2020-2-18 14:00 |

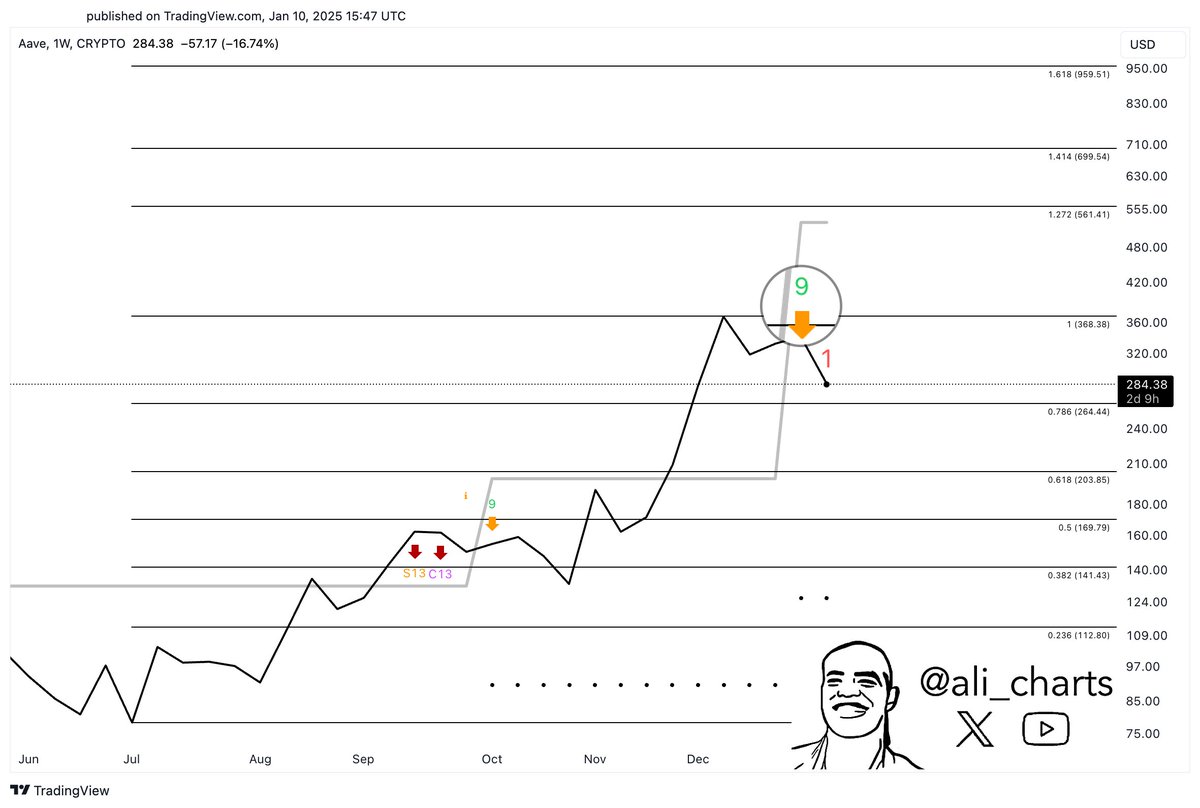

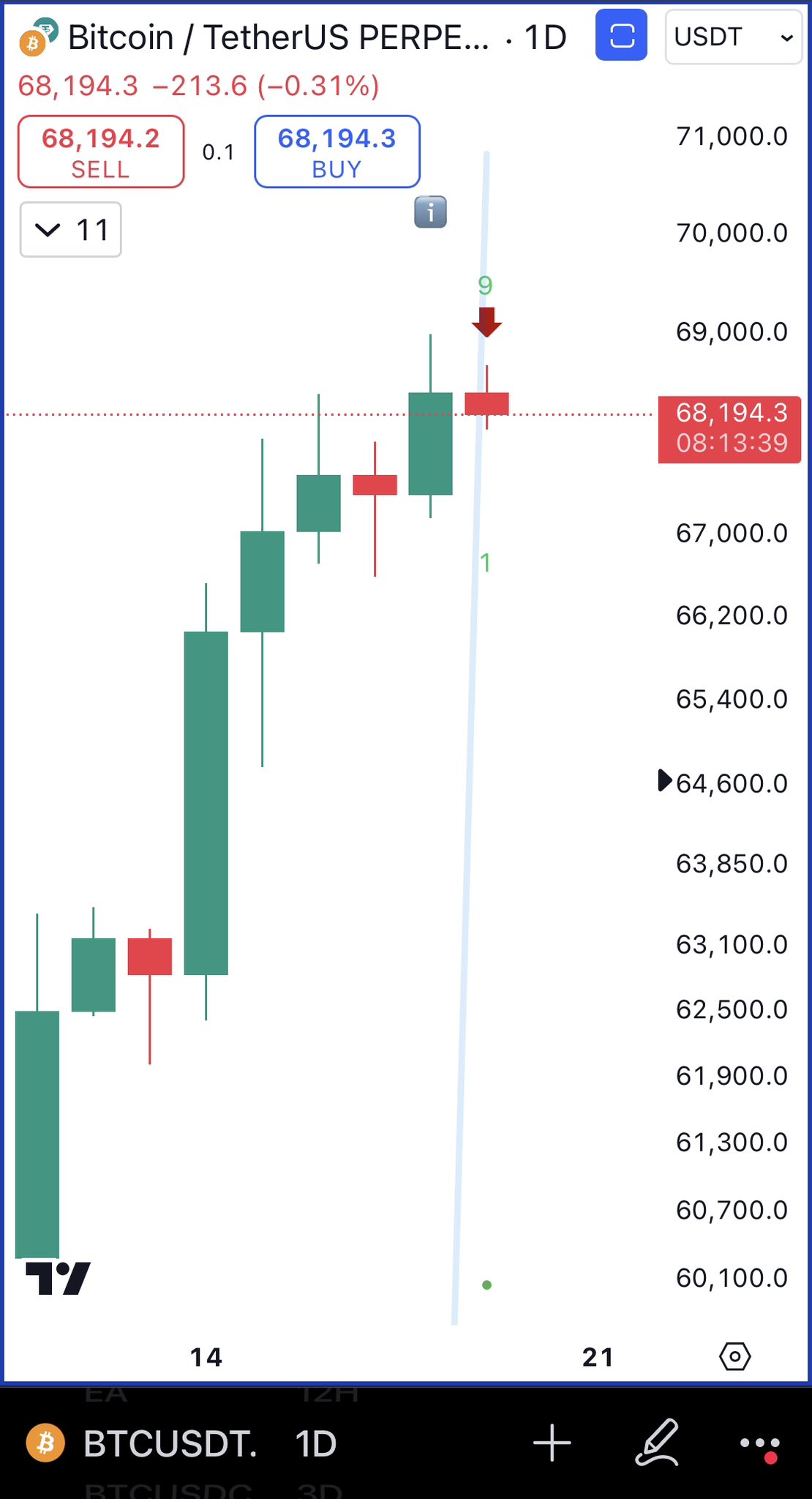

Bitcoin hasn’t fared too well over the past few days, tumbling as low as $9,500 on Monday as sellers have started to liquidate their stacks en-masse. This meant that at the current correction’s worst, BTC was down just around 10% from the local $10,550 high that was set last week. While this plunge seemingly marks a strong reversal from the decisive uptrend Bitcoin has been trading in for the past two months, a key signal suggests that bulls may once again take over, likely to push the asset back above $10,000 and beyond. Related Reading: Crypto Tidbits: Bitcoin Slides Under $10,000, JP Morgan & Ethereum, and the US’ Cryptocurrency Crackdown Bitcoin About to Roar Even Higher, Indicator Predicts If you’ve spent any time at all perusing Crypto Twitter, you likely know of TD Sequential, which is a time-based indicator that tries to predict when an asset will see a certain trend or reversal of its ongoing trend. The Sequential has done well in predicting Bitcoin’s trends. Extremely well. So well, in fact, that the creator of the indicator remarked in an interview with Bloomberg that 13 candles (signals reversals) were seen when Bitcoin hit $20,000 in December 2017, when BTC cratered to $3,150 in December 2018, and near the $14,000 top seen in June. The indicator is now signaling that Bitcoin will see a reversal on a short-term time frame. Analyst Crypto Hamster remarked that the TD Sequential for the four-hour chart just printed a red 9, suggesting a recovery towards $10,000 and beyond. Indeed, the prior 9 