2024-12-8 21:54 |

2024 was a landmark year for the cryptocurrency market. It was a year when the market matured, barriers to the institutional investing world came down, and international regulations started to pave the way for digital currencies to enter the mainstream global financial system.

With a President-elect keen on making the US a global crypto hub, the market experienced significant growth. As crypto adoption rose, more users turned to crypto platforms and ETFs to invest. 2024 was a transformative experience for the crypto market and the blockchain technology that powers it.

The general public, buoyed by positive sentiment and rising crypto prices, has flocked to DeFi platforms to download their first wallet. Many of those new users have found their way to the highly trusted crypto brand Binance.

It takes a leader to help an industry continue to mature and Binance CEO Richard Teng has taken on that role throughout 2024’s massive growth. Teng commented on his leadership and the future, “we have served in the best interests of our users since day one, leading the industry’s standard and continue building the future of the industry responsibly.”

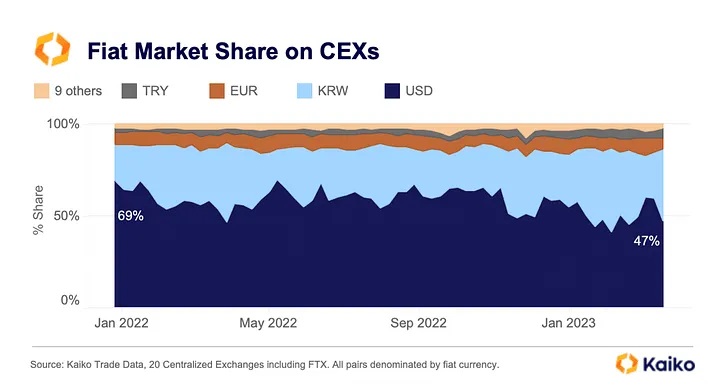

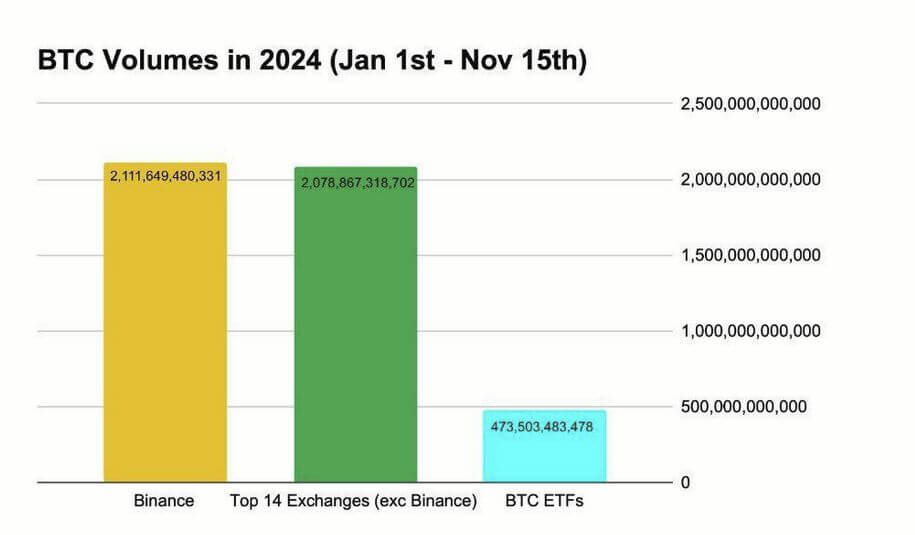

Binance accounts for approximately 50% of all trading volume globally. This number has only increased from Jan-Nov 2024. During the 2024 US Presidential election week, Binance captured $7.7 billion out of the $20 billion total inflows across all exchanges. Combine that with the leading crypto exchange reaching a new milestone surpassing 200 million users and safeguarding over $130 billion in user assets.

So, these are exciting times for the crypto industry that come off the back of a lot of hard work in 2024. The highlights of the year included:

Institutional Involvement and Widespread AdoptionIn 2024, BlackRock launched its spot Bitcoin ETF IBIT, before bringing options to the table on November 19th 2024, and broke all the records on day one with 354,000 contracts traded and $1.9 billion in notional value. This was a landmark moment for the crypto industry, but it came at the end of a year of institutional investment.

