2024-12-8 03:30 |

The year 2024 will be one for the history books for the cryptocurrency industry and, especially, for Bitcoin. After kickstarting the year with the approval of spot exchange-traded funds (ETFs), it didn’t take long before the premier cryptocurrency rode on the back of fresh institutional capital to a new all-time high.

This has pretty much been the story for Bitcoin in the past 12 months, as the market leader has enjoyed the most attention from institutional players and large corporations. Blockchain analytics firm CryptoQuant recently published a report to highlight the impact of large investors on the world’s largest cryptocurrency this year.

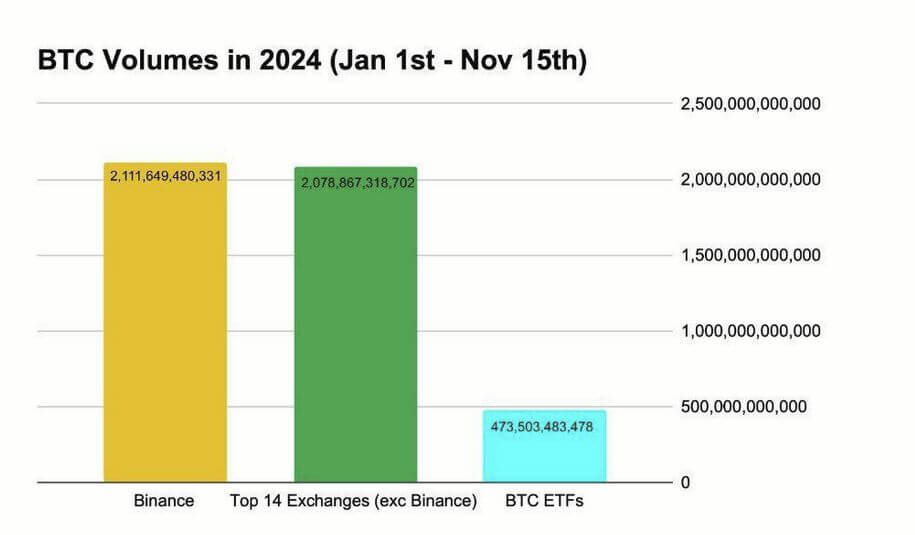

Is 2024 The Best Year In Terms Of Bitcoin Institutional Adoption?In its latest weekly report, blockchain intelligence platform CryptoQuant discussed how 2024 was a defining year for Bitcoin’s institutional adoption — driven by the launch of the spot ETFs in January. By year-end, the BTC funds already hold more coins (over 1.1 million) than any entity (including Bitcoin’s anonymous creator Satoshi Nakamoto).

The ETFs have provided an avenue for both institutional and retail investors to gain exposure to Bitcoin without directly owning them. At the same time, the spot exchange-traded funds have helped propagate a steady inflow of capital into the flagship cryptocurrency in the past 11 months.

According to data from CryptoQuant, BTC has witnessed an impressive increase in its realized capitalization, rising from $430 billion to a record high of $730 billion so far in 2024. One of the major contributors to this level of growth is MicroStrategy, the largest corporate holder of Bitcoin so far in the year.

Data from CryptoQuant reveals that MicroStrategy strived to strengthen its position as the largest corporate BTC holder by steadily filling its bags all year long. The business intelligence company kicked off the year with an 189,000 BTC holding, which has now expanded by 112% to 402,000 coins.

Furthermore, on-chain data shows that large Bitcoin investors increased their holdings by a net 275,000 coins so far in 2024 reaching a record high of 16.4 million BTC. These figures highlight the burgeoning institutional demand and the growing influence of crypto and Bitcoin in traditional finance, especially in the past year.

Bitcoin Price OverviewAs a result of the surging institutional adoption, the BTC price has witnessed exponential growth in 2024, recently reaching a six-figure valuation. As of this writing, the premier cryptocurrency is valued at just above $100,000, reflecting an almost 5% increase in the past 24 hours. According to data from CoinGecko, BTC remains the largest cryptocurrency in the digital asset sector, with a market cap of roughly $1.99 trillion.

origin »Bitcoin price in Telegram @btc_price_every_hour

New Year Bull (NYB) на Currencies.ru

|

|