candle seen on the four-hour chart was a precursor to a 10% surge higher than brought the asset from $9,600 or so to $10,550 in a few days’ time. TD Sequential: a red "9" on a 4h TF. I wouldn't trust it too much, but hey, it is there… $BTC $BTCUSD #bitcoin pic.twitter.com/czm7AhPAV9 — CryptoHamster (@CryptoHamsterIO) February 18, 2020 Long-Term Trend Still Positive Whatever Bitcoin will do in the near future, analysts have said they’re convinced the cryptocurrency has entered back into a long-term uptrend. Analysts on Monday observed that a key technical signal had appeared: the 50-day simple moving average and the 200-day simple moving average crossed, with the former moving over the latter for the first time in nearly a year. For those not versed in technical analysis, this event is called a “golden cross.” As Investopedia describes it: As long-term indicators carry more weight, the golden cross indicates a bull market on the horizon and is reinforced by high trading volumes. The importance of this shouldn’t be understated: in 2019, Bitcoin rallied by nearly 200% from the time of the golden cross, and the golden cross in October 2015 preceded an over 6,000% move higher. On the fundamental side of things, there is a confluence of geopolitical and macroeconomic factors that could help push the price of BTC higher. These include but are not limited to the impending block reward halving, the lowering of interest rates by central banks, potential volatility in the equities markets, and trade tensions between nations. Featured Image from Shutterstock origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|