2022-5-21 20:00 |

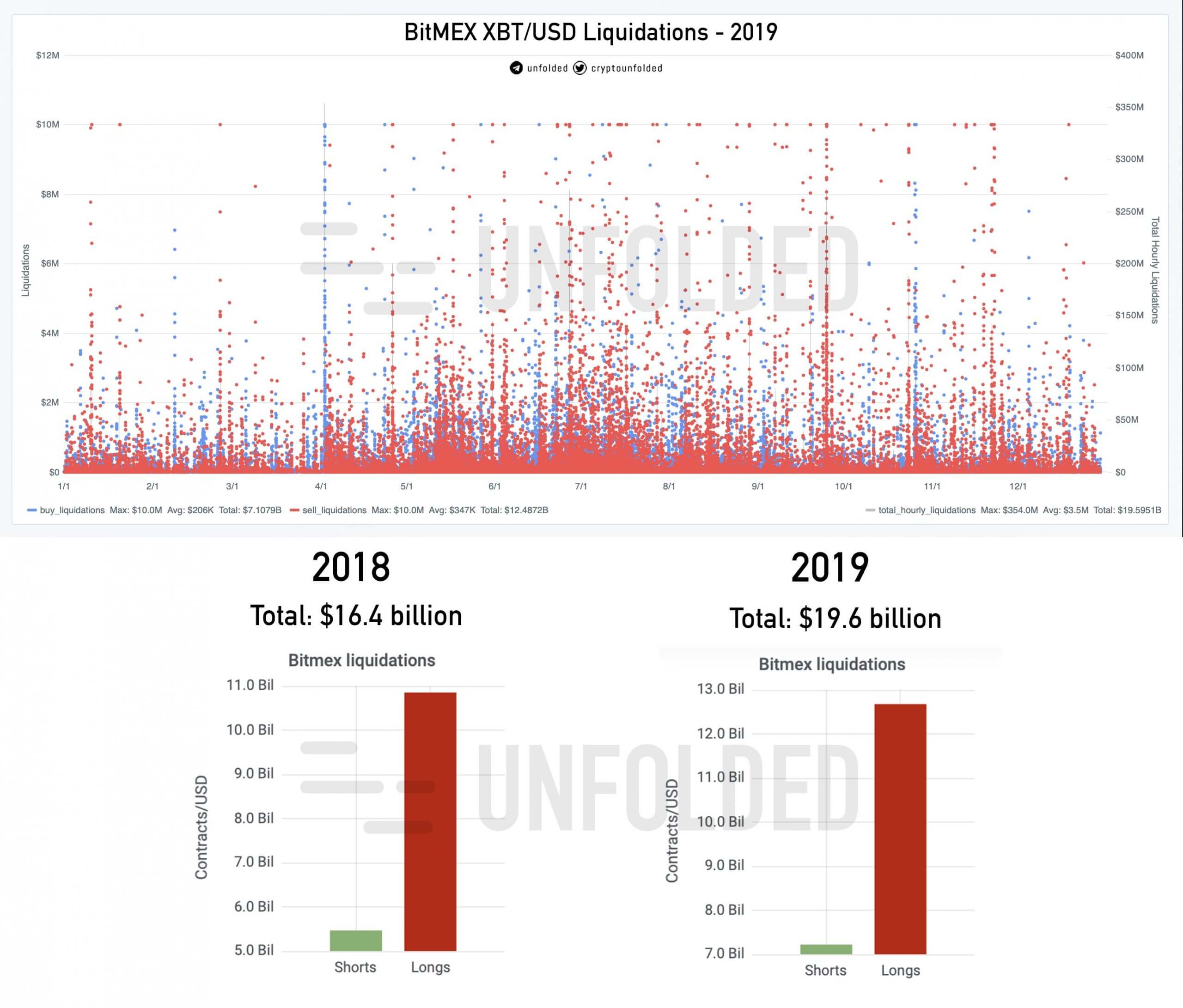

The effects of the long liquidations that rocked bitcoin after the digital asset had fallen to $25,000 continue to be felt even now. Bitcoin which has since managed to recover above $30,000 once more remains a prime liquidation target in the market. Even now, a week after the crash that had seen it record its largest liquidation event in six, long traders are still being rekt in the markets.

Bitcoin Liquidations Touch $61 MillionBitcoin long liquidations may have slowed down but they are far from over. In the last 24 hours, the market has seen more than 61 traders liquidated which has come out to more than $257 million liquidations in the last 24 hours. Naturally, bitcoin liquidations make up a large portion of this and long traders have been the worse hit in the market.

