2022-8-8 22:00 |

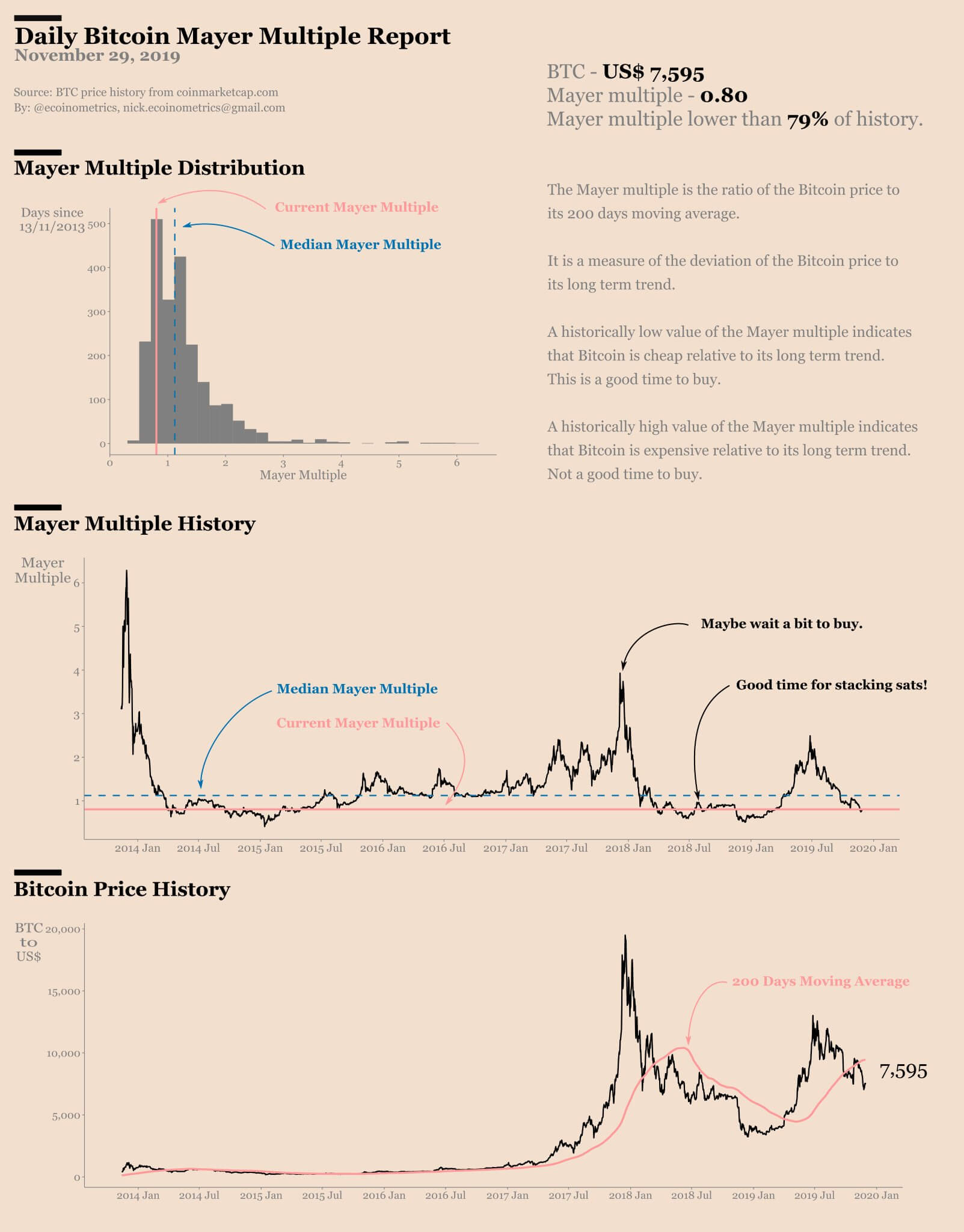

On-chain data shows both the Bitcoin leverage ratio and the futures open interest has spiked up recently, a sign that may turn out to be bearish for the crypto’s price.

Bitcoin Estimated Leverage Ratio And Open Interest Surge UpAs pointed out by an analyst in a CryptoQuant, the BTC futures market seems to have been heating up during the past day.

To understand the leverage ratio, two other metrics need to be looked at first. They are the “open interest” and the “derivatives exchange reserve.”

The open interest is an indicator that measures the total amount of contracts currently open on the Bitcoin futures market. The metric includes both short and long positions.

The other indicator, the derivatives exchange reserve, tells us about the total number of coins currently present in the wallets of all derivatives exchanges.

Now, the former metric divided by the latter gives us the “estimated leverage ratio.” What this indicator signifies is the average amount of leverage used by users on derivatives exchanges.

Here is a chart that shows the trend in the Bitcoin leverage ratio, as well as the open interest, over the past month:

The value of the two metrics has sharply risen recently | Source: CryptoQuantAs you can see in the above graph, both the Bitcoin leverage ratio and the open interest have spiked up during the last 24 hours as the value of the coin has also observed a surge.

This means that right now not only is the average leverage very high, but also the total number of positions are quite big.

The chart also includes data for the funding rate, another indicator that tells us about the ratio between long and short positions. It looks like currently its value is positive, suggesting that longs are more dominant.

Historically, such a setup has generally lead to higher volatility in the market. It is because a high leverage means any price move will bring about a great number of liquidations, which will further enlarge the move in question.

This stretched price move in turn leads to more liquidations. When liquidations cascade together in this way, the event is called a “squeeze.”

Since there are more long positions in the market right now and the leverage is high, a long squeeze could happen. If it does occur, the latest bullish momentum for Bitcoin may be slowed down.

BTC PriceAt the time of writing, Bitcoin’s price floats around $23.9k, up 3% in the past week.

Looks like the value of the crypto has spiked up during the last day | Source: BTCUSD on TradingView Featured image from Natarajan sethuramalingam on Unsplash.com, charts from TradingView.com, CryptoQuant.com origin »Bitcoin (BTC) на Currencies.ru

|

|