2020-6-27 03:21 |

It’s been a quiet past few weeks for Bitcoin.

After reaching $10,400 at the start of June, the cryptocurrency has seen a correction and now trades in the low-$9,000s.

Although a bear trend has yet to form, many have stated that the rejection BTC faced at $10,400 was bearish. After all, $10,400-10,500 is the exact region Bitcoin faltered at in February, prior to the crash to $3,700.

Yet a crucial on-chain signal that appeared at the start of three previous bull runs has just been seen.

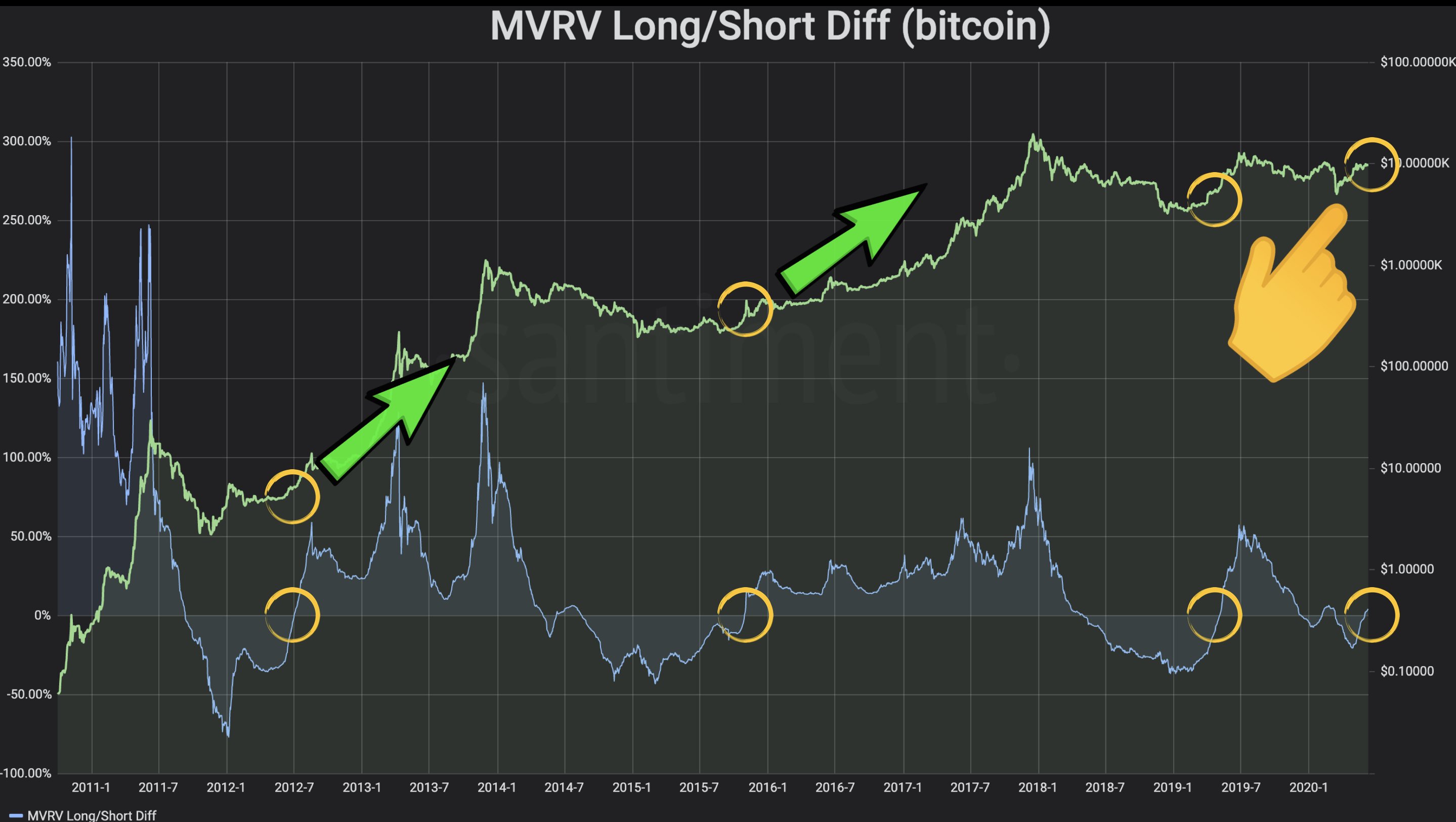

Related Reading: U.S. Congressman Davidson Says BTC Is “Required to Defend Freedom” Bitcoin Flashes Crucial Bull SignA cryptocurrency technical and on-chain analyst noted on Jun. 26 that an important on-chain signal just appeared: The MVRV Long/Short Differential indicator passed above 0% after a multi-month correction.

Blockchain analytics firm Santiment describes the MVRV Long/Short Differential as follows:

“MVRV is a measure of how much each coin holder paid for their coins and compares it to the current price of that given coin. If the ratio is above 1.0, then on average all holders will get profit if they sell their coins now. If it is below 1.0, on average everyone will realize a loss if they sell.”

The reason why this is important is that every time the metric has historically crossed one, rallies have followed suit.

In 2012, the metric crossed one before BTC rallied to $1,000. In 2015, the metric crossed one before the ~2,000% rally to $20,000. And after 2018’s bear market, the metric crossed one to precede BTC’s rally to $14,000.

Bitcoin MVRV Long/Short Diff chart shared by MMCrypto, a crypto content creator and trader.This historical precedent suggests that Bitcoin may be on the verge of a macro rally.

Luke Martin, a cryptocurrency trader, commented the following on the indicator’s performance in September of last year:

“With $BTC continuing it’s month-long chop, I’ve been learning more about on-chain metrics. MVRV ratio gives a good idea of exchange price relationship to “fair value” of a BTC. MVRC <= 1 has been an excellent buy every time.”

Related Reading: On-Chain Data: Ethereum Is Rapidly Growing as DeFi Hype Spreads Don’t Count Out a Short-Term CorrectionWhile there is this evidence, Bitcoin could experience a short-term correction.

As reported by NewsBTC, on-chain analyst Cole Garner has found a confluence of reasons why Bitcoin could correct. They are as follows: Glassnode has reported that miners are attempting to liquidate a large amount of Bitcoin, institutions are bearish on BTC via the CME, Bitfinex’s order book has been skewed “massively to the sell side.”

There’s also comments from another analyst suggesting that Bitcoin is trading in a “high time frame distribution” pattern.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com When This Signal Appeared in 2015, Bitcoin Rallied 2,000%. It's Back origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|