2018-8-6 13:06 |

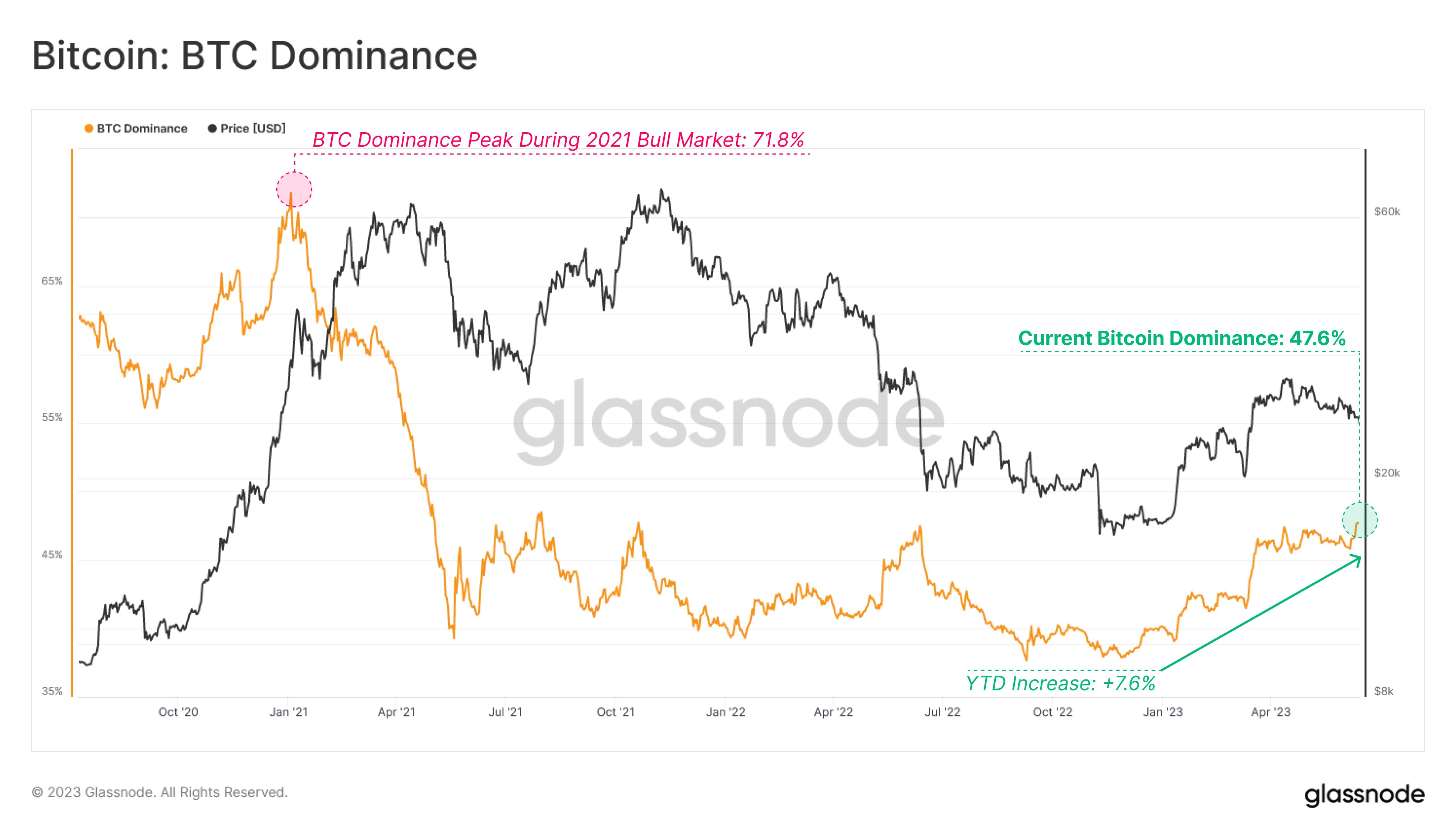

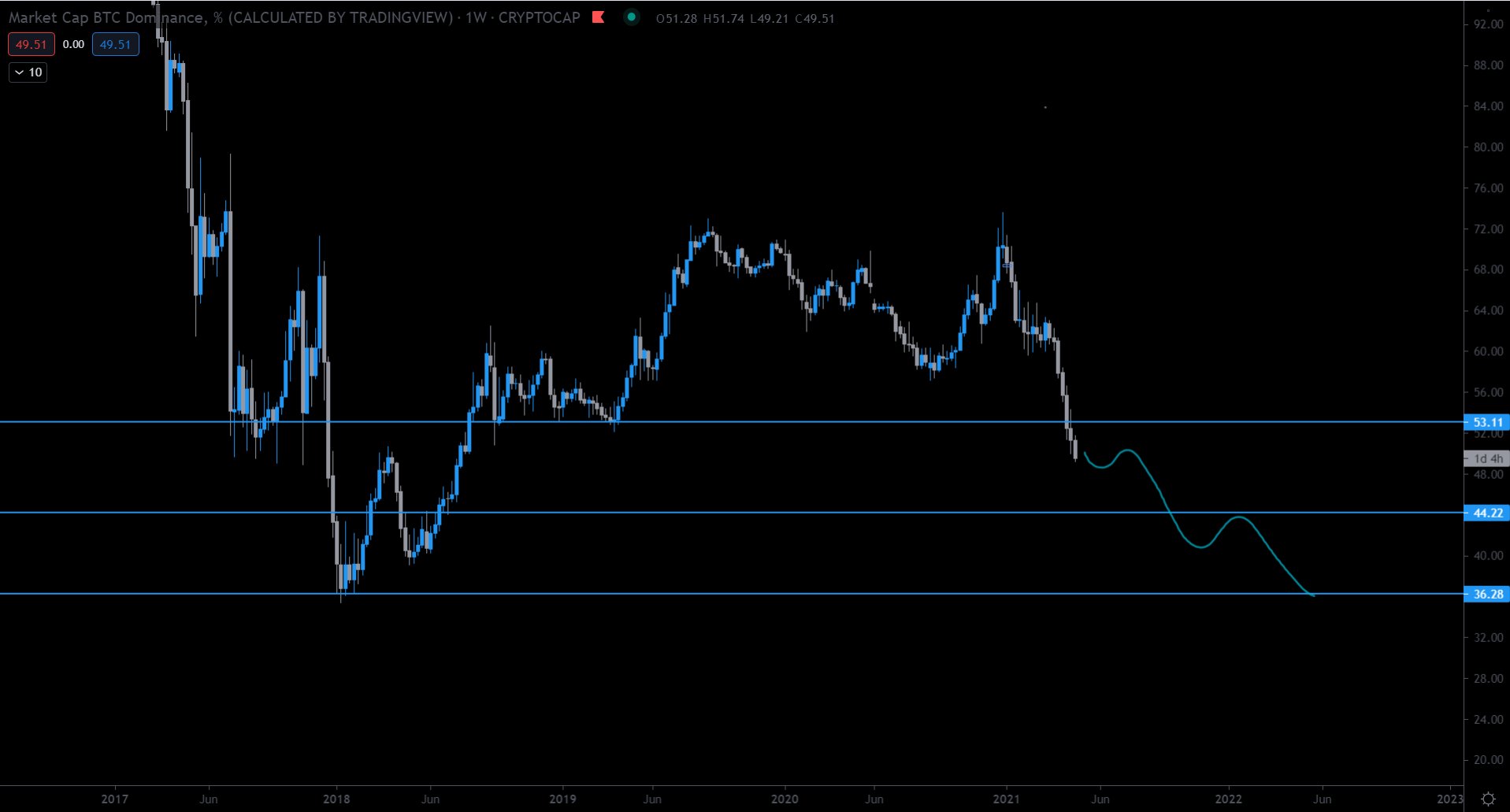

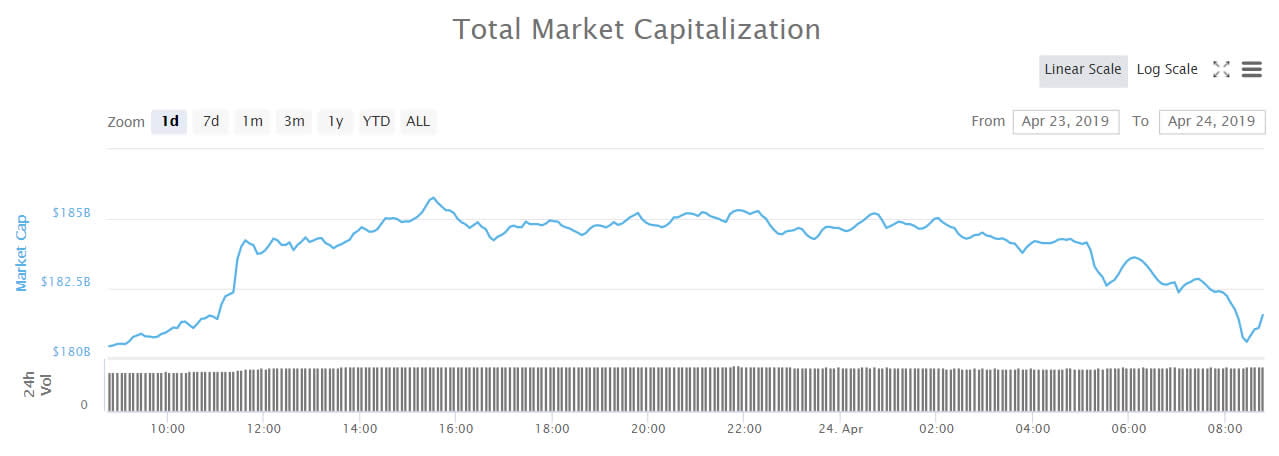

The cryptocurrency markets are experiencing some sideways movement this morning (UTC + 3) with the total market capitalization showing some stability above $250 Billion and at current levels of $254.65 Billion. The same cannot be said about the dominance of the King of Crypto in the markets. Bitcoin (BTC) dominance seems to be declining at the current levels of 47.4%. BTC has dropped from 48.76% levels witnessed less than 3 days ago on August 3rd. This is a drop of 1.36% in the same time period.

BTC Dominance on August 3rd. Source, coinmarketcap.comThe dominance of Ethereum (ETH) has however increased to current levels of 16.26% from those of 15.62% witnessed on the 3rd of August.

