2021-9-10 10:09 |

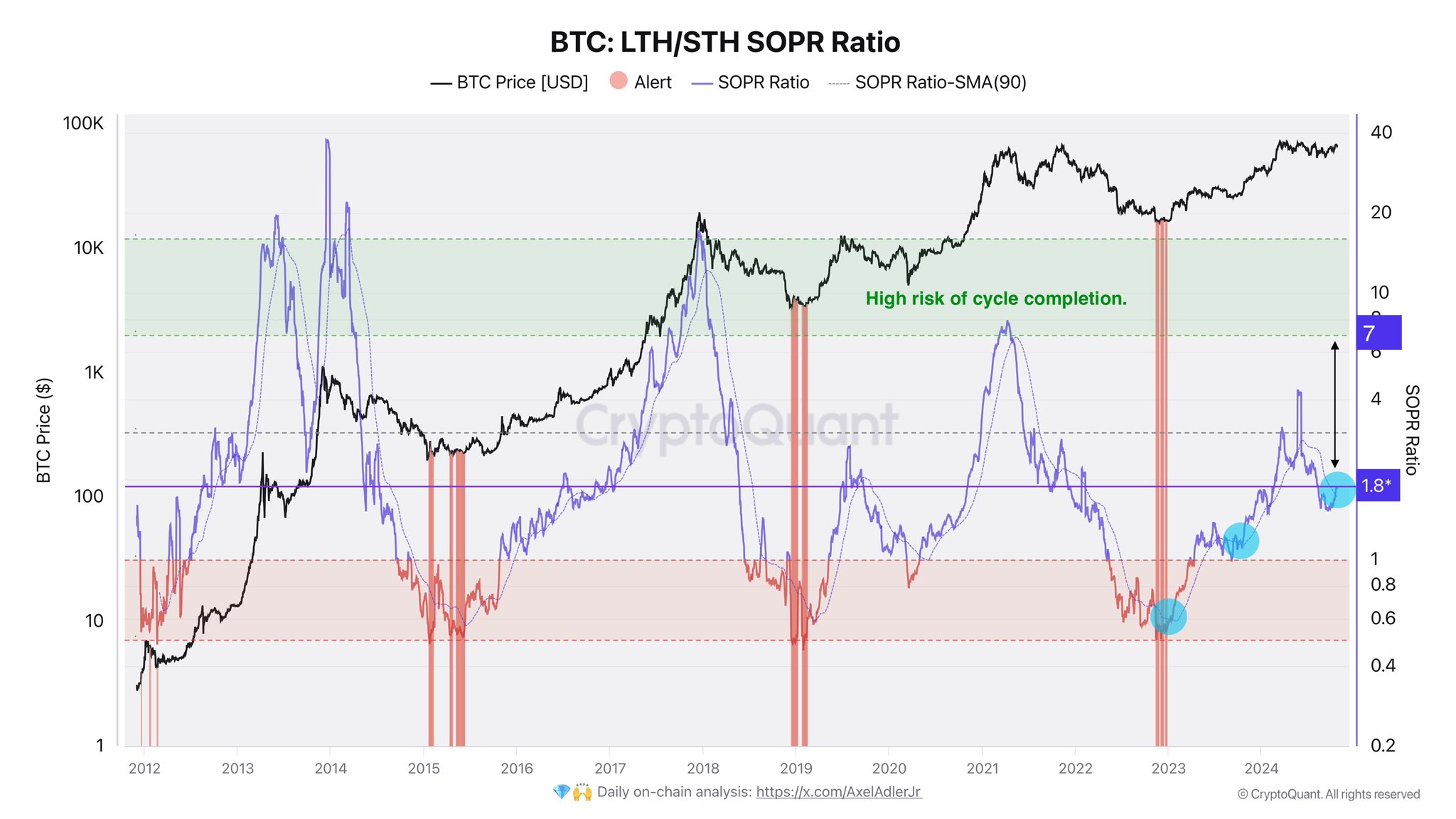

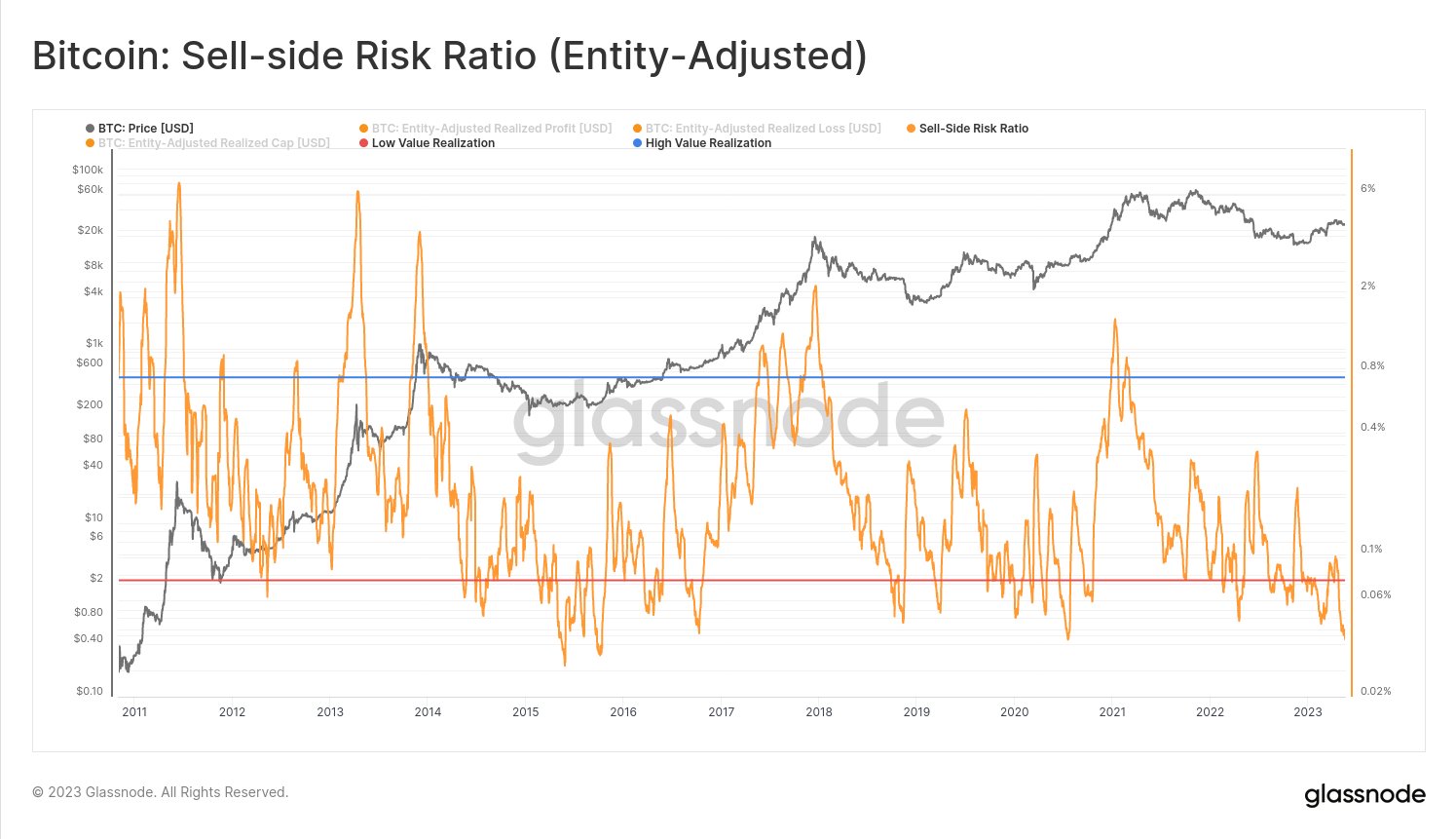

BeInCrypto looks at on-chain indicators for Bitcoin (BTC), more specifically Spent Output Profit Ratio (SOPR) and Market Value to Realized Value Ratio (MVRV), in order to validate current market movements.

