2024-2-14 22:28 |

Institutional inflows continue to flood the market, with new analysis predicting a significant price appreciation for the benchmark cryptocurrency.

Bitcoin prices could blast to an impressive $112,000 per coin this year if the ongoing trend of inflows linked to United States BTC spot exchange-traded funds (ETFs) continues, according to CryptoQuant founder and CEO Ki Young Ju.

Spot ETFs Have Potential To Push BTC To Six FiguresKi Young Ju of CryptoQuant sees Bitcoin’s successful journey to $112,000 in 2024.

In a recent post on the X (formerly Twitter) platform, the on-chain analyst highlighted the impact of the newly minted spot BTC ETFs on Bitcoin’s realized market cap. Per CryptoQuant data, the ETF’s combined inflows could add a whopping $114 billion to the existing $451 billion in 2024 alone — leading to a potential market cap of $565 billion.

“Bitcoin market has seen $9.5B in spot ETF inflows per month, potentially boosting the realized cap by $114B yearly. Even with $GBTC outflows, a $76B rise could elevate the realized cap from $451B to $527-565B,” Ki noted.

#Bitcoin market has seen $9.5B in spot ETF inflows per month, potentially boosting the realized cap by $114B yearly.

Even with $GBTC outflows, a $76B rise could elevate the realized cap from $451B to $527-565B. pic.twitter.com/b7iFCIbGVP

Ki referenced the current withdrawals from the largest fund, Grayscale, which have subsided significantly in recent weeks since its launch as a spot Bitcoin exchange-traded fund last month.

The landmark approval and subsequent trading of nearly a dozen spot ETFs on Wall Street has led institutional investors to flock to the investment vehicles as they give them exposure to the alpha digital coin in a safe and regulated way. The rush is mainly due to pent-up demand. Before the eventual greenlighting, the U.S. Securities and Exchange Commission (SEC) stonewalled the listing of spot market crypto ETFs for a decade.

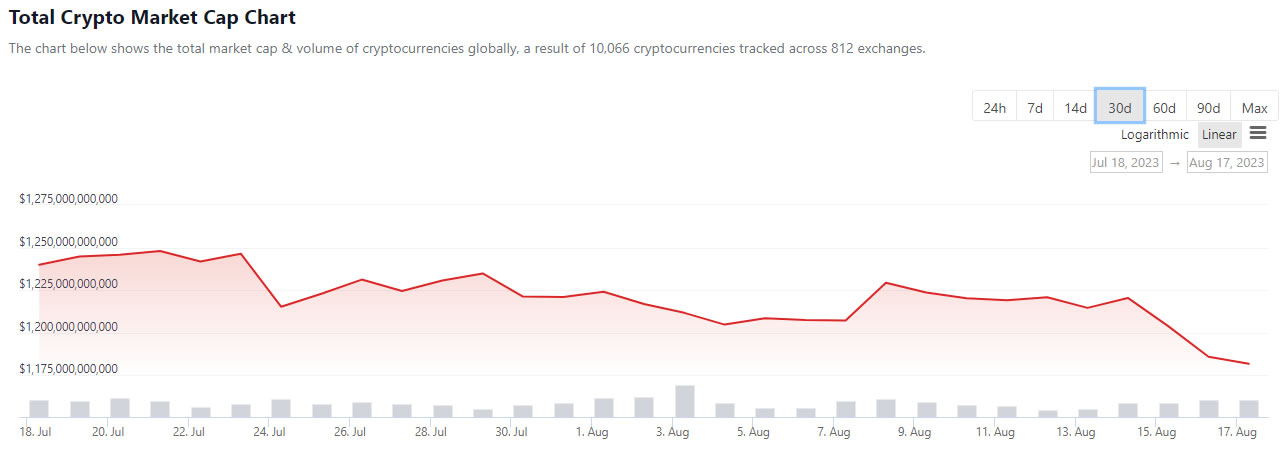

BTC is trading for $49,787 per coin at publication time, having risen by approximately 10.9% over the week, according to CoinGecko. The entire crypto market cap is down about 1.2% today, now valued at $1.88 trillion.

Ki concluded that BTC’s “worst case” scenario was $55,000 — or a roughly 14% jump from today’s prices.

Bitcoin To Surpass $100K Even Before April Halving?Multiple market watchers maintain a bullish outlook for 2024, a sentiment reflected in the recent price bump. For instance, Blockstream CEO Adam Back thinks Bitcoin could potentially exceed the coveted $100,000 milestone even before the historically bullish halving event scheduled for April.

“1st oct 2021 #bitcoin crossed $47k like yesterday, then on it’s way to the $69k ATH. that run-up took 41 days. there are 70 days to the halving. just another data point for what it looks like, and how we may yet get a new ATH or even $100k before the halvening,” Back postulated in his own X post.

Halving is part of the Bitcoin network’s code to tame inflation on the cryptocurrency and will slash the miner rewards in half for successfully mining a BTC block. This makes obtaining or mining new bitcoin much harder — and has historically preceded bull runs.

origin »Bitcoin price in Telegram @btc_price_every_hour

Time New Bank (TNB) на Currencies.ru

|

|