The same August 3rd saw BTC 24 hour trade volumes of $4.6 Billion. That volume is now at $3.798 Billion indicating a significant drop in the market action of Bitcoin. The volumes of ETH have dropped from $1.88 billion to current levels of $1.4 Billion in the same time period.

Looking at the preferred stable coin – Tether (USDT) – during times of decline in the markets, its daily trade volume has been surging on a constant basis in the last month or so. This indicates that investors are choosing to hold on to USDT whenever there is market turmoil.

Regular daily trade levels of USDT are fluctuating from $1.5 Billion to around $3 Billion. But on the 28th of July, this value reached a staggering $13.487 Billion in one day.This is a clear indication of a worried or overly cautious Bitcoin and Ethereum investor base.

What also has been noted in the last 24 hours, is that some alternative coins have gained significantly in the markets indicating a shift from the top 5 crypto assets of BTC, ETH, XRP, BCC, EOS and LTC.

Ethereum Classic (ETC) is still basking in the news of a confirmed addition on Coinbase and is currently up 4.26% in the last 24 hours and trading at $17.32. ZCash (ZEC) is also up 3.37% in the last 24 hours and currently trading at $182. DigiByte (DGB) is up 3.58% in the last 24 hours and currently trading at $0.0334.

MOAC current value. Source, coinmarketcap.comThe most impressive of the top 100 digital assets according to coinmarketcap.com is MOAC (MOAC) that is currently up 12.67% in the last 24 hours and trading at $4.50 at the moment of writing this.

Disclaimer: This article is not meant to give financial advice. Any opinion herein should be taken as is. Please carry out your own research before investing in any of the numerous cryptocurrencies available.The post Bitcoin Dominance Drops Significantly, Further Worrying BTC Investors appeared first on Ethereum World News.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|