Pension funds, hedge funds, and sovereign wealth funds have worked hard into crypto this year as they try to take advantage of the growth potential and protect against problems with fiat currency. They follow on the heels of Goldman Sachs, Morgan Stanley, and Fidelity Investments, who all offer Bitcoin as part of their Wealth Management services.

Institutional investment has curbed market volatility, and this year, Bitcoin emerged as one possible protection against inflation. New clarity with the regulations, improved custody solutions, and advanced risk management frameworks all gave the institutions the confidence to jump into crypto feet first in 2024.

The Rise and Rise of DeFiDecentralized Finance (DeFi) is changing the world we live in and providing a real alternative to traditional banking. The world’s unbanked poor and privacy-obsessed High Net Worth Individuals alike have discovered the delights of downloading a crypto wallet and sending money with low fees and no questions.

According to one recent study, the global DeFi market should be worth almost $440 Billion in 2030, up from just over $20 billion in 2023.

We can now tokenize any asset, from real estate and fine art to cars and stocks, to create more liquidity without the help of a traditional bank. This is opening up new methods of borrowing, saving, lending, and earning interest that put the power in the hands of the people.

Unbanked individuals around the world can have access to basic financial services, including sending and receiving money from friends or families, without huge fees. We are also seeing an ecosystem of liquidity pools and borrowing facilities open up that can change the world of finance.

Retail Market IntegrationIn the background, the Web3 technology that underpins the crypto market has found a home with DeFi platforms, as well as retail and e-commerce. Blockchain technology is now the foundation of supply chain management, healthcare providers, and numerous company processes. If the blockchain continues to take over corporate and public life, then the tokenized crypto ecosystem has to go with it.

Retailers are increasingly relying on the blockchain, with Starbucks using it to trace their coffee from the farm to the cup and Nike tokenizing each pair of sneakers on its Swoosh platform for authenticity and traceability.

In October 2023, Ferrari started accepting crypto payments for its high-end sportscars, joining the likes of Tesla, PayPal, Shopify, and Microsoft. This is a slow process, but crypto has slowly acquired the social proof it requires to break through with mainstream retailers. The blockchain that forms its foundations and is becoming such a mainstream hit was an unexpected bonus.

Regulatory Frameworks: Chaos to ClarityFragmented regulations that change from country to country are terrible for the crypto industry, and 2024 was the year it finally got its house in order. The Financial Stability Board, International Monetary Fund, and World Economic Forum helped guide disparate countries towards one set of standard practices for crypto taxation, Anti Money Laundering compliance, and consumer protection. A simple foundation of regulations that works across borders could work wonders for the industry. We’re not there yet, but we are getting closer.

Technological Advancements Driving MaturityIt isn’t just the political landscape that had to change to give the crypto market a shot at mass adoption. Real technical issues with the early blockchain systems kept them as a niche interest rather than an everyday occurrence.

Blockchain congestion, slow transactions, high energy consumption, and scalability were all real issues. Ethereum 2.0 and Layer 2 solutions mean that Ethereum, the most ubiquitous blockchain by far when it comes to dApps and Web3 technology, is now much more scalable, with lower fees and less blockchain congestion. Solana and alternative blockchains like BNB Smart Chain also offer alternative solutions, with blockchain bridges seamlessly connecting the networks.

AI integration has already changed the world of trading, analytics, risk management, and supply chain management. Artificial Intelligence has unlocked another level of performance from Web3 technology and automated complex processes that can streamline almost any company.

ConclusionThese factors have all combined to create a market that is ready, willing, and waiting for mass adoption. Institutional adoption, regulatory clarity, cultural acceptance, and technical improvements have all helped the cryptocurrency industry go from a sideshow to a central player in 2024. We have not seen anything yet, and next year could be the biggest yet.

The post 2024 saw crypto markets dramatically mature appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

New Year Bull (NYB) на Currencies.ru

|

|