Related Reading | Exchange Inflows Rock Bitcoin, Ethereum As Market Struggles To Recover

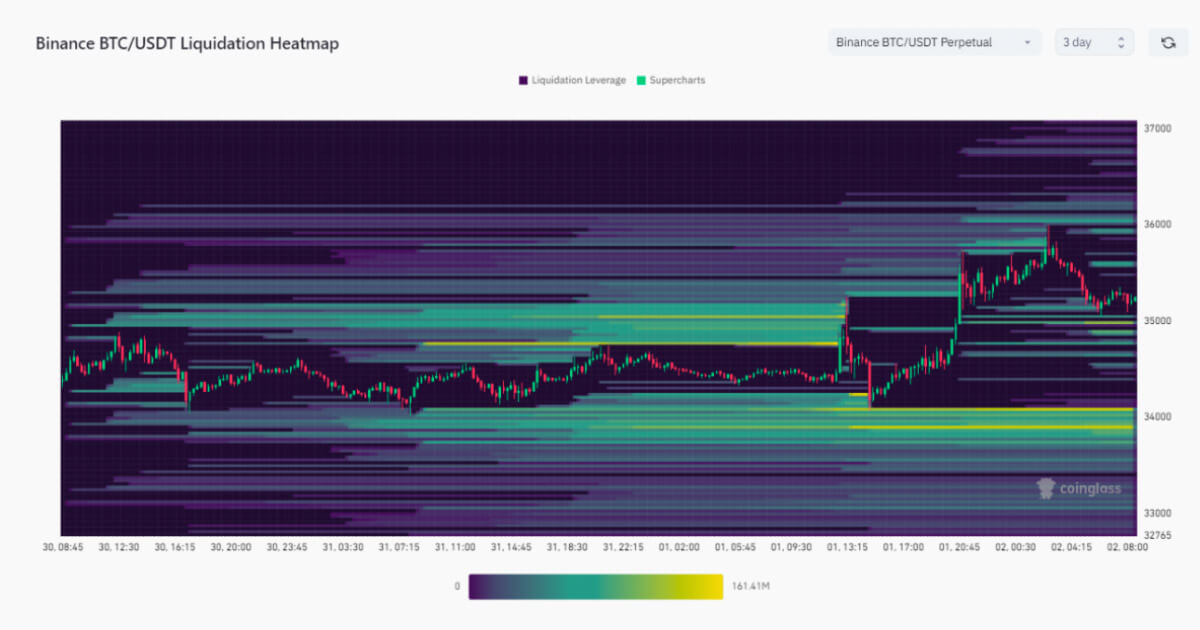

Bitcoin liquidations touched above $61 million on Friday after a particularly brutal day of trading on Thursday. The majority of these had taken place in the mid-afternoon to early evening of Thursday that saw traders liquidate more than $30 million. This had been a result of bitcoin falling below the $30,000 level, a level which it will ultimately retake in the early hours of Friday.

Indicators had turned bullish for the digital asset after this recovery. Even though long traders had seen the most losses for the 24-hour period, it was beginning to turn in their favor as short traders started taking more of the heat with time.

BTC recovers above $30,000 | Source: BTCUSD on TradingView.com Crypto Market Still RedLiquidations across other cryptocurrencies such as Ethereum had also been significant in this same 24-hour period, although not to the same extent as bitcoin. In total, there have been $29 million in Ethereum liquidations over the last 24 hours and $7.16 million on the 12-hour chart.

Related Reading | More Stress For El Salvador As Bitcoin Dips To $29,000

The broader crypto market liquidations touched as high as $258 million as of the time of this writing. Data from Coinglass shows that 73.55% of this figure has been made up of long liquidations. 40.28% of these liquidations have come from crypto exchange Binance, where long liquidations were of a similar percentage. On Okex, 81.54% has been from long liquidations and has made up the majority across various exchanges as well.

Other digital assets that have seen large liquidations including GMT, SOL, and APE, are all being driven by the recent downtrend. Bitcoin has recovered above $30,000, ETH is back above $2,000, and this is facilitating a change. The most recent liquidations on the 4-hour chart have been made up of shorts as sentiment begins to turn positive among investors.

Featured image from The Indian Express, chart from TradingView.comFollow Best Owie on Twitter for market insights, updates, and the occasional funny tweet…

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|