2024-12-6 01:40 |

Bitcoin’s (BTC) historic rally above $100,000 hit a roadblock on Dec. 5 as the flagship crypto fell back into five-figure territory, leaving a trail of liquidations across the market.

BTC gave up almost all of the 24-hour gains that took it to a new all-time high of $103,679. It fell to a low of roughly $90,300 for the day before attempting a recovery.

Bitcoin was trading at $95,500 as of press time amid heavy volatility, based on CryptoSlate data.

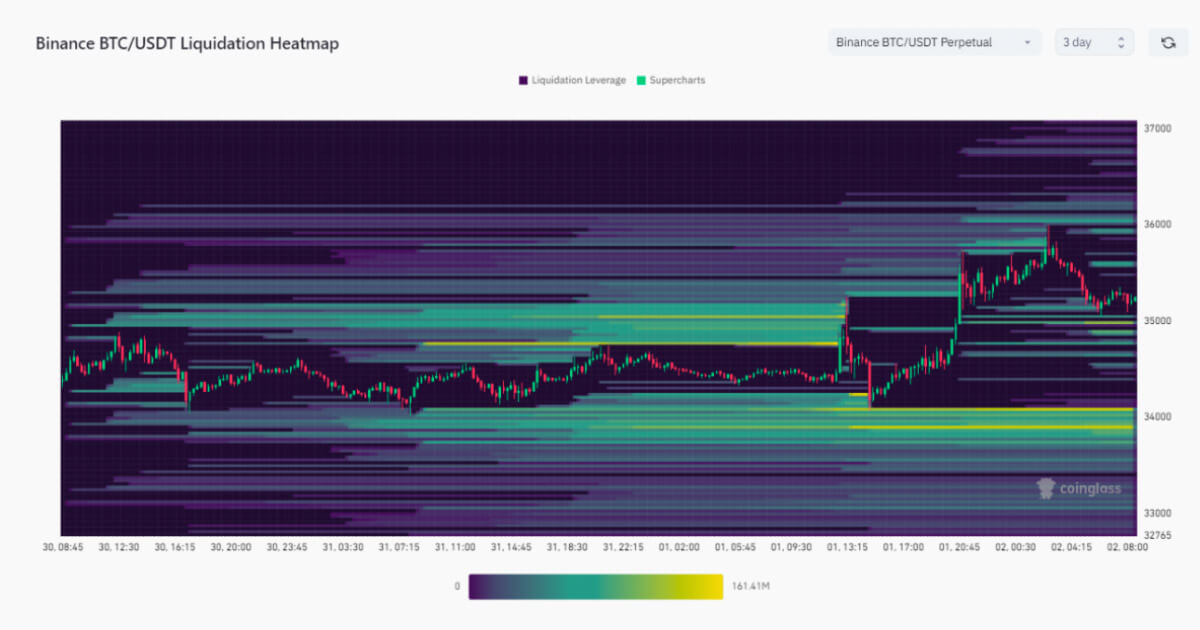

LiquidationsRoughly $885.61 million in leveraged positions were liquidated in the past 24 hours, impacting 202,956 traders worldwide. Bitcoin accounted for $540 million of the total liquidations, followed by Ethereum (ETH) with $105.53 million.

Other altcoins also experienced substantial liquidations, including XRP with $57.07 million, DOGE with $37.54 million, and Solana with $29.28 million. A combined $92 million was liquidated across other cryptocurrencies, highlighting the broad impact of Bitcoin’s price movement.

