2020-10-30 00:28 |

The week started on a low note as altcoins, global stocks, and other risk-on assets all bled. The Dow Jones, in particular, fell by almost 800 points on Monday as investors pondered what a contested election would do to the much-needed coronavirus stimulus aid.

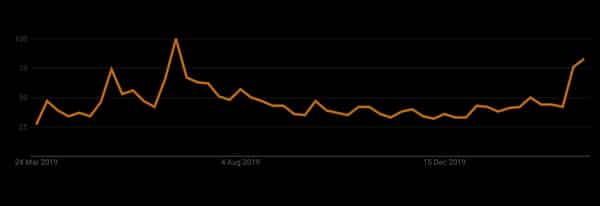

Bitcoin, surprisingly, evaded the bearish pressure. The dominant cryptocurrency has continued to forge ahead, subsequently cutting its correlation with equities markets. In fact, bitcoin has even trumped gold to offer a better hedge against the latest stock market insanity.

Gold has not provided a hedge against recent equity volatility. Bitcoin, meanwhile, has crushed it. pic.twitter.com/UR5Jdk5sBm

— Lisa Abramowicz (@lisaabramowicz1) October 27, 2020Bitcoin is valued at $13,652.21 at the time of publication, after gaining 2.25 percent over the past 24 hours. This represents a new 16-month high for the OG crypto. BTC is now up over 86% since the beginning of this year.

Today’s bullish mood has been buoyed by the news that Singapore’s largest bank, DBS, is reportedly planning to launch a digital assets platform, per a cached website page. As the cryptocurrency edges higher, top macro investor Raoul Pal believes it is inevitable for the bitcoin price to hit a new all-time high soon.

Raoul Pal Is Convinced That Bitcoin Is On Track To See A New All-Time High By Early Next YearRaoul Pal is a former hedge fund manager at Goldman Sachs and the present CEO of Real Vision. He is a well-respected voice when it comes to macroeconomic analysis.

In a tweet on October 27, Pal suggested that the current bullish rampage will likely send bitcoin soaring past its old record of $20,000 by early next year (or in the next three months).

There are literally only two resistances left on the #bitcoin chart – 14,000 and then the old all-time high at 20,000. I fully expect new all-time highs by early next year at the latest.#irresponsiblylong pic.twitter.com/Xhp8qgHrAC

— Raoul Pal (@RaoulGMI) October 27, 2020Bitcoin has increased by 26% on a monthly basis. To take out current ATH, the cryptocurrency will need to increase by a further 50% within the next three months.

The New-Found Participation By Big Players Is Helping Push The Price of Bitcoin HigherBitcoin has caught the eye of several big players in recent months. First, there was hedge fund pioneer Paul Tudor Jones revealing in May that he had allocated some part of his portfolio to the flagship cryptocurrency. MicroStrategy, Square, and PayPal then followed in the footsteps of Jones and also endorsed bitcoin.

Even JPMorgan, the investment bank whose CEO once called bitcoin “a fraud” and threatened to fire any employee who dealt with crypto, is now siding with bitcoin. The bank’s quantitative experts recently stated that bitcoin is solidly competing with gold as an “alternative” currency, thanks to the Millennial generation.

Most recently, reports have surfaced that Singapore-based DBS bank with over 420 billion of assets has launched a digital asset exchange alongside institutional-grade custody and a platform for security token offerings (STOs).

Last three months in Bitcoin:

-MicroStrategy buys $425m in Bitcoin

-Square buys $50m in Bitcoin

-Stone Ridge buys $110m in Bitcoin

-PayPal integrates crypto purchases

-JPMorgan writes about Bitcoin vs Gold competition

-DBS soft launches crypto exchange

What's next?

The bitcoin price has reacted positively to each of the aforementioned events. With this trend of big players foraying into the cryptocurrency market not showing any signs of slowing down, the bitcoin rally indeed seems to be in its first inning.

origin »Bitcoin price in Telegram @btc_price_every_hour

High Voltage (HVCO) на Currencies.ru

|

|