2024-8-16 06:00 |

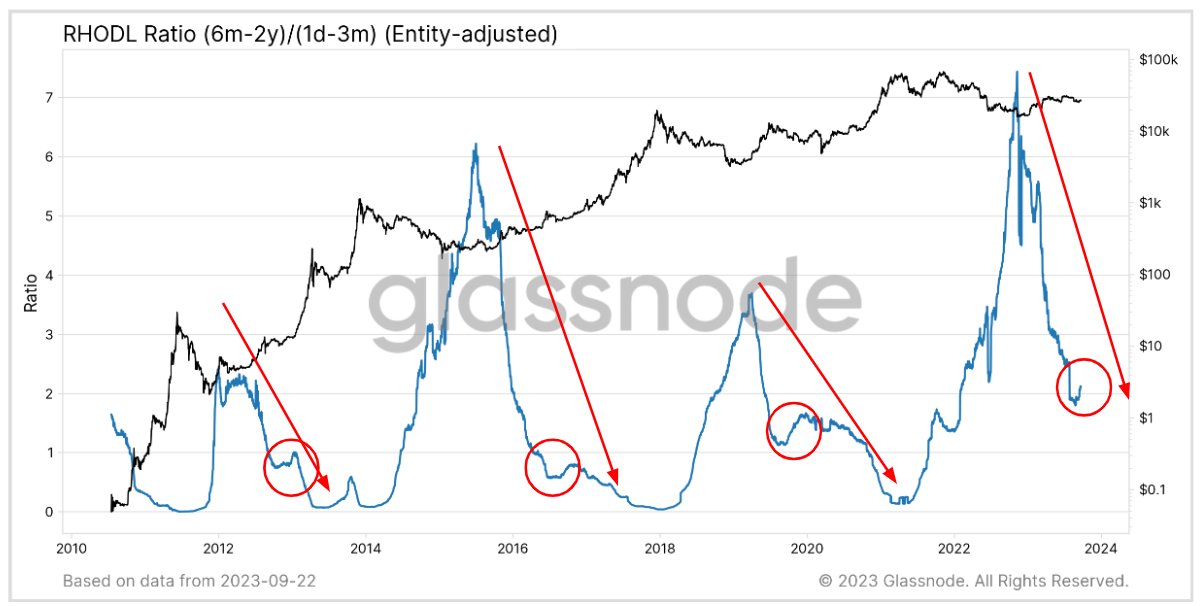

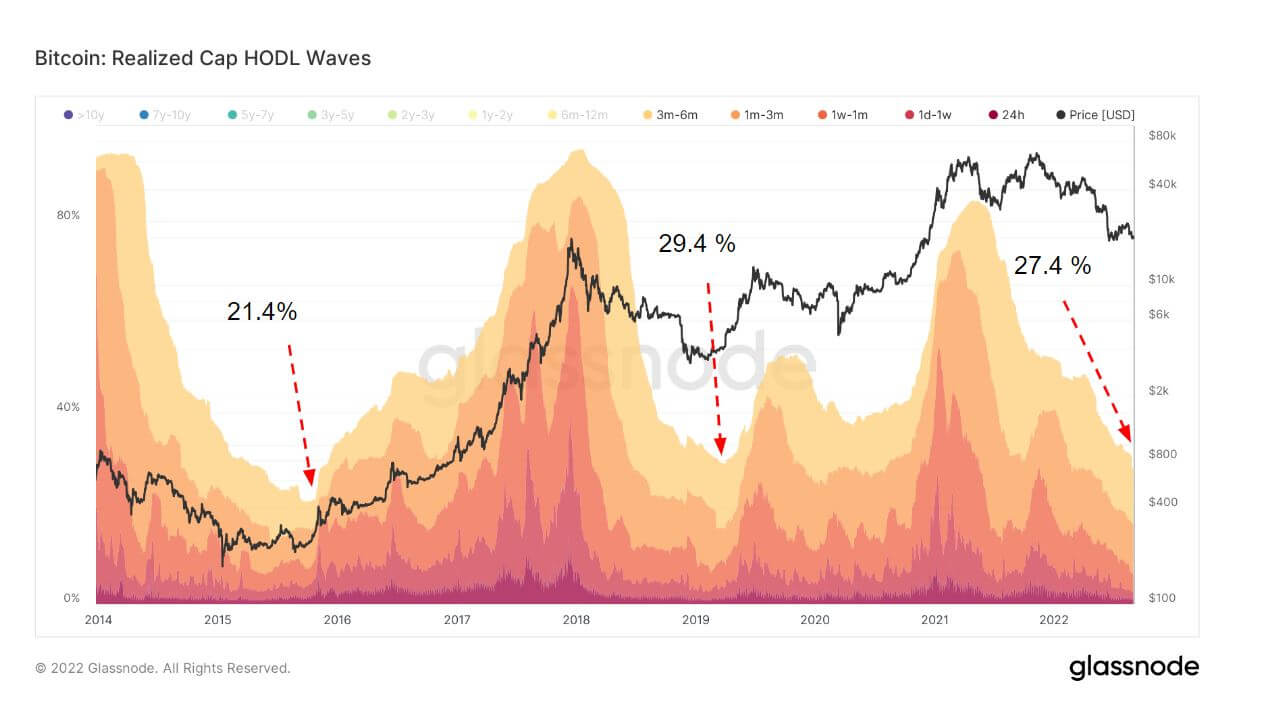

The crossing of this indicator on two different timeframes has signaled to traders that short-term performance may be weakening, sparking fear in the market. origin »

Bitcoin price in Telegram @btc_price_every_hour

Theresa May Coin (MAY) на Currencies.ru

|

|