2024-12-24 16:33 |

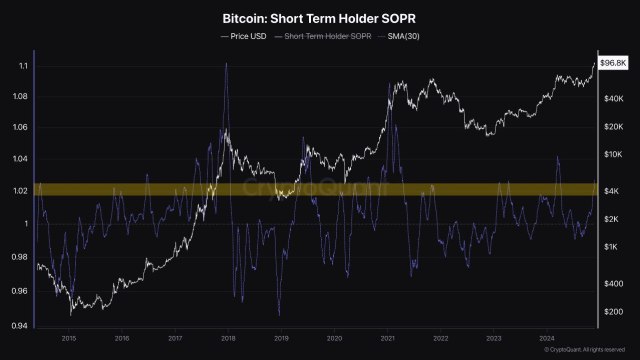

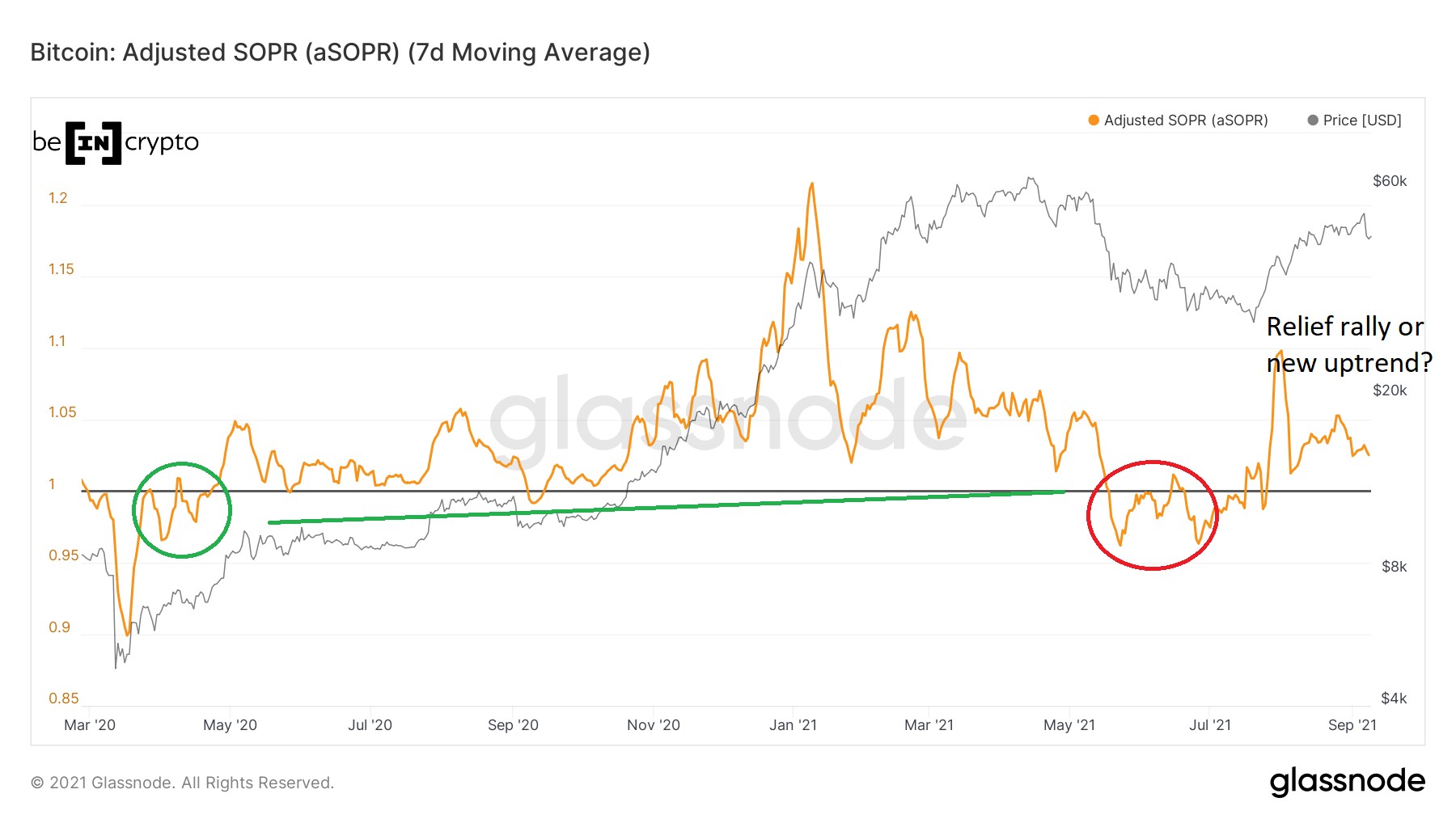

As of this writing, BTC was slumping for the fourth day. SOPR, however, shows positive trends from LTH. As Bitcoin[BTC] hovered near $94,000, the Spent Output Profit Ratio (SOPR) andThe post Bitcoin nears $95k: Why SOPR metrics hint at BTC profit-taking? appeared first on AMBCrypto. origin »

Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|