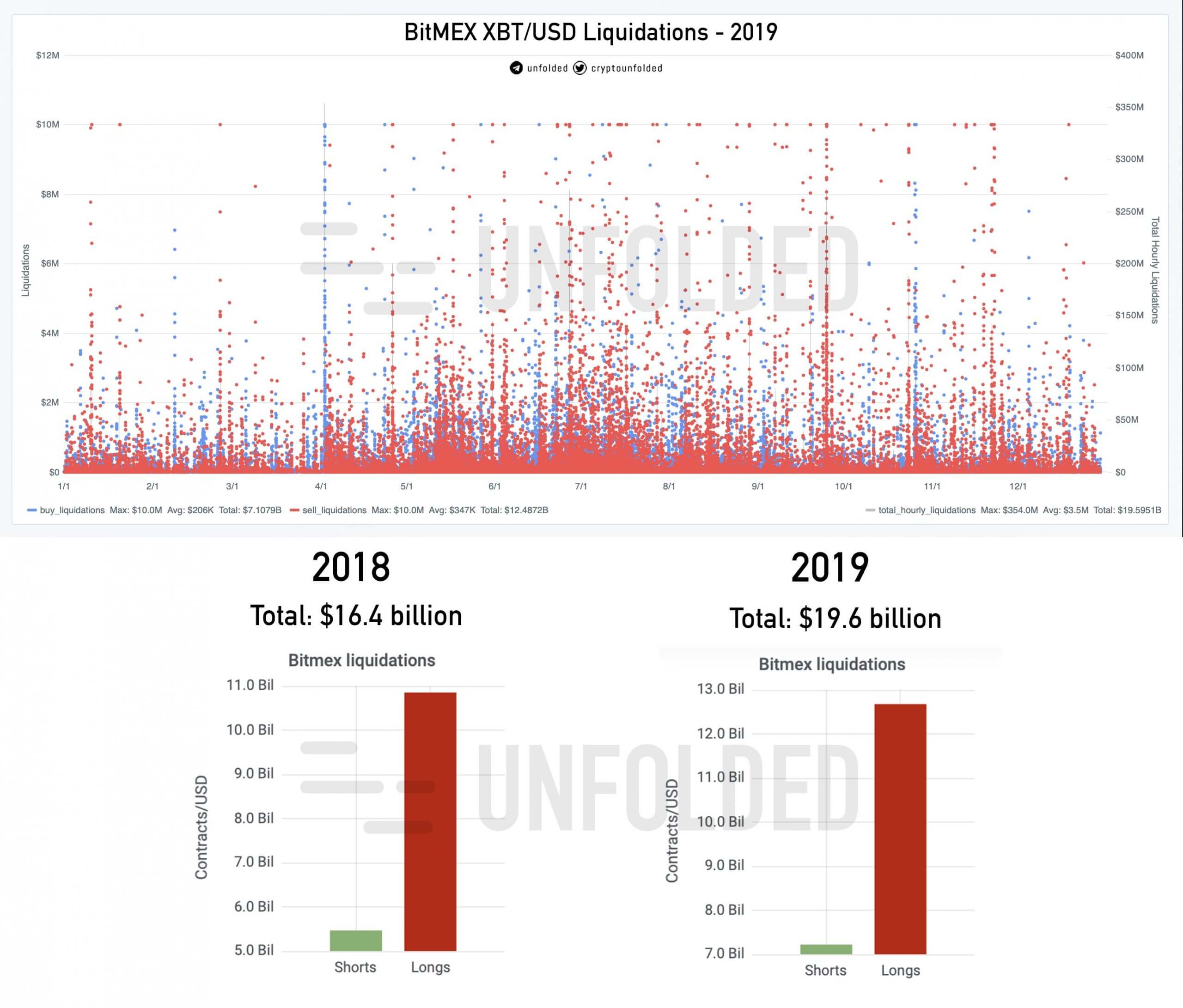

Long traders, who bet on rising prices, bore the brunt of the impact, with $640.83 million in liquidated positions — 72.4% of the total.

Short positions, which bet on price declines, accounted for $244.78 million. The largest single liquidation occurred on OKX, where an $18.63 million BTC-USDT swap was forcibly closed.

High volatilityBreaking down the data further, $284.43 million was liquidated in just one hour, of which $279.50 million were longs. Over the last 12 hours, $552.54 million in liquidations were recorded, including $482.81 million in longs and $69.72 million in shorts.

The four-hour liquidation figure stood at $428.42 million, reflecting heightened volatility during Bitcoin’s decline.

Editor’s Note: The liquidation numbers may not be fully accurate due to extremely high volatility at the time the article was published.

The post Bitcoin flash crashes to $90,200 causing over $885 million in liquidations appeared first on CryptoSlate.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|