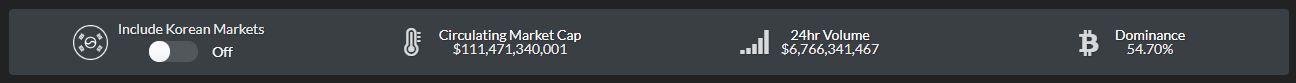

In comparison with the larger fiat market, Bitcoin’s market capitalization of $90 billion is fairly minuscule. However, if adoption increases and fiat is chided for its virtual equivalent, the potential users that will come into the digital assets realm will shoot up BTC’s price.

He added:

“Currently, only about 0.56% of potential users have exposure to Bitcoin, which implies nearly 99.5% of the potential market is still untapped.”

Additionally, one of the main tenets of the decentralized currency market, being unable to be controlled by a single entity, will pose as an attractive factor for its adoption in the future. As financial fractures rupture global economies, many will turn to cryptocurrencies as a savior currency, states Dergunov.

He concluded:

“Bitcoin and other digital assets act as alternative currencies and payment systems relative to the current fiat financial status quo.”

The post Bitcoin’s [BTC] next market peak will surge higher than December 2017 high: Researcher appeared first on AMBCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|