Both indicators are still showing signs of strength, indicating that the bullish trend is still intact.

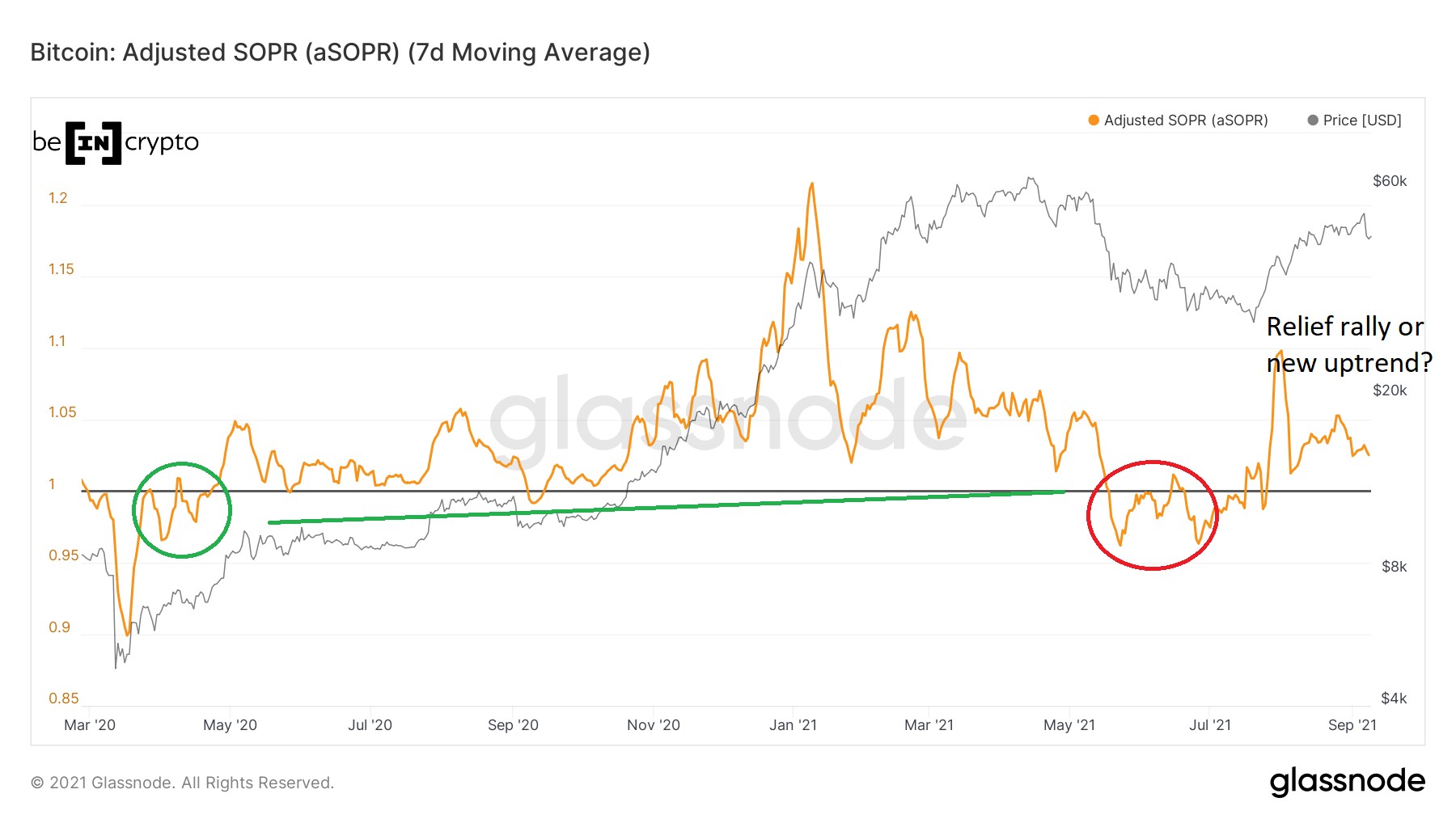

SOPRSOPR is an indicator that is used to measure whether the market is in a state of profit or loss. Its value is found by dividing the selling and buying prices for every unspent transaction output (UTXO). The adjusted SOPR (aSOPR) is a slight variation of this indicator. It disregards BTC transactions with a lifespan of less than one hour.

