2022-12-9 20:00 |

The Bitcoin price action remains stalled as the cryptocurrency moves in a tight range; uncertainty is king in the current environment. Market participants are more optimistic after BTC climbed 12% from the yearly lows, but the possibility of a sustainable rally is declining.

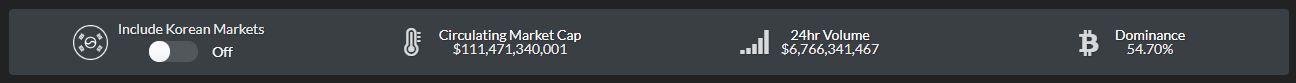

The sideways price action is affecting the sentiment in the market. As of this writing, Bitcoin (BTC) is trading at $16,800. Other cryptocurrencies in the top 10 by market cap display similar price action, with very few recording profits on these timeframes.

BTC’s price moves sideways on the daily. Source: BTCUSDT Tradingview Bitcoin Whales Jump Ship, What This Means For BTCBitcoin has been moving in tandem with legacy financial markets since the end of 2021. The cryptocurrency is responding as a risk-on asset to the U.S. Federal Reserve (Fed) monetary policy. The financial institution is hiking interest rates to slow down inflation.

As NewsBTC reported, the sentiment in the legacy financial market was bullish and robust, and it supported a 12% BTC rally. The sentiment in this sector was strong enough to drive the BTC price upwards in a hostile environment.

The second largest crypto exchange in the world, FTX, collapsed. This event triggered a new capitulation event in the crypto market, pushing BTC to fresh lows. However, equities trending to the upside reverted the losses on the nascent asset class.

The bullish momentum is fading as the FTX debacle impacted crypto investors’ confidence in the nascent asset class. Analyst Ali Martinez shared recent data about Bitcoin whales. These investors are selling into the current BTC price action. Martinez said:

Bitcoin around 33 whales holding 1,000 to 100,000 $BTC have left the network, and these whales sold or redistributed around 20,000 $BTC in the last 96 hours.

BTC Whales dumping into the current price action. Source: Santiment via Ali Martinez on TwitterThe selling increased due to strong economic growth in the United States. The Fed has more room to continue with its tightening policy if the economy is resilient.

Additional data from analytics firm Jarvis Labs indicates that $16,550 and $19,150 are critical. As uncertainty endures, leverage players take positions to benefit from a potential breakout.

These positions add liquidity below and above the Bitcoin price. The chart below shows that these levels hold the most extensive liquidity pools. Thus, if the market taps into them, whales can drive the price in a particular direction.

BTC’s price with massive liquidity pools at $16,550 and $19,150. Source: Jarvis Labs via TwitterFor example, BTC whale can continue selling to tap the liquidity of around $16,550; this move will take out most of the leverage positions. Then, the price can attempt to take the upside liquidity at approximately $19,150.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|