2018-12-11 04:28 |

Crypto Market Slows After Imbroglio

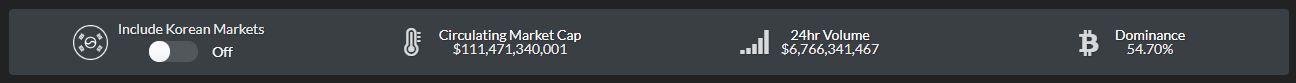

Although selling pressure eased off crypto markets over the weekend, Bitcoin (BTC) and altcoins are still in the midst of stormy seas. BTC has found itself stagnant at $3,375, seemingly caught in an inflection point between a short-term bounce and lower lows. As this market’s leading asset has slowed, so has the market capitalization of all cryptocurrencies in circulating. This pertinent figure has moved to $111 billion, just three billion down from Ethereum World News’ Friday update.

Interestingly, trading has dried up in recent days, with the 24-hour volume figure dropping to $13 billion ($6.7 billion adjusted) from the $20 billion ($10 billion adjusted) posted amid Friday’s rapid price action.

What would be a market update with BTC… right?

Over the weekend, BTC embarked on a short-term recovery, moving from $3,300 to a multi-day high at $3,650 over the course of multiple hours. However, as the buying pressure quickly dissipated, BTC began to fall back to Earth on Sunday, moving under $3,500, a cited key support level, before falling victim to the weekly Monday sell-off.

At the time of writing, BTC has found itself at $3,375, down 4.25% in the past 24 hours. Altcoins have also followed suit, with XRP, Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Tron (TRX), and Binance Coin (BNB) all posting near-identical performances to the cryptocurrency godfather.

Analyst: Bitcoin Well Beyond The Ridiculousness Of The Tulip BubbleAmid this seemingly endless market tumult, Stephen Innes, head of the Pacific Asia trading arm of Oanda, only doubled-down on his hate for BTC and other cryptocurrencies. Speaking with MarketWatch, the short-term crypto skeptic exclaimed that Bitcoin still doesn’t have a viable use case.

Innes added that “BTC has gone well beyond the ridiculousness of tulip bulb mania,” evidently referencing the unpopular sentiment that cryptocurrencies are the second coming of the ‘Tulipmania’ of yesteryear.

However, a multitude of industry insiders has overtly stated that cryptocurrencies aren’t in the midst of a bubble, contradicting the relevant point of contention. Ambrosus CEO Angel Versetti, for instance, recently told the Independent, a U.K.-centric news outlet, that while lines can be drawn between the Dotcom Boom at the turn of millennia and crypto in 2017/2018, commentators would be remiss to classify the latter as a bubble.

The startup chief explained that seeing that cryptocurrencies have yet to beckon in institutions, which he referred to as “financiers,” en-masse, a bonafide market bubble has yet to strike this budding asset class. Yet, as seen by the countless crypto-related forays from Wall Street participants, this bubble may be right on the horizon. In fact., Versetti explained that in due time, the aggregate value of all cryptocurrencies may eclipse the $15 to $20 trillion mark, cementing BTC and its altcoin brethren as a legitimate component of the financial world’s vast intricacies.

Still, the aforementioned Oanda head trader cast aside these arguments, drawing attention to the “disastrous year” that cryptocurrencies have undergone, likely touching on the ~87% decline experienced by this decade-old market. Innes added that the “current bear market could go from bad to worse,” claiming that there currently isn’t a fundamental or underlying rationale behind purchasing BTC, especially when “the only support offered up is a squiggly line on an analyst’s chart.”

Innes’ most recent quip comes just two weeks after the trader lambasted cryptocurrencies on Bloomberg TV. As reported by Ethereum World News previously, the Oanda head trader claimed that it’s a “wild west show” out in crypto, before adding that mature investors are still hesitant to purchase BTC, due to its “falling knife” status.

Yet, issuing a comment on Twitter, Innes recently claimed that he’s “actually very bullish on [BTC] long-term, just not today,” evidently referencing sentiment that while the cryptocurrency is still well over-bought and over-hyped, it likely has long-term value as a borderless, censorship-resistant, decentralized, and efficient medium of value that transcends traditional boundaries.

Edit: Stephen Innes has commented on the piece, Ethereum World News has added it accordingly.

Title Image Courtesy of W A T A R I on UnsplashThe post Analyst: Crypto Bear Market May Get Worse, Bitcoin (BTC) Fundamentally Unsupported appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|