2020-10-10 16:37 |

Since Square's Bitcoin investment news broke out on Thursday, the digital currency has been chasing higher levels. The first bust of momentum saw us reaching for $11,000, the second one breaking it, and then we went nearly to the $11,500 level.

At the time of writing, BTC/USD has been trading around $11,300, back to early September level, in green on the back of the gradually rising volume.

Bitcoin’s gains have brought back the greens in the crypto market, especially DeFi tokens, which have been bleeding for the past few weeks.

Odds for Parabolic AdvanceThese greens have also brought back the euphoria in the market, with participants expecting a strong momentum.

“New highs after explicitly bearish news is a strong indicator of underlying market strength,” said Ari Paul, the co-founder of investment firm BlockTower Capital.

According to him, “this is the common set up” for parabolic moves, which are rare. “Higher odds of a parabolic advance now than any time since March,” he added.

Interestingly, adding to this bullish case is the 2.88 million BTC that recently flowed out of centralized cryptocurrency exchanges.

As per Crypto Quant, all exchanges' netflow of bitcoin has hit the year-low, and it is likely to keep negative “when the bull run is about to start,” much like the case was in 2017.

Whales on itIn anticipation of a strong movement towards the north, the number of whales, those entities holding more than 1,000 BTC, has been on an upwards trend for the past few months.

“An indication that more high-net-worth individuals are entering the space to invest in Bitcoin in expectation of BTC price appreciation,” noted Glassnode.

The same momentum in whales’ increased BTC accumulation was seen in 2014-2016 and before that during 2012-2013.

Source: CoinMetricsAdding to this bullishness is the Bitcoin’s Realized Cap, which has been steadily increasing just like it did before the 2017 bull market took off.

As per Coin Metrics, “If it continues as it did in 2017, 2021 should be an interesting year.”

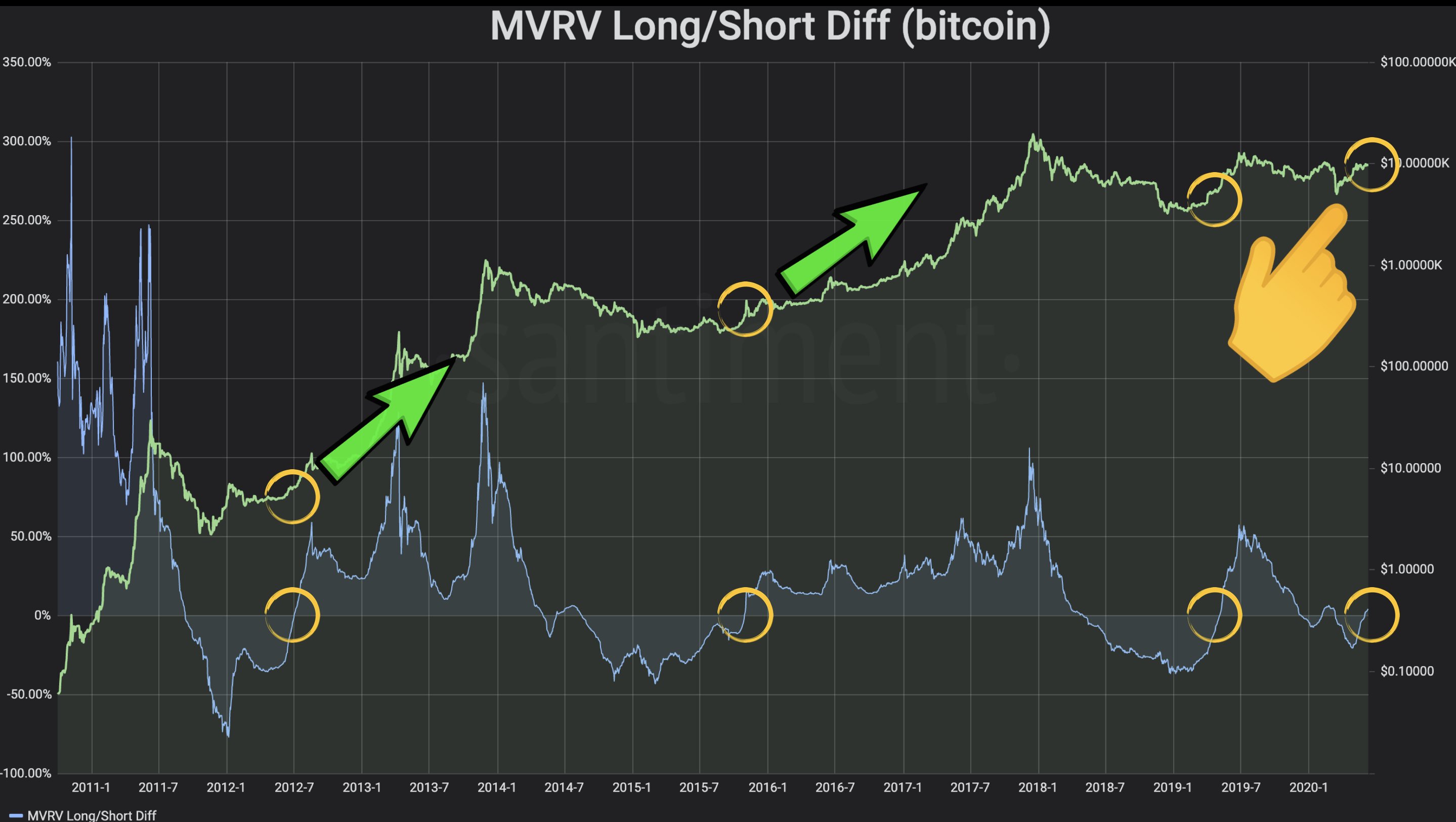

Bitcoin MVRV (Market-Value-to-Realized-Value) is also holding the same trajectory as of the last bull run.

Bullishness all aroundInterestingly, most of the post-March activity hasn’t been followed by the re-activation of long-term held bitcoin, which supports the idea that holders expect the medium price action to be positive.

The network is also growing in a healthy fashion with the network more secure than ever as hash rate hits a new peak and transfer count growing steadily, indicating an increasing user base.

Amidst all the bullishness, trader, and economist Alex Kruger shared a bearish case, “If price were to move down and linger in the low 10s – upper 9s, it would set a bull trap and could then easily breakdown.”

However, he is not expecting the trend to be bearish; rather, he is bullish, as a matter of fact, “extremely bullish, not just bullish.”

Bitcoin (BTC) Live Price 1 BTC/USD =11,349.4515 change ~ 2.41Coin Market Cap

210.11 Billion24 Hour Volume

25.49 Billion24 Hour Change

2.41 var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~BTC~USD");The post Bitcoin Indicators Following the Same Trajectory They Did Before the 2017 Bull Run first appeared on BitcoinExchangeGuide.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|