As outlined in our previous SOPR article, a movement above the 1-line after a breakdown could be a relief rally if SOPR cannot hold above 1. Therefore, if the market is in a state of profit for a long period of time (green) and then moves to a state of loss (red circle), it is a sign of a potential bearish trend reversal. If the market first moves back to a state of profit but falls back to a loss afterward, it confirms the bearish trend reversal.

Currently, the indicator (orange) shows that the BTC market is in a state of profit since it is above 1. Until it breaks down below it, a bearish trend reversal is not confirmed.

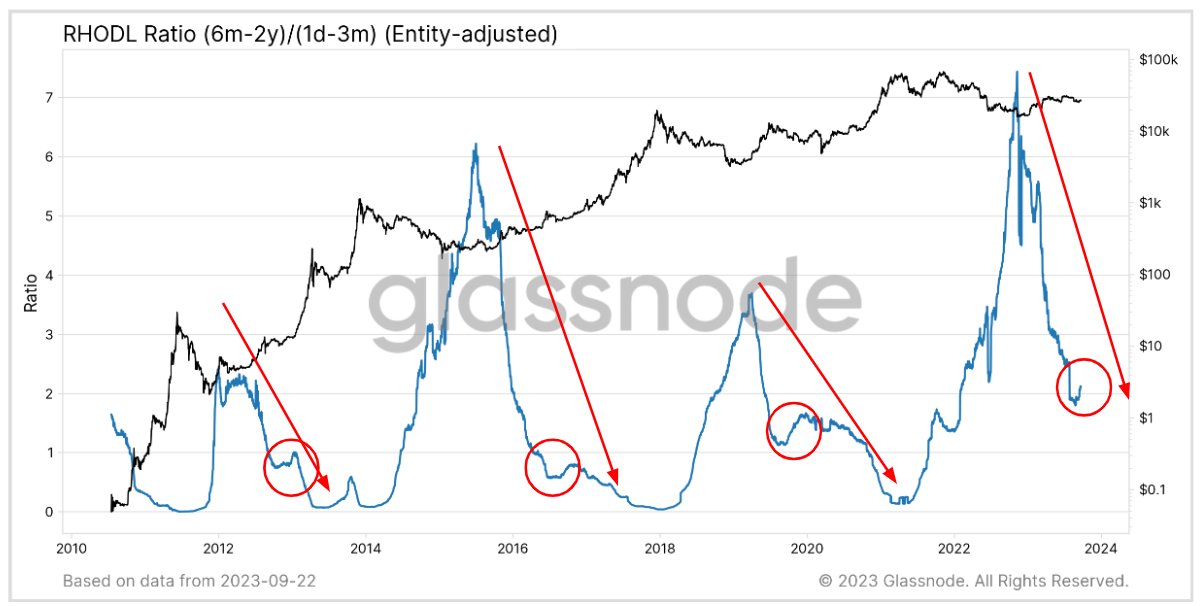

BTC SOPR Chart By Glassnode MVRV for BTCThe MVRV value is the ratio between the BTC market and realized capitalization levels. Therefore, a value of 2 suggests that the market cap is twice as big as the realized cap.

BIC has previously outlined that the 1.75 MVRV level is crucial in order for the uptrend to continue. Since then, the indicator has bounced at the level (black rectangle) and continued to move upwards. It currently shows a value of 2.2

As long as it does not fall below it, the upward trend remains intact.

BTC MVRV Chart By GlassnodeFor BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

The post Bitcoin On-Chain Analysis: MVRV and SOPR Move Above Crucial Levels appeared first on BeInCrypto.

origin »Bitcoin (BTC) на Currencies